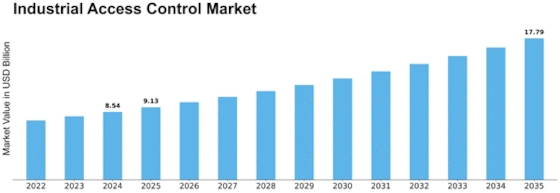

Industrial Access Control Size

Industrial Access Control Market Growth Projections and Opportunities

Numerous factors influence the Industrial Access Control Market, contributing to its overall growth and progress. The growing emphasis on security within industrial workplaces is one important motivator. Entities' appreciation of the need to protect sensitive areas, assets, and the foundation has led to a sharp rise in demand for strong access control systems. Intelligent card readers, biometric authentication, keypad access, and other access control mechanisms are increasingly becoming essential components of industrial security systems. Because biometric validation verifies individuals based on unique physiological characteristics, it provides an increased level of protection. Additionally, the use of cloud-based access control solutions provides flexibility, adaptability, and remote administration capabilities, meeting the evolving needs of business endeavors. Businesses, especially those in charge of sensitive data and essential infrastructure, rely on strict policies controlling access and security. Adherence to industry standards and administrative requirements motivates the use of access control solutions to provide a stable environment. The market responds to the ongoing advancements in administrative systems by providing arrangements that comply with the latest consistency standards. The access control business is expanding as a result of the industrial sector's heightened attention on network security. The proliferation of industrial frameworks and the growth of the Industrial Internet of Things (IIoT) increase the attack surface of cyber threats. Access control systems play a crucial role in preventing unauthorized access to business organizations and providing protection against cyberattacks. Strong access control policies are becoming more and more popular as companies invest in strengthening their network security. The advent of Industry 4.0 is bringing about a transformation in the industrial landscape, as seen by the integration of digital advances into assembly processes. The need for reliable and safe access control systems that can support the linked concept of the modern industrial environment is being driven by this shift. The use of computerization, improved mechanics, and information-driven processes by firms has made access control frameworks imperative for ensuring the integrity and safety of industrial operations.

Leave a Comment