Growth in the Textile Printing Sector

The growth in the textile printing sector is emerging as a vital driver for the Large Format Inkjet Printers LFP Market. The demand for customized and high-quality textile prints has been on the rise, particularly in fashion and interior design. Market analysis indicates that the textile printing segment is expected to witness a CAGR of approximately 7% over the next few years. This growth is largely attributed to the increasing consumer preference for personalized designs and sustainable printing practices. As a result, manufacturers are focusing on developing large format inkjet printers that can cater to the specific needs of the textile industry, thereby enhancing the overall dynamics of the Large Format Inkjet Printers LFP Market.

Rising Demand for High-Quality Prints

The increasing demand for high-quality prints across various sectors appears to be a primary driver for the Large Format Inkjet Printers LFP Market. Industries such as advertising, textiles, and architecture require superior print quality to meet client expectations. According to recent data, the demand for high-resolution prints has surged, with a notable increase in the use of large format printers for promotional materials and signage. This trend indicates that businesses are investing in advanced printing technologies to enhance their visual communication strategies. As a result, manufacturers are focusing on developing printers that can deliver exceptional color accuracy and detail, thereby propelling the growth of the Large Format Inkjet Printers LFP Market.

Technological Innovations in Printing

Technological innovations in printing technology are reshaping the Large Format Inkjet Printers LFP Market. Advancements such as eco-solvent inks, UV printing, and improved print head technology are enabling printers to produce faster and more efficiently. Recent statistics indicate that the adoption of these technologies has led to a reduction in printing costs and an increase in production speed, which are critical factors for businesses aiming to remain competitive. Furthermore, the integration of automation and smart technologies into large format printers is enhancing operational efficiency. As these innovations continue to evolve, they are likely to attract more users to the Large Format Inkjet Printers LFP Market, driving further growth.

Expansion of the Signage and Display Sector

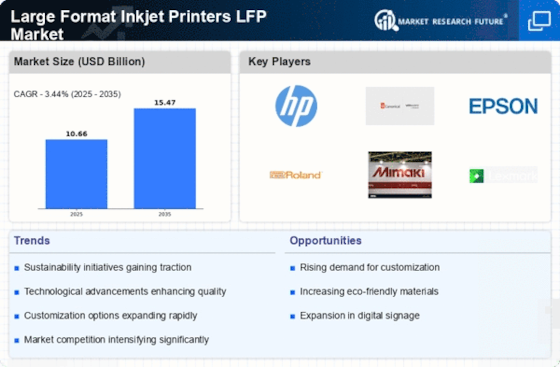

The expansion of the signage and display sector is significantly influencing the Large Format Inkjet Printers LFP Market. With the rise of retail and outdoor advertising, there is a growing need for large format printing solutions that can produce eye-catching displays. Market data suggests that the signage industry is projected to grow at a compound annual growth rate (CAGR) of over 5% in the coming years. This growth is driven by the increasing use of digital signage and promotional displays, which require high-quality large format prints. Consequently, manufacturers are innovating to provide printers that cater to this expanding market, thus enhancing the overall landscape of the Large Format Inkjet Printers LFP Market.

Increased Adoption of Digital Printing Solutions

The increased adoption of digital printing solutions is significantly impacting the Large Format Inkjet Printers LFP Market. Businesses are increasingly shifting from traditional printing methods to digital solutions due to their flexibility, cost-effectiveness, and ability to produce short runs. Recent data suggests that the digital printing market is expected to grow substantially, with large format inkjet printers playing a crucial role in this transition. This shift is particularly evident in sectors such as packaging, where the demand for customized prints is rising. As companies seek to enhance their operational efficiency and reduce waste, the Large Format Inkjet Printers LFP Market is likely to experience robust growth driven by this trend.