Market Trends

Introduction

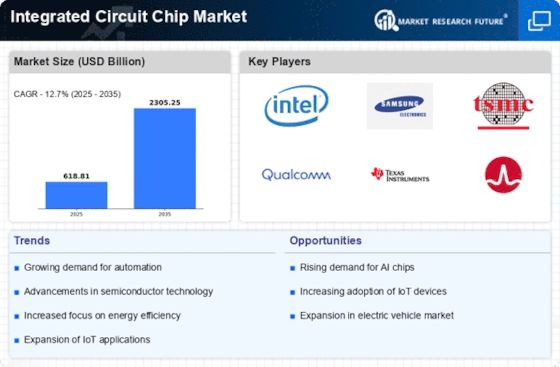

We are now looking at the IC market in 2023. As we examine the IC market in 2023, we find a number of macro-economic factors that are strongly influencing its course. Artificial intelligence, the Internet of Things, and 5G are bringing with them a need for more and more sophisticated and efficient chips. Regulations concerning the environment and cybersecurity are forcing manufacturers to change their products. And the shift in the way consumers are using smart devices and automation is affecting the design and use of ICs. These trends are of vital importance to all the participants in the IC industry. Not only do they indicate the new opportunities that are coming, but they also underline the need for strategic planning in this rapidly evolving market.

Top Trends

-

Increased Demand for AI and Machine Learning Chips

The use of artificial intelligence has caused a large increase in the demand for specialized integrated circuits. Intel and other companies have been investing heavily in the development of these circuits, and a projected increase of 30 percent in sales of such chips is expected by 2022. This is expected to lead to innovations in chip design, which in turn should lead to higher performance. Artificial intelligence is spreading to many fields, and the demand for these chips is expected to grow even further. -

Advancements in 5G Technology

The advent of 5G networks has created a demand for advanced ICs capable of higher data rates. Industry leader Qualcomm has seen a 25 per cent increase in demand for 5G-ready chips. This trend is affecting both design and manufacturing processes, driving companies to improve their mmWave and RF technology. These innovations could lead to smaller, more energy-efficient chips that will help to support the growing 5G network. -

Sustainability and Eco-Friendly Chip Production

There is a growing emphasis on the use of sustainable production methods in the manufacture of microelectronics, and the company STMicroelectronics has vowed to reduce its carbon emissions by 50 per cent by 2030. This trend is being driven both by the legal system and by the demand for greener products. In the area of manufacturing, this translates into investment in such things as the use of renewable energy and waste reduction. In the future, we may see the emergence of a circular economy in the microelectronics industry. -

Rise of Automotive Electronics

The automobile industry is becoming increasingly digital, with a forecast that by 2025, about 40% of new cars will be equipped with a driving assistant system. The trend is being driven by companies like NXP Semiconductors, which develops chips that are adapted to the special requirements of the automobile industry. This shift is changing the value chains and establishing new cooperation between chip manufacturers and car manufacturers. In the future, developments may include an increase in safety and the possibility of driving without a driver. -

Miniaturization of Integrated Circuits

In fact, this trend towards smaller and more powerful microchips is accelerating. In fact, companies like Texas Instruments are pushing the limits of miniaturization. In the past five years, the average size of integrated circuits has fallen by 20 percent, enabling devices to become more compact. This is influencing the design of all kinds of products, resulting in more lightweight and efficient electronics. However, future advances may be based on stacking chips in three dimensions and using new methods of packaging. -

Increased Focus on Cybersecurity in Chip Design

There is an increased emphasis on implementing security features in integrated circuits. Incidents of hacking on IoT devices are up by 50% over the last year. Chip makers like Infineon are responding with circuits that have built-in security features. This is changing the priorities of chip design and requiring close collaboration between chip makers and security specialists. Future developments may lead to the establishment of a security framework for chip design. -

Expansion of IoT Applications

The Internet of Things, or IoT, is a new field for the manufacture of special integrated circuits. It is estimated that there will be 75 billion connected devices in 2025. The company MediaTek is developing low-power integrated circuits for IoT applications. This trend is influencing the strategy of manufacturers and forcing them to focus on energy efficiency and interoperability. Future developments may include improved interoperability and smarter edge computing. -

Supply Chain Resilience and Localization

The localization of the semiconductor supply chain is accelerated by the geopolitical tensions and pandemic disruptions. The governments are incentivizing the local production of chips, the United States has allocated up to fifty-two billion dollars for this purpose. This is reshaping the global supply chain, and companies are diversifying their procurement strategies. Local production is increasing, and this may have further consequences. -

Emergence of Quantum Computing Chips

Quantum computing is beginning to take off. IBM and Google are investing in the development of quantum chips. Market expectations are considerable, as progress in quantum algorithms and applications drives demand. This trend is influencing the R&D priorities of the chip industry, and is forcing the traditional chip makers to start exploring quantum technology. Quantum computing has the potential to lead to major breakthroughs in the processing power and problem-solving capabilities of the future. -

Integration of Advanced Packaging Technologies

On Semiconductor is one of the companies that has been developing this technology. The need for higher performance and lower power consumption is a driving force. With advanced packaging, the efficiency of chip performance can be increased by as much as 15 percent. This also means a reduction in the thermal management challenges and better signal integrity. In the future, it may be possible to develop hybrid integration and system-on-chips.

Conclusion: Navigating the Competitive IC Landscape

The IC chip market in 2023 is characterized by high competition and considerable fragmentation, with both traditional and new companies competing for market share. The trend in the regional market is towards Asia-Pacific as the manufacturing center, while North America and Europe focus on innovation and sustainability. The strategic focus of the companies is on the ability to meet changing customer needs through the use of AI, automation and flexibility. The big players are improving their offerings through alliances and acquisitions, while the new ones are shaking up the market with agile solutions. The ability to integrate sustainable product development is a decisive factor in determining market leadership in this rapidly changing market.

Leave a Comment