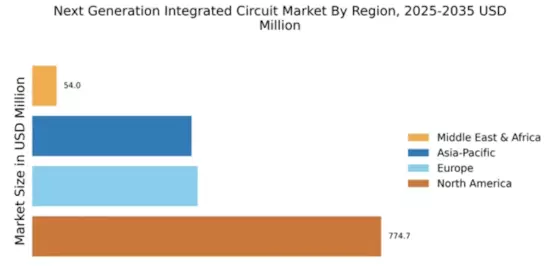

North America : Innovation and Leadership Hub

North America continues to lead the Next Generation Integrated Circuit market, holding a significant share of 774.72M in 2025. The region's growth is driven by robust demand for advanced technologies, including AI and IoT, alongside substantial investments in R&D. Regulatory support for semiconductor manufacturing and innovation further catalyzes market expansion, ensuring a competitive edge in global supply chains. The United States stands out as a key player, hosting major companies like Intel, Qualcomm, and NVIDIA. This competitive landscape is bolstered by a strong ecosystem of startups and established firms, fostering innovation. The presence of leading manufacturers and a skilled workforce positions North America as a pivotal region in The Next Generation Integrated Circuit.

Europe : Emerging Technology Landscape

Europe's Next Generation Integrated Circuit market is projected at 367.12M in 2025, driven by increasing demand for energy-efficient technologies and sustainable practices. The European Union's regulatory frameworks, such as the European Chips Act, aim to enhance semiconductor production and innovation, positioning the region as a competitive player in the global market. Leading countries like Germany, France, and the Netherlands are at the forefront of this growth, with significant investments in semiconductor research and development. Major players, including STMicroelectronics, are enhancing their capabilities, contributing to a vibrant competitive landscape. The focus on collaboration between industry and academia further strengthens Europe's position in the integrated circuit sector.

Asia-Pacific : Rapid Growth and Adoption

The Asia-Pacific region, with a market size of 353.59M in 2025, is witnessing rapid growth in the Next Generation Integrated Circuit sector. This growth is fueled by increasing demand for consumer electronics, automotive applications, and advancements in telecommunications. Countries are implementing favorable policies to attract investments in semiconductor manufacturing, enhancing regional capabilities. China, South Korea, and Taiwan are leading the charge, with companies like Samsung and TSMC driving innovation and production. The competitive landscape is characterized by a mix of established giants and emerging startups, fostering a dynamic environment for technological advancements. The region's strategic importance in the global supply chain is underscored by its manufacturing prowess and innovation capabilities.

Middle East and Africa : Emerging Market Potential

The Middle East and Africa (MEA) region, with a market size of 54.0M in 2025, is beginning to tap into the Next Generation Integrated Circuit market. The growth is driven by increasing investments in technology infrastructure and a rising demand for electronics across various sectors. Governments are focusing on diversifying their economies, which includes boosting the semiconductor industry as a strategic priority. Countries like South Africa and the UAE are emerging as key players, with initiatives aimed at fostering local manufacturing capabilities. The competitive landscape is still developing, but the presence of international firms is gradually increasing, paving the way for future growth. As the region invests in education and technology, the potential for market expansion is significant.