Market Analysis

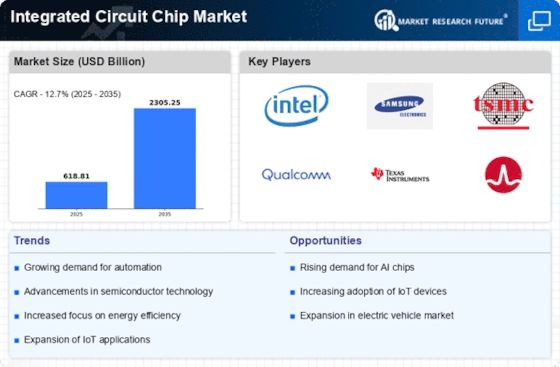

Integrated Circuit Chip Market (Global, 2023)

Introduction

The IC market is the spearhead of innovation, a key component of the vast array of electric devices that have come to define modern life. The IC market is undergoing a sea change driven by the IoT, AI, and 5G. The ICs that form the brains of devices from mobile phones and PCs to cars and industry are becoming more sophisticated, enabling higher performance and better energy efficiency. The industry is populated with a diverse array of players, from the established giants to the newcomers. All of them are striving to carve out a share of the market through innovation and strategic alliances. And, as the market develops, the ongoing challenges of supply chain disruptions and geopolitical tensions are changing the game, influencing the way companies are rethinking their sourcing and manufacturing strategies. As the industry navigates these complexities, it is essential for all market participants to understand the trends, opportunities, and challenges in the IC market.

PESTLE Analysis

- Political

- In 2023, the IC market was heavily influenced by the policy of the government to promote the development of the domestic semiconductor industry. The U.S. CHIPS Act, which allocated fifty-two billion dollars to promote the development of the U.S. semiconductor industry, was the main political factor driving the IC market. In addition, the conflict between China and the United States also led to the export of high-tech chips and the collapse of the supply chain. , the market was more complex. For example, the U.S. Department of Commerce reported that in 2023, the export of 30% of the IC chip to China would be subject to a new certification, which would lead to market fluctuations.

- Economic

- In 2023, the economic situation in the IC market will be characterized by rising production costs and inflationary pressures. The average cost of semiconductor manufacturing equipment will increase by approximately 15% compared to 2022, driven by the impact of supply chain disruptions and the growing demand for advanced equipment. In addition, in the United States, the number of employees in the semiconductor industry will reach 1.2 million in early 2023, indicating a strong labor market, but also indicating the challenge of labor shortages in skilled positions that can hinder production.

- Social

- The IC market is influenced by the growing demand for electrical appliances, and the increasing awareness of the role played by technology in daily life. It was estimated that by 2023, over 80 per cent of households in developed countries would own at least three smart devices, which would have a positive impact on the demand for ICs. The rising trend towards environmentalism also encouraged consumers to favour products that used energy-efficient ICs, and this in turn encouraged manufacturers to innovate in this area. According to one survey, more than 65 per cent of consumers were willing to pay a higher price for products that used less energy. This had a significant impact on product development strategies.

- Technological

- Advances in technology are rapidly transforming the integrated circuit market, with a notable trend towards smaller, more efficient chips. In 2023, the industry will have adopted the 5nm and 3nm process technology. Leading the way are TSMC and Samsung. Their combined production of 5nm chips is around a billion units, a 20 per cent increase over the previous year. In addition, as the demand for artificial intelligence and machine learning rises, the market for specialised chips is expected to grow rapidly. By 2023, the market for AI chips will have grown to 25 per cent of the total.

- Legal

- Legal factors affecting the IC chip market are the laws and regulations regarding intellectual property and fair competition. In 2023, the United States Trademark and Patent Office reported that the percentage of patents related to the IC chip industry accounted for 35% of all patents for technology filed in that year. This clearly indicated the fierce competition in the industry. In addition, the rules of international trade are also important. There are tariffs and export restrictions. Also, the European Union has recently passed the Digital Market Act, which regulates large Internet companies, and will have an impact on the IC chip industry in the European Union.

- Environmental

- The integrated circuits market is increasingly influenced by the environment, especially in terms of waste disposal and the disposal of waste. In 2023, it is expected that e-waste will reach about 1,500,000 tons worldwide from the manufacture of integrated circuits. This has led to the need for a more sustainable development. And that is where green technology is important, because today about 40 percent of semiconductor companies have committed themselves to reducing their carbon footprint by 25 percent by 2025. And since the average fab uses 500,000 liters of water per day, water conservation is also an important issue.

Porter's Five Forces

- Threat of New Entrants

- The market for integrated circuits is characterized by high barriers to entry, such as high capital requirements, advanced technology, and consumers’ brand loyalty. However, with the development of technology and the emergence of niche markets, new entrants may find opportunities, especially in the field of special applications.

- Bargaining Power of Suppliers

- The supply of materials and components for ICs is wide-ranging, with many suppliers. The suppliers' bargaining power is limited by the abundance of the supply, because manufacturers can easily change suppliers without much trouble or cost.

- Bargaining Power of Buyers

- The buyers of integrated circuits, the large high-tech companies and manufacturers, have considerable negotiating power because of their size and the volume of their purchases. They can bargain for lower prices and they can also demand higher quality or additional features, which puts pressure on the producers.

- Threat of Substitutes

- The fact is that there are several alternative technological processes which can perform the same functions as the integrated circuits. These are field-programmable gate arrays (FPGAs) and application-specific integrated circuits (ASICs). But the unique characteristics and the high performance of the conventional chip make these alternative processes less dangerous. However, the technological progress that is constantly being made may in the long run increase this danger.

- Competitive Rivalry

- Competition in the market for integrated circuits is intense among the established companies, among which the major players with large market shares. The rivalry is based on rapid technological development, price competition and the constant need for innovation, and this creates a highly dynamic market environment.

SWOT Analysis

Strengths

- High demand for integrated circuits in consumer electronics and automotive sectors.

- Advancements in technology leading to smaller, more efficient chips.

- Strong investment in research and development by leading manufacturers.

Weaknesses

- High production costs and capital-intensive manufacturing processes.

- Supply chain vulnerabilities, particularly in semiconductor materials.

- Limited availability of skilled labor in advanced chip design and manufacturing.

Opportunities

- Growing demand for IoT devices and smart technologies.

- Expansion into emerging markets with increasing electronics consumption.

- Potential for innovation in AI and machine learning applications.

Threats

- Intense competition leading to price wars among manufacturers.

- Geopolitical tensions affecting global supply chains.

- Rapid technological changes requiring constant adaptation and investment.

Summary

The IC market will be characterized by strong demand in 2023, driven by technological development and significant investment in R & D. The high cost of production and the weakening of the supply chain are the main challenges. Opportunities exist in the IoT and in emerging markets. Competition and geopolitical risks may limit growth. Strategically, innovation and supply chain resilience will be the main drivers of success.

Leave a Comment