Growing E-commerce Sector

The expansion of the e-commerce sector significantly influences the Global Point of Sale (POS) Terminal Market Industry. As online shopping continues to rise, businesses are increasingly integrating POS systems that facilitate seamless transactions across multiple platforms. This integration allows for improved inventory management and customer relationship management, which are essential for online retailers. The market's growth is reflected in its projected increase to 185.0 USD Billion by 2035, driven by the need for efficient payment solutions that cater to both in-store and online customers. This dual capability is likely to become a standard expectation among consumers.

Market Growth Projections

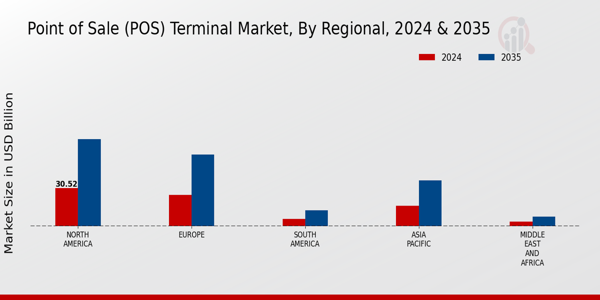

The Global Point of Sale (POS) Terminal Market Industry is poised for substantial growth, with projections indicating a market size of 81.3 USD Billion in 2024 and an anticipated increase to 185.0 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate (CAGR) of 7.76% from 2025 to 2035. Such figures reflect the increasing adoption of advanced POS systems across various sectors, including retail, hospitality, and healthcare. The market's expansion is likely to be driven by technological innovations, evolving consumer preferences, and the need for efficient transaction solutions.

Technological Advancements

The Global Point of Sale (POS) Terminal Market Industry is experiencing rapid technological advancements, particularly in mobile and cloud-based solutions. These innovations enhance transaction speed and security, appealing to a broader range of businesses. For instance, the integration of contactless payment options has surged, with a notable increase in consumer preference for swift transactions. As businesses adopt these technologies, the market is projected to reach 81.3 USD Billion in 2024, indicating a robust shift towards modernized payment systems. This trend suggests that companies prioritizing technological upgrades may gain a competitive edge in the evolving retail landscape.

Regulatory Compliance and Security

The Global Point of Sale (POS) Terminal Market Industry is increasingly shaped by regulatory compliance and security concerns. With the rise in digital transactions, businesses are compelled to adopt POS systems that meet stringent security standards to protect customer data. Compliance with regulations such as PCI DSS is essential for maintaining consumer trust and avoiding potential penalties. As a result, the demand for secure and compliant POS solutions is expected to grow, driving innovations in encryption and fraud prevention technologies. This focus on security not only protects businesses but also enhances the overall credibility of the POS market.

Increased Focus on Customer Experience

Enhancing customer experience remains a pivotal driver in the Global Point of Sale (POS) Terminal Market Industry. Businesses are recognizing that efficient and user-friendly POS systems can significantly improve customer satisfaction and loyalty. Features such as personalized promotions and loyalty programs integrated into POS systems are becoming commonplace. This focus on customer-centric solutions is likely to contribute to the market's growth, as companies strive to differentiate themselves in a competitive landscape. As the industry evolves, the emphasis on creating a seamless shopping experience will likely remain a priority for retailers and service providers alike.

Rising Demand for Contactless Payments

The Global Point of Sale (POS) Terminal Market Industry is witnessing a rising demand for contactless payment solutions, driven by consumer preferences for convenience and speed. This trend is particularly evident in urban areas where consumers favor quick transactions. As a result, businesses are increasingly adopting POS systems that support NFC technology and mobile wallets. The anticipated growth in this segment aligns with the overall market trajectory, which is expected to grow at a CAGR of 7.76% from 2025 to 2035. This shift indicates a potential transformation in how transactions are conducted, emphasizing the importance of adaptability in payment solutions.