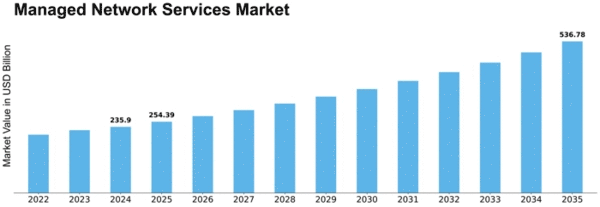

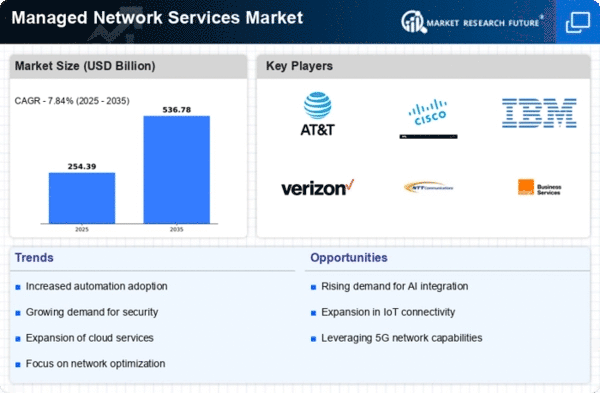

Managed Network Services Size

Managed Network Services Market Growth Projections and Opportunities

The market MNS is dependent upon the impact of various elements that add to its direction of development and elements. The increasing complexity of information technology infrastructures within businesses operating in a variety of industries is a crucial market determinant. Network services that are both effective and dependable are in high demand as a result of businesses' growing reliance on digital technologies. Suppliers of overseen network administrations help associations in exploring this intricacy by excellence of their insight into network engineering, organization, and upkeep. Besides, the rising meaning of network protection comprises a significant market determinant inside the MNS business. In light of the rising refinement and recurrence of digital dangers, associations are putting more prominent accentuation on network security. Because of this interest, purveyors of MNS are integrating refined security arrangements into their items and administrations. Among other features, this includes vulnerability assessments, threat detection, and data encryption. With an end goal to defend delicate information, associations are changing the MNS market to give secure and strong organization conditions. Another significant influence on the Managed Network Services market is the growing popularity of cloud computing. Cloud-based administrations are being used by associations to work on their versatility, adaptability, and cost-adequacy. MNS suppliers are coordinating and supporting cloud-based applications in a consistent way by adjusting their contributions to cloud advances. This usefulness empowers associations to smooth out their organization framework to meet the necessities of a cloud-driven and computerized climate. Additionally, the worldwide rise in the use of remote work has increased the demand for Managed Network Services. Because of the development of the conventional office-based model, representatives currently access corporate organizations from different areas. This progress requires that associations ensure the trustworthiness and accessibility of their organizations. MNS suppliers are of principal significance in working with distant availability, ensuring the usefulness of basic applications regardless of the client's geological area, and laying out secure virtual confidential organizations (VPNs). Furthermore, cost factors fundamentally impact the MNS market. Various associations establish that re-appropriating their organization is a more financially practical choice than putting resources into an inward IT group. MNS suppliers present a financially practical other option, empowering undertakings to acquire admittance to cutting edge level capability without requiring critical introductory capital costs. This viewpoint accepts specific importance for little and medium-sized endeavours trying to augment their data innovation consumptions while accessing premium organization administrations. Besides, the administrative climate considerably affects the market for oversaw network administrations. Considering the rising severity of information insurance and security guidelines on a worldwide scale, organizations genuinely should ensure adherence to these principles. To follow administrative commitments, suppliers of MNS are altering their contributions to incorporate information encryption, review trails, and consistence revealing. Thusly, associations ensure that they acquire successful organization administrations as well as agree with the lawful and administrative designs that direct their separate areas.

Leave a Comment