Market Trends

Key Emerging Trends in the Managed Network Services Market

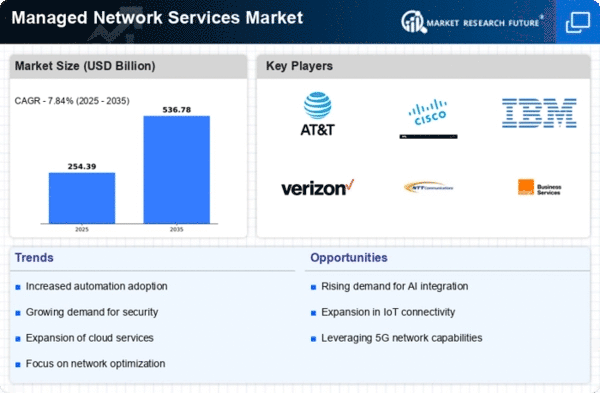

As of now, the MNS industry is going through unique changes and advancements that are affecting the manner by which IT framework the executives and computerized network are led. As businesses realize the significance of dependable, secure, and efficient network solutions, the demand for managed network services grows. An outstanding improvement is the rising commonness of cloud based MNS, which is propelled by the advantages of versatility, flexibility, and practical estimating. Cloud-based oversaw network administrations are being used by associations to advance their cycles, cultivate group cooperation, and assurance continuous availability for geologically scattered and far off staff. An extra critical pattern in the MNS market is the rising spotlight on network protection. Considering the rising refinement and recurrence of digital dangers, associations are putting more noteworthy accentuation on the fuse of modern security functionalities into their oversaw network administrations. To distinguish and alleviate potential security weaknesses, this incorporates arrangements like interruption identification and counteraction frameworks, encryption conventions, and proactive checking. Businesses lately are observing MNS way beyond merely a connectivity method; rather, they believe it to be an integral segment of their whole cybersecurity strategy for the burgeoning awareness of the cybersecurity vulnerabilities. Software-Defined Networking (SDN) and Network Function Virtualization (NFV) are also gaining popularity in the Managed Network Services sector. These mechanical progressions engage associations to augment network productivity, further develop adaptability, and abatement functional consumptions. Programming Characterized Systems administration (SDN) works with unified administration and programmability of organization foundation, consequently working with consistent variations to advancing business needs. Interestingly, NFV works with the virtualization of organization capabilities, accordingly, advancing asset effectiveness and decreasing the dependence on actual equipment. A noticeable tendency is arising among associations to integrate Man-made reasoning (computer-based intelligence) and AI (ML) into oversaw network administrations, as they try to keep up with intensity and versatility. Dissecting tremendous amounts of information produced by network gadgets, ML and simulated intelligence calculations are being used to recognize examples and conjecture possible issues preceding their exhibition influence. This predictive analytics approach improves overall network efficiency, reduces outages, and facilitates proactive network management. In addition, a more integrated and all-encompassing strategy is becoming a new trend in the Managed Network Services sector. Instead of putting reliance on various merchants to deal with unmistakable aspects of organization, associations are dynamically choosing incorporated arrangements that envelop a broad scope of administrations. Notwithstanding availability and security, this incorporate presentation the board, advancement, and organization checking administrations. Expanding in unmistakable quality are coordinated MNS suppliers, which give associations trying to smooth out their organization the executives’ processes with a concentrated area.

Leave a Comment