Market Analysis

In-depth Analysis of Network Slicing Market Industry Landscape

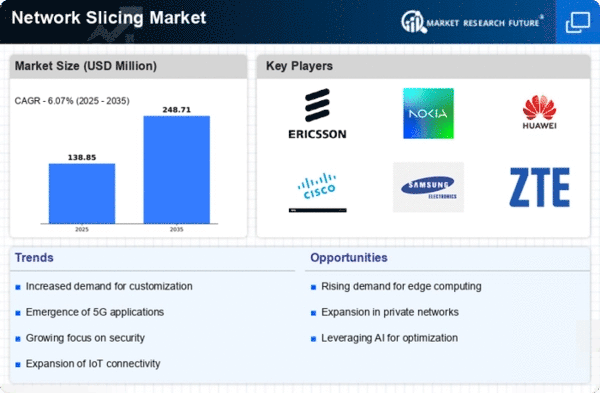

The changing telecommunications landscape and the growing demand for customized and effective network services shape the network slicing market's dynamics. Network Slicing, a critical part of 5G innovation, empowers the virtual dividing of a solitary actual organization into numerous, detached virtual organizations. This division permits telecom administrators to tailor administrations for explicit applications, ventures, or client gatherings, giving a more adaptable and enhanced network insight. The market is seeing a flood popular because of the developing reception of 5G innovation across different areas, including medical care, assembling, and savvy urban communities.

One critical driver of the organization cutting business sector is the rising requirement for low-dormancy and high-throughput correspondence administrations. Enterprises like independent vehicles, expanded reality, and the Web of Things (IoT) demand ongoing information transmission, which can be accomplished through the effective assignment of organization assets worked with by network cutting. To meet these demands and provide improved connectivity solutions, telecom operators are making significant investments in upgrading their infrastructure. This venture adds to the general development and extension of the organization cutting business sector.

Additionally, the competitive landscape has a significant impact on market dynamics. Telecom administrators are endeavoring to separate themselves by offering particular and custom-made administrations through network cutting. This opposition cultivates advancement and pushes the limits of what is attainable with 5G innovation. Thus, sellers and arrangement suppliers are constantly creating and upgrading network cutting answers for meet the assorted necessities of various ventures. This pattern of development and rivalry is driving the market forward and establishing a powerful climate.

The administrative scene additionally impacts the market elements of organization cutting. Legislatures and administrative bodies are progressively perceiving the significance of 5G innovation and changing different sectors potential. Approaches and guidelines that help the sending of 5G organizations and the execution of organization cutting add to the market's development. Clear and great administrative systems urge telecom administrators to put resources into and send Network Slicing Market arrangements, cultivating a helpful climate for market improvement.

However, the dynamics of the market present obstacles and challenges. Interoperability issues, normalization concerns, and the intricacy of carrying out network cutting across various organization components can obstruct its boundless reception. Standardization bodies, vendors, and telecom operators are just a few of the industry stakeholders that must work together to overcome these obstacles. As the market develops, addressing these difficulties becomes critical to guaranteeing the consistent mix and sending of organization cutting arrangements.

Leave a Comment