Hand Hygiene Products Market Share

Hand Hygiene Products Market Research Report: Information By Product Type (Soaps, Hand Wash, Hand Sanitizers, Lotion & Creams and Others), By End-Use (Residential, Commercial {Educational Institutions, Hotels & Restaurants, Hospitals & Health Centers, Corporate Offices and Others}), By Distribution Channel (Supermarkets & Hypermarkets, Convenience Stores and Others) And By Regio...

Market Summary

The Global Hand Hygiene Products Market is projected to grow from 7.74 USD Billion in 2024 to 14.4 USD Billion by 2035, reflecting a robust CAGR of 5.84%.

Key Market Trends & Highlights

Hand Hygiene Products Key Trends and Highlights

- The market valuation is expected to increase from 7.74 USD Billion in 2024 to 14.4 USD Billion by 2035.

- The compound annual growth rate (CAGR) for the period from 2025 to 2035 is estimated at 5.84%.

- This growth trajectory indicates a rising demand for hand hygiene products across various sectors.

- Growing adoption of hand hygiene practices due to increased awareness of health and safety is a major market driver.

Market Size & Forecast

| 2024 Market Size | 7.74 (USD Billion) |

| 2035 Market Size | 14.4 (USD Billion) |

| CAGR (2025-2035) | 5.84% |

| Largest Regional Market Share in 2024 | latin_america) |

Major Players

Reckitt Benckiser Group Plc (UK), Unilever Group (UK), Smith & Nephew plc (UK), 3M (US), Procter & Gamble Co. (US), Johnson & Son, Inc. (US), Whiteley Corporation (Australia), GOJO Industries, Inc. (US), Kimberly-Clark Corporation (US), Medline Industries, Inc.

Market Trends

Growing hygiene concern is driving the market growth

The rising hygiene concern is driving market CAGR for hand hygiene products. The development of the world economy has led to a change in lifestyle, a rise in the standard of living, and the adoption of a health-conscious way of living. As a result, more people are using personal care products to preserve their health. Nowadays, people are more likely to engage in yoga and stretching exercises to keep their bodies healthy and active during lockdowns and boost their immune systems to fight off pandemic illnesses like COVID-19.

Additionally, the prevalence of hospitals and other healthcare institutions is projected to increase demand for sanitary products because hospitals frequently utilize various personal care and hygiene products to ensure cleanliness and a germ-free environment. The expansion of infrastructure facilities, including schools, colleges, hotels, restaurants, corporations, and residences, also fuels the need for the products. Government programmes and promotions to encourage personal hygiene and cleanliness.

The demand for personal care products is influenced by various government campaigns and programs linked to personal cleanliness and care, fueling market expansion. The government of Victoria has started a personal hygiene care and learning strategy to raise awareness of hand hygiene products among school students, teachers and other personnel, according to the report "Personal Hygiene," issued by the Victoria State Government of Education & Training.

Additionally, the use of palm and finger cleansing products is likely to increase due to the growing awareness of the value of cleanliness due to numerous promotional initiatives through websites, radio, television, social networking sites, print media, and other media. Thus, driving the Hand Hygiene Products market revenue.

The increasing awareness of health and hygiene practices is driving a notable shift towards the adoption of hand hygiene products across various sectors, reflecting a broader commitment to public health and safety.

Centers for Disease Control and Prevention (CDC)

Hand Hygiene Products Market Market Drivers

Market Growth Projections

The Global Hand Hygiene Products Market Industry is poised for substantial growth, with projections indicating a market size of 7.74 USD Billion in 2024 and an anticipated increase to 14.4 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate (CAGR) of 5.84% from 2025 to 2035. Such projections reflect the ongoing commitment to hand hygiene across various sectors, driven by factors such as increased awareness, regulatory support, and technological advancements. The market's expansion is likely to be influenced by evolving consumer preferences and the continuous development of innovative products that cater to diverse needs.

Regulatory Support and Standards

The Global Hand Hygiene Products Market Industry benefits from stringent regulatory support and standards aimed at enhancing public health. Governments worldwide are implementing regulations that mandate the use of hand hygiene products in various settings, including healthcare facilities, schools, and food service establishments. These regulations not only promote the use of hand sanitizers and soaps but also ensure product safety and efficacy. As a result, manufacturers are increasingly investing in compliance with these standards, which may contribute to market growth. The anticipated market expansion to 14.4 USD Billion by 2035 underscores the potential impact of regulatory frameworks on consumer behavior and industry dynamics.

Rising Awareness of Hygiene Practices

The Global Hand Hygiene Products Market Industry experiences a notable surge in demand driven by increasing awareness of hygiene practices. Public health campaigns and educational initiatives emphasize the importance of hand hygiene in preventing infections. This heightened awareness is reflected in the growing consumption of hand sanitizers and soaps. In 2024, the market is projected to reach 7.74 USD Billion, indicating a robust response to these initiatives. As consumers become more informed about the transmission of pathogens, the industry is likely to see sustained growth, with a projected CAGR of 5.84% from 2025 to 2035, suggesting a long-term commitment to hygiene.

Growing Demand for Eco-Friendly Products

The Global Hand Hygiene Products Market Industry is witnessing a growing demand for eco-friendly and sustainable products. Consumers are increasingly concerned about the environmental impact of their choices, leading to a shift towards biodegradable and natural ingredients in hand hygiene products. Manufacturers are responding to this trend by developing eco-conscious formulations that align with consumer preferences. This shift not only addresses environmental concerns but also enhances brand loyalty among consumers who prioritize sustainability. As the market evolves, the anticipated growth to 14.4 USD Billion by 2035 suggests that eco-friendly products may play a pivotal role in shaping the future landscape of the industry.

Technological Advancements in Product Development

Innovations in product development are significantly influencing the Global Hand Hygiene Products Market Industry. Advances in formulation technology have led to the creation of more effective and user-friendly hand hygiene products. For instance, the introduction of alcohol-based hand sanitizers with enhanced skin conditioning agents addresses consumer concerns about skin irritation. Additionally, the development of touchless dispensers and smart hygiene solutions is reshaping consumer experiences. These technological advancements not only improve product efficacy but also cater to the evolving preferences of consumers. As the market adapts to these innovations, it is likely to witness sustained growth, aligning with the projected CAGR of 5.84% from 2025 to 2035.

Increased Focus on Health and Safety in Workplaces

The Global Hand Hygiene Products Market Industry is significantly impacted by the increasing focus on health and safety in workplaces. Organizations are prioritizing employee well-being and implementing stringent hygiene protocols to mitigate the risk of infections. This trend is particularly evident in sectors such as healthcare, food service, and education, where hand hygiene is critical. Companies are investing in hand hygiene products to create a safe environment for employees and customers alike. The market's growth trajectory, with an expected valuation of 7.74 USD Billion in 2024, reflects this shift towards enhanced workplace hygiene practices, which are likely to persist in the coming years.

Market Segment Insights

Hand Hygiene Products Type Insights

The Hand Hygiene Products market segmentation, based on product type, includes soaps, hand wash, hand sanitizers, lotion & creams and others. The hand sanitizers segment dominated the market, accounting for 45% of market revenue. Sales are being driven by customers' increasing awareness of the necessity for sanitizer and its superior effectiveness over regular soaps.

Additionally, the market is growing as a result of efforts made by the World Health Organisation (WHO) and Food and Drug Administration (FDA) to raise awareness of the importance of good hand hygiene and the dangerous diseases it is linked to, as well as product innovations by the major players like the inclusion of organic ingredients and calming fragrances.

Hand Hygiene Products End-Use Insights

Based on end-use, the Hand Hygiene Products market segmentation includes residential, commercial {educational institutions, hotels & restaurants, hospitals & health centers, corporate offices and others}). The commercial segment dominated the market, accounting for 45% of market revenue due to the increased need for cleaning supplies due to the need for clean and hygienic environments in schools, hospitals, clinics, and other business settings. The booming commercial sector is also projected to contribute to segmental revenues.

Hand Hygiene Products Distribution Channel Insights

The Hand Hygiene Products market segmentation, based on distribution channels, includes supermarkets & hypermarkets, convenience stores and others. The supermarkets & hypermarkets category generated the most income. The distribution of cleansers on the market has increased in many of these establishments across several places. In the initial several weeks of the outbreak, several retailers had trouble keeping their hand sanitizer inventories stocked. In March 2020, supermarkets in Singapore were also out of these and other household cleaning supplies, mostly due to panic buying or stockpiling hand sanitizers. Prices were raised to deter stockpiling and put a limit on excessive purchases.

Figure 1: Hand Hygiene Products Market, by Distribution channel, 2022 & 2032 (USD Billion)

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Get more detailed insights about Hand Hygiene Products Market Research Report - Global Forecast till 2032

Regional Insights

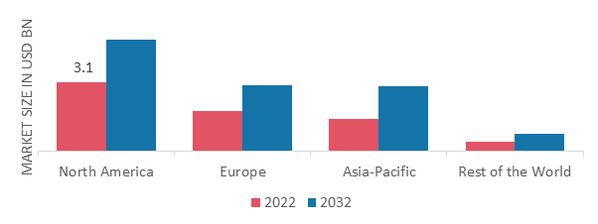

North America, Europe, Asia-Pacific, and the rest of the world are the four regions covered by the report regarding market insights. The North American Hand Hygiene Products market will dominate this market due to strict laws surrounding hand hygiene in the healthcare industry and highly advanced healthcare facilities. Another element promoting the expansion of the target market in North America is the increased awareness of the value of hand hygiene among people.

Therefore the major region covered in the market report is France, Canada, German, Italy, Spain, the UK, The US, Japan, India, Australia, China, South Korea, and Brazil.

Figure 2: HAND HYGIENE PRODUCTS MARKET SHARE BY REGION 2022 (USD Billion)

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Europe's Hand Hygiene Products market accounts for the second-largest market share. This region has many market participants where wipes, gel-based, foam-based, and spray-based hand antiseptics are widely used. Further, the German Hand, Hygiene Products market, held the largest market share, and the UK Hand Hygiene Products market was the fastest growing market in the European region.

The Asia-Pacific Hand, Hygiene Products Market, will be to growing at the fastest CAGR from 2023 to 2032.The countries' expanding manufacturing sectors will fuel demand for the goods by escalating dust and air pollution issues. Moreover, China's Hand Hygiene Products market held the largest market share, and the India Hand Hygiene Products market will be the fastest-growing market in the Asia-Pacific region.

Key Players and Competitive Insights

The market for hand hygiene products will grow even more due to major industry participants spending a lot of funds on Development and research to diversify their line of goods. Market participants also engage in various strategic efforts to broaden their reach. Significant market developments include new product launches, contractual agreements, mergers and acquisitions, greater investments, and collaboration with other companies. The hand hygiene products industry must provide competitively priced goods to expand and flourish in a more competitive and challenging market environment.

A few of the most common tactics producers employ in the Hand Hygiene Products industry to benefit customers and expand the market as a whole is creating products locally that minimize operational costs. In recent years, the Hand Hygiene Products industry has offered some of the most significant advantages. Major players in the Hand Hygiene Products market, Clensta, Smith & Nephew plc (UK), 3M (US), Procter & Gamble Co. (US) and others, are attempting to increase market demand by investing in research and development operations.

Clensta main goals are to add value and find solutions to issues that have yet to be dared to address. They aim to revolutionize how to take care of customers and customer houses, from wellness to personal care, home care, and all in between. In April 2020, Leading biotechnology company Clensta International introduced the Clensta Instant Hand Hygiene Solution, a cutting-edge hand sanitizer. A rapid fix for all-around protection and freshness, the unique product provides instant 99.9% germ prevention and has antibacterial and antiseptic characteristics.

The privately held firm DetectaChem is the creator of Seeker, a quickly deployed, portable, intelligent, and user-friendly detection system. Real-time danger identification for safety and security around the globe is made possible by The Seeker. Although the firm products are advanced in function. The Seeker deploys automatic colorimetric examination of incredibly minute amounts of explosive and drug components using patented, proprietary technologies. The business has created a unique card-collecting system that gathers samples and has everything needed for a colorimetric reaction.The Seeker uses color reaction-related technology widely applied to molecular analysis.

The Seeker can quickly perform on-site diagnostic identification of explosive and narcotic components because of this liquid chemistry-based technique. Since DetectaChem products are multilingual, they can be used wherever. In April 2020, On the DetectaChem website, customers may purchase the company's inexpensive antiseptic hand lotion. To improve neighborhood safety during the COVID-19 pandemic, the launch was made.

Key Companies in the Hand Hygiene Products Market market include

Industry Developments

December 2022: According to an official letter of intent from NHS Supply Chain, SpectrumX, a healthcare and pharmaceutical company headquartered in the UK purchased Spectricept Care+ Hands. This hand sanitizer was included in the non-alcohol-based hand disinfectant lot of the Hand Hygiene and Associated Products and Services Tender. It will be available to consumers in May 2023.

May 2022: The makers of Purell products, GOJO Industries, introduced the Purell CS4 All-Weather Dispensing System. Commercial and municipal buyers can use the dispenser to supply soap and hand sanitizer in outdoor or busy areas.

July 2021: A five-year partnership between Unibail-Rodamco-Westfield and Unilever PLC allowed access to the Lifebuoy brand of hygiene soap in all 66 Westfield centers in the United Kingdom and the European property portfolio.

Future Outlook

Hand Hygiene Products Market Future Outlook

The Hand Hygiene Products Market is projected to grow at a 5.84% CAGR from 2024 to 2035, driven by increasing health awareness, regulatory mandates, and technological advancements.

New opportunities lie in:

- Develop eco-friendly hand sanitizers to capture environmentally conscious consumers.

- Leverage e-commerce platforms for direct-to-consumer sales expansion.

- Innovate with smart dispensers that integrate IoT for usage tracking and analytics.

By 2035, the Hand Hygiene Products Market is expected to be robust, reflecting heightened global health standards and consumer demand.

Market Segmentation

Outlook

- Residential

- Commercial

- Educational Institutions

- Hotels & Restaurants

- Hospitals & Health Centers

- Corporate Offices

- Others

Hand Hygiene Products Type Outlook

- Soaps

- Hand Wash

- Hand Sanitizers

- Lotion & Creams

- Others

Hand Hygiene Products End-Use Outlook

- Residential

- Commercial

- Educational Institutions

- Hotels & Restaurants

- Hospitals & Health Centers

- Corporate Offices

- Others

Hand Hygiene Products Regional Outlook

- US

- Canada

- Germany

- Franc

- UK

- Italy

- Spain

- Rest of Europe

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia-Pacific

- Middle East

- Africa

- Latin America

Hand Hygiene Products Distribution Channel Outlook

- Supermarkets & Hypermarkets

- Convenience Stores

- Others

Report Scope

| Report Attribute/Metric | Details |

| Market Size 2023 | USD 7.25 Billion |

| Market Size 2024 | USD 7.73575 Billion |

| Market Size 2032 | USD 12.18 Billion |

| Compound Annual Growth Rate (CAGR) | 6.70% (2024-2032) |

| Base Year | 2023 |

| Market Forecast Period | 2024-2032 |

| Historical Data | 2018- 2022 |

| Market Forecast Units | Value (USD Billion) |

| Report Coverage | Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | Product Type, End User, Distribution Channel, and Region |

| Geographies Covered | North America, Europe, Asia Pacific, and the Rest of the World |

| Countries Covered | The US, Canada, German, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

| Key Companies Profiled | Reckitt Benckiser Group Plc (UK), Unilever Group (UK), Smith & Nephew plc (UK), 3M (US), Procter & Gamble Co. (US), C. Johnson & Son, Inc. (US), Whiteley Corporation (Australia), GOJO Industries, Inc. (US), Kimberly-Clark Corporation (US), Medline Industries, Inc |

| Key Market Opportunities | Increasing awareness regarding the usage of health |

| Key Market Dynamics | Increasing Disposable Income of Consumers. |

Market Highlights

Author

Latest Comments

This is a great article! Really helped me understand the topic better.

Thanks for sharing this. I’ve bookmarked it for later reference.

FAQs

How much is the Hand Hygiene Products market?

The Hand Hygiene Products market size was valued at USD 6.8 Billion in 2023.

What is the growth rate of the Hand Hygiene Products market?

The market is projected to grow at a CAGR of 5.84% during the forecast period, 2024-2032.

Which region held the largest market share in the Hand Hygiene Products market?

North America had the largest share in the market

Who are the key players in the Hand Hygiene Products market?

The key players in the market are Reckitt Benckiser Group Plc (UK), Unilever Group (UK), Smith & Nephew plc (UK), 3M (US), Procter & Gamble Co. (US), C. Johnson & Son, Inc. (US), Whiteley Corporation (Australia).

Which product type led the Hand Hygiene Products market?

The sanitizer category dominated the market in 2022.

Which distribution channel had the largest market share in the Hand Hygiene Products market?

The Supermarkets & Hypermarkets had the largest share in the market.

-

'Table

-

of Contents

-

EXECUTIVE SUMMARY

-

MARKET INTRODUCTION

-

MARKET DEFINITION

-

SCOPE OF THE STUDY

-

RESEARCH OBJECTIVES

-

ASSUMPTIONS & LIMITATIONS

- MARKET STRUCTURE

-

MARKET RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- FORECAST MODEL

-

MARKET LANDSCAPE

-

SUPPLY CHAIN ANALYSIS

- RAW MATERIAL SUPPLIERS

- MANUFACTURERS/PRODUCERS

- DISTRIBUTORS/RETAILERS/WHOLESALERS/E-COMMERCE

- END USES

- PORTER’S FIVE

-

SUPPLY CHAIN ANALYSIS

-

FORCES ANALYSIS

-

THREAT OF NEW ENTRANTS

-

BARGAINING POWER OF BUYERS

-

BARGAINING POWER OF SUPPLIERS

- THREAT OF SUBSTITUTES

- INTERNAL RIVALRY

-

BARGAINING POWER OF SUPPLIERS

-

MARKET DYNAMICS OF THE GLOBAL HAND HYGIENE PRODUCTS

-

MARKET

-

INTRODUCTION

-

DRIVERS

-

RESTRAINTS

-

OPPORTUNITIES

-

CHALLENGES

-

GLOBAL HAND HYGIENE PRODUCTS MARKET, BY PRODUCT TYPE

- INTRODUCTION

-

SOAPS

- MARKET ESTIMATES & FORECAST, 2024–2032

- MARKET ESTIMATES

-

& FORECAST, BY REGION, 2024–2032

-

HAND WASH

- MARKET ESTIMATES & FORECAST, 2024–2032

- MARKET ESTIMATES

-

HAND SANITIZERS

- MARKET ESTIMATES & FORECAST, 2024–2032

- MARKET ESTIMATES

-

LOTION & CREAMS

- MARKET ESTIMATES & FORECAST, 2024–2032

- MARKET ESTIMATES

-

OTHERS

- MARKET ESTIMATES & FORECAST, 2024–2032

- MARKET ESTIMATES

-

HAND WASH

-

GLOBAL HAND HYGIENE PRODUCTS MARKET, BY END USE

- INTRODUCTION

-

RESIDENTIAL

- MARKET ESTIMATES

-

& FORECAST, 2024–2032

- MARKET ESTIMATES & FORECAST, BY REGION, 2024–2032

-

COMMERCIAL

- MARKET ESTIMATES

- MARKET ESTIMATES & FORECAST, BY REGION, 2024–2032

-

INSTITUTIONS

-

MARKET ESTIMATES & FORECAST, 2024–2032

- MARKET ESTIMATES & FORECAST, BY REGION,

-

2024–2032

-

HOTELS & RESTAURANTS

-

MARKET ESTIMATES & FORECAST, 2024–2032

- MARKET ESTIMATES

-

INDUSTRIAL

- MARKET ESTIMATES

- MARKET ESTIMATES & FORECAST, BY REGION, 2024–2032

-

MARKET ESTIMATES & FORECAST, 2024–2032

-

GLOBAL HAND HYGIENE

-

PRODUCTS MARKET, BY DISTRIBUTION CHANNEL

- INTRODUCTION

-

STORE-BASED

- MARKET ESTIMATES & FORECAST, 2024–2032

- MARKET ESTIMATES

- SUPERMARKETS & HYPERMARKETS

- CONVENIENCE STORES

- OTHERS

-

NON-STORE-BASED

- MARKET ESTIMATES

- MARKET ESTIMATES & FORECAST, BY REGION, 2024–2032

-

GLOBAL HAND HYGIENE

-

PRODUCTS MARKET, BY REGION

- INTRODUCTION

-

NORTH AMERICA

- MARKET ESTIMATES & FORECAST, 2024–2032

- MARKET ESTIMATES &

-

FORECAST, BY PRODUCT TYPE, 2024–2032

- MARKET ESTIMATES & FORECAST, BY END USE,

-

MARKET ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2024–2032

- MARKET ESTIMATES

-

& FORECAST, BY COUNTRY, 2024–2032

-

US

- MARKET ESTIMATES & FORECAST, BY PRODUCT TYPE,

-

US

-

MARKET ESTIMATES & FORECAST, BY END USE, 2024–2032

- MARKET ESTIMATES & FORECAST, BY DISTRIBUTION

-

CHANNEL, 2024–2032

-

CANADA

- MARKET ESTIMATES & FORECAST, BY PRODUCT TYPE, 2024–2032

-

CANADA

-

& FORECAST, BY END USE, 2024–2032

-

MARKET ESTIMATES & FORECAST, BY DISTRIBUTION

- MEXICO

-

EUROPE

- MARKET ESTIMATES & FORECAST, 2024–2032

- MARKET ESTIMATES &

- MARKET ESTIMATES & FORECAST, BY END USE,

- MARKET ESTIMATES

- GERMANY

-

MARKET ESTIMATES & FORECAST, BY DISTRIBUTION

-

TYPE, 2024–2032

-

MARKET ESTIMATES & FORECAST, BY DISTRIBUTION

- UK

-

MARKET ESTIMATES & FORECAST, BY DISTRIBUTION

-

MARKET ESTIMATES & FORECAST, BY PRODUCT TYPE, 2024–2032

- MARKET ESTIMATES &

-

FORECAST, BY END USE, 2024–2032

-

MARKET ESTIMATES & FORECAST, BY DISTRIBUTION

- FRANCE

- SPAIN

- ITALY

- REST OF EUROPE

-

ASIA-PACIFIC

- MARKET ESTIMATES & FORECAST, 2024–2032

- MARKET ESTIMATES &

- MARKET ESTIMATES & FORECAST, BY END USE,

- MARKET ESTIMATES

- CHINA

- JAPAN

- INDIA

- AUSTRALIA & NEW ZEALAND

- REST OF ASIA-PACIFIC

-

REST OF THE WORLD

- MARKET ESTIMATES & FORECAST, 2024–2032

- MARKET ESTIMATES

-

MARKET ESTIMATES & FORECAST, BY DISTRIBUTION

-

& FORECAST, BY PRODUCT TYPE, 2024–2032

-

MARKET ESTIMATES & FORECAST, BY END USE,

- MARKET ESTIMATES

- SOUTH AMERICA

- MIDDLE EAST

- AFRICA

-

MARKET ESTIMATES & FORECAST, BY END USE,

-

COMPETITIVE LANDSCAPE

- INTRODUCTION

- MARKET STRATEGY

- KEY DEVELOPMENT ANALYSIS

-

(EXPANSIONS/MERGERS & ACQUISITIONS/JOINT

-

VENTURES/NEW PRODUCT DEVELOPMENTS/AGREEMENTS/INVESTMENTS)

-

COMPANY PROFILES

-

RECKITT BENCKISER GROUP PLC

- COMPANY OVERVIEW

- FINANCIAL UPDATES

- PRODUCT/BUSINESS

-

RECKITT BENCKISER GROUP PLC

-

SEGMENT OVERVIEW

-

STRATEGIES

-

KEY DEVELOPMENTS

-

SWOT ANALYSIS

-

UNILEVER GROUP

-

COMPANY OVERVIEW

-

FINANCIAL UPDATES

-

PRODUCT/BUSINESS SEGMENT OVERVIEW

-

STRATEGIES

- KEY DEVELOPMENTS

- SWOT ANALYSIS

-

SMITH & NEPHEW PLC

- COMPANY OVERVIEW

- FINANCIAL UPDATES

- PRODUCT/BUSINESS SEGMENT OVERVIEW

- STRATEGIES

- KEY DEVELOPMENTS

- SWOT ANALYSIS

-

3M

- COMPANY OVERVIEW

- FINANCIAL UPDATES

- PRODUCT/BUSINESS

-

STRATEGIES

-

PROCTER & GAMBLE CO.

-

COMPANY OVERVIEW

- FINANCIAL UPDATES

- PRODUCT/BUSINESS SEGMENT OVERVIEW

- STRATEGIES

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KIMBERLY-CLARK

-

COMPANY OVERVIEW

-

CORPORATION

-

STRATEGIES

- KEY DEVELOPMENTS

- SWOT ANALYSIS

-

S. C. JOHNSON & SON, INC.

- COMPANY OVERVIEW

- FINANCIAL UPDATES

- PRODUCT/BUSINESS

-

STRATEGIES

-

WHITELEY CORPORATION

-

STRATEGIES

- KEY DEVELOPMENTS

- SWOT ANALYSIS

-

GOJO INDUSTRIES, INC.

- COMPANY OVERVIEW

- FINANCIAL UPDATES

- PRODUCT/BUSINESS SEGMENT OVERVIEW

- STRATEGIES

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- MEDLINE INDUSTRIES,

-

STRATEGIES

-

INC.

-

STRATEGIES

- KEY DEVELOPMENTS

- SWOT ANALYSIS

-

STRATEGIES

-

CONCLUSION

-

-

LIST OF TABLES

-

TABLE 1 GLOBAL NATURAL DEODORANTS & PERFUMES

-

MARKET, BY REGION, 2024–2032 (USD MILLION)

-

TABLE 2 GLOBAL NATURAL DEODORANTS & PERFUMES

-

MARKET, BY PRODUCT TYPE, 2024–2032 (USD MILLION)

-

TABLE 3 GLOBAL NATURAL DEODORANTS & PERFUMES

-

MARKET, BY END USE, 2024–2032 (USD MILLION)

-

TABLE 4 GLOBAL NATURAL DEODORANTS & PERFUMES

-

MARKET, BY DISTRIBUTION CHANNEL, 2024–2032 (USD MILLION)

-

TABLE 5 NORTH AMERICA: NATURAL

-

DEODORANTS & PERFUMES MARKET, BY COUNTRY, 2024–2032 (USD MILLION)

-

TABLE 6 NORTH AMERICA:

-

NATURAL DEODORANTS & PERFUMES MARKET, BY PRODUCT TYPE, 2024–2032 (USD

-

MILLION)

-

TABLE

-

NORTH AMERICA: NATURAL DEODORANTS & PERFUMES MARKET, BY END USE, 2024–2032

-

(USD MILLION)

-

NORTH AMERICA: NATURAL DEODORANTS & PERFUMES MARKET, BY DISTRIBUTION CHANNEL,

-

2024–2032 (USD MILLION)

-

TABLE 9 US: NATURAL DEODORANTS & PERFUMES MARKET, BY PRODUCT TYPE,

-

TABLE 10 US: NATURAL DEODORANTS & PERFUMES MARKET, BY END USE,

-

TABLE 11 US: NATURAL DEODORANTS & PERFUMES MARKET, BY DISTRIBUTION

-

CHANNEL, 2024–2032 (USD MILLION)

-

TABLE 12 CANADA: NATURAL DEODORANTS & PERFUMES MARKET,

-

BY PRODUCT TYPE, 2024–2032 (USD MILLION)

-

TABLE 13 CANADA: NATURAL DEODORANTS & PERFUMES

-

TABLE 14 CANADA: NATURAL DEODORANTS & PERFUMES

-

TABLE 15 MEXICO: NATURAL DEODORANTS

-

& PERFUMES MARKET, BY PRODUCT TYPE, 2024–2032 (USD MILLION)

-

TABLE 16 MEXICO: NATURAL

-

DEODORANTS & PERFUMES MARKET, BY END USE, 2024–2032 (USD MILLION)

-

TABLE 17 MEXICO: NATURAL

-

DEODORANTS & PERFUMES MARKET, BY DISTRIBUTION CHANNEL, 2024–2032 (USD

-

EUROPE: NATURAL DEODORANTS & PERFUMES MARKET, BY COUNTRY, 2024–2032

-

EUROPE: NATURAL DEODORANTS & PERFUMES MARKET, BY PRODUCT TYPE, 2024–2032

-

EUROPE: NATURAL DEODORANTS & PERFUMES MARKET, BY END USE, 2024–2032

-

EUROPE: NATURAL DEODORANTS & PERFUMES MARKET, BY DISTRIBUTION CHANNEL, 2024–2032

-

GERMANY: NATURAL DEODORANTS & PERFUMES MARKET, BY PRODUCT TYPE, 2024–2032

-

GERMANY: NATURAL DEODORANTS & PERFUMES MARKET, BY END USE, 2024–2032

-

GERMANY: NATURAL DEODORANTS & PERFUMES MARKET, BY DISTRIBUTION CHANNEL, 2024–2032

-

FRANCE: NATURAL DEODORANTS & PERFUMES MARKET, BY PRODUCT TYPE, 2024–2032

-

FRANCE: NATURAL DEODORANTS & PERFUMES MARKET, BY END USE, 2024–2032

-

FRANCE: NATURAL DEODORANTS & PERFUMES MARKET, BY DISTRIBUTION CHANNEL, 2024–2032

-

ITALY: NATURAL DEODORANTS & PERFUMES MARKET, BY PRODUCT TYPE, 2024–2032

-

ITALY: NATURAL DEODORANTS & PERFUMES MARKET, BY END USE, 2024–2032

-

ITALY: NATURAL DEODORANTS & PERFUMES MARKET, BY DISTRIBUTION CHANNEL, 2024–2032

-

SPAIN: NATURAL DEODORANTS & PERFUMES MARKET, BY PRODUCT TYPE, 2024–2032

-

SPAIN: NATURAL DEODORANTS & PERFUMES MARKET, BY END USE, 2024–2032

-

SPAIN: NATURAL DEODORANTS & PERFUMES MARKET, BY DISTRIBUTION CHANNEL, 2024–2032

-

UK: NATURAL DEODORANTS & PERFUMES MARKET, BY PRODUCT TYPE, 2024–2032

-

UK: NATURAL DEODORANTS & PERFUMES MARKET, BY END USE, 2024–2032 (USD

-

UK: NATURAL DEODORANTS & PERFUMES MARKET, BY DISTRIBUTION CHANNEL, 2024–2032

-

REST OF EUROPE: NATURAL DEODORANTS & PERFUMES MARKET, BY PRODUCT TYPE, 2024–2032

-

REST OF EUROPE: NATURAL DEODORANTS & PERFUMES MARKET, BY END USE, 2024–2032

-

REST OF EUROPE: NATURAL DEODORANTS & PERFUMES MARKET, BY DISTRIBUTION CHANNEL,

-

TABLE 40 ASIA-PACIFIC: NATURAL DEODORANTS & PERFUMES MARKET, BY

-

COUNTRY, 2024–2032 (USD MILLION)

-

TABLE 41 ASIA-PACIFIC: NATURAL DEODORANTS & PERFUMES

-

TABLE 42 ASIA-PACIFIC: NATURAL DEODORANTS & PERFUMES

-

TABLE 43 ASIA-PACIFIC: NATURAL DEODORANTS & PERFUMES

-

TABLE 44 CHINA: NATURAL DEODORANTS

-

TABLE 45 CHINA: NATURAL

-

TABLE 46 CHINA: NATURAL

-

INDIA: NATURAL DEODORANTS & PERFUMES MARKET, BY PRODUCT TYPE, 2024–2032

-

INDIA: NATURAL DEODORANTS & PERFUMES MARKET, BY END USE, 2024–2032

-

INDIA: NATURAL DEODORANTS & PERFUMES MARKET, BY DISTRIBUTION CHANNEL, 2024–2032

-

JAPAN: NATURAL DEODORANTS & PERFUMES MARKET, BY PRODUCT TYPE, 2024–2032

-

JAPAN: NATURAL DEODORANTS & PERFUMES MARKET, BY END USE, 2024–2032

-

JAPAN: NATURAL DEODORANTS & PERFUMES MARKET, BY DISTRIBUTION CHANNEL, 2024–2032

-

REST OF ASIA-PACIFIC: NATURAL DEODORANTS & PERFUMES MARKET, BY PRODUCT TYPE,

-

TABLE 54 REST OF ASIA-PACIFIC: NATURAL DEODORANTS & PERFUMES MARKET,

-

BY END USE, 2024–2032 (USD MILLION)

-

TABLE 55 REST OF ASIA-PACIFIC: NATURAL DEODORANTS

-

& PERFUMES MARKET, BY DISTRIBUTION CHANNEL, 2024–2032 (USD MILLION)

-

TABLE 56 REST OF THE

-

WORLD (ROW): NATURAL DEODORANTS & PERFUMES MARKET, BY REGION, 2024–2032

-

REST OF THE WORLD (ROW): NATURAL DEODORANTS & PERFUMES MARKET, BY PRODUCT

-

TYPE, 2024–2032 (USD MILLION)

-

TABLE 58 REST OF THE WORLD (ROW): NATURAL DEODORANTS &

-

PERFUMES MARKET, BY END USE, 2024–2032 (USD MILLION)

-

TABLE 59 REST OF THE WORLD (ROW): NATURAL DEODORANTS

-

TABLE 60 SOUTH AMERICA:

-

SOUTH AMERICA: NATURAL DEODORANTS & PERFUMES MARKET, BY END USE, 2024–2032

-

SOUTH AMERICA: NATURAL DEODORANTS & PERFUMES MARKET, BY DISTRIBUTION CHANNEL,

-

TABLE 63 MIDDLE EAST: NATURAL DEODORANTS & PERFUMES MARKET, BY

-

PRODUCT TYPE, 2024–2032 (USD MILLION)

-

TABLE 64 MIDDLE EAST: NATURAL DEODORANTS & PERFUMES

-

TABLE 65 MIDDLE EAST: NATURAL DEODORANTS & PERFUMES

-

TABLE 66 AFRICA: NATURAL DEODORANTS

-

TABLE 67 AFRICA: NATURAL

-

TABLE 68 AFRICA: NATURAL

-

LIST

-

OF FIGURES

-

FIGURE

-

GLOBAL NATURAL DEODORANTS & PERFUMES MARKET SEGMENTATION

-

FIGURE 2 FORECAST RESEARCH METHODOLOGY

-

FIGURE 3 FIVE FORCES

-

ANALYSIS OF THE GLOBAL NATURAL DEODORANTS & PERFUMES MARKET

-

FIGURE 4 VALUE CHAIN OF THE GLOBAL

-

NATURAL DEODORANTS & PERFUMES MARKET

-

FIGURE 5 SHARE OF THE GLOBAL NATURAL DEODORANTS & PERFUMES

-

MARKET IN 2024, BY COUNTRY (%)

-

FIGURE 6 GLOBAL NATURAL DEODORANTS & PERFUMES MARKET, BY REGION,

-

2024–2032,

-

GLOBAL NATURAL DEODORANTS & PERFUMES MARKET SIZE, BY PRODUCT TYPE, 2024

-

FIGURE 8 SHARE OF THE

-

GLOBAL NATURAL DEODORANTS & PERFUMES MARKET, BY PRODUCT TYPE, 2024–2032

-

(%)

-

GLOBAL NATURAL DEODORANTS & PERFUMES MARKET SIZE, BY END USE, 2024

-

FIGURE 10 SHARE OF THE

-

GLOBAL NATURAL DEODORANTS & PERFUMES MARKET, BY END USE, 2024–2032 (%)

-

FIGURE 11 GLOBAL NATURAL

-

DEODORANTS & PERFUMES MARKET SIZE, BY DISTRIBUTION CHANNEL, 2024

-

FIGURE 12 SHARE OF THE GLOBAL

-

NATURAL DEODORANTS & PERFUMES MARKET, BY DISTRIBUTION CHANNEL, 2024–2032

-

(%)'

Hand Hygiene Products Market Segmentation

Hand Hygiene Products Type Outlook (USD Billion, 2018-2032)

- Soaps

- Hand Wash

- Hand Sanitizers

- Lotion & Creams

- Others

Hand Hygiene Products By End-Use (USD Billion, 2018-2032)

- Residential

- Commercial

- Educational Institutions

- Hotels & Restaurants

- Hospitals & Health Centers

- Corporate Offices

- Others

Hand Hygiene Products By Distribution Channel (USD Billion, 2018-2032)

- Supermarkets & Hypermarkets

- Convenience Stores

- Others

Hand Hygiene Products Regional Outlook (USD Billion, 2018-2032)

- North America Outlook (USD Billion, 2018-2032)

- North America Hand Hygiene Products by Type

- Soaps

- Hand Wash

- Hand Sanitizers

- Lotion & Creams

- Others

- North America Hand Hygiene Products By End-Use

- Residential

- Commercial

- Educational Institutions

- Hotels & Restaurants

- Hospitals & Health Centers

- Corporate Offices

- Others

- North America Hand Hygiene Products By Distribution Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- Others

- US Outlook (USD Billion, 2018-2032)

- US Hand Hygiene Products by Type

- Soaps

- Hand Wash

- Hand Sanitizers

- Lotion & Creams

- Others

- US Hand Hygiene Products By End-Use

- Residential

- Commercial

- Educational Institutions

- Hotels & Restaurants

- Hospitals & Health Centers

- Corporate Offices

- Others

- US Hand Hygiene Products By Distribution Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- Others

- CANADA Outlook (USD Billion, 2018-2032)

- CANADA Hand Hygiene Products by Type

- Soaps

- Hand Wash

- Hand Sanitizers

- Lotion & Creams

- Others

- CANADA Hand Hygiene Products By End-Use

- Residential

- Commercial

- Educational Institutions

- Hotels & Restaurants

- Hospitals & Health Centers

- Corporate Offices

- Others

- CANADA Hand Hygiene Products By Distribution Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- Others

- Europe Outlook (USD Billion, 2018-2032)

- Europe Hand Hygiene Products by Type

- Soaps

- Hand Wash

- Hand Sanitizers

- Lotion & Creams

- Others

- Europe Hand Hygiene Products By End-Use

- Residential

- Commercial

- Educational Institutions

- Hotels & Restaurants

- Hospitals & Health Centers

- Corporate Offices

- Others

- Europe Hand Hygiene Products By Distribution Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- Others

- Germany Outlook (USD Billion, 2018-2032)

- Germany Hand Hygiene Products by Type

- Soaps

- Hand Wash

- Hand Sanitizers

- Lotion & Creams

- Others

- Germany Hand Hygiene Products By End-Use

- Residential

- Commercial

- Educational Institutions

- Hotels & Restaurants

- Hospitals & Health Centers

- Corporate Offices

- Others

- Germany Hand Hygiene Products By Distribution Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- Others

- France Outlook (USD Billion, 2018-2032)

- France Hand Hygiene Products by Type

- Soaps

- Hand Wash

- Hand Sanitizers

- Lotion & Creams

- Others

- France Hand Hygiene Products By End-Use

- Residential

- Commercial

- Educational Institutions

- Hotels & Restaurants

- Hospitals & Health Centers

- Corporate Offices

- Others

- France Hand Hygiene Products By Distribution Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- Others

- UK Outlook (USD Billion, 2018-2032)

- UK Hand Hygiene Products by Type

- Soaps

- Hand Wash

- Hand Sanitizers

- Lotion & Creams

- Others

- UK Hand Hygiene Products By End-Use

- Residential

- Commercial

- Educational Institutions

- Hotels & Restaurants

- Hospitals & Health Centers

- Corporate Offices

- Others

- UK Hand Hygiene Products By Distribution Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- Others

- ITALY Outlook (USD Billion, 2018-2032)

- ITALY Hand Hygiene Products by Type

- Soaps

- Hand Wash

- Hand Sanitizers

- Lotion & Creams

- Others

- ITALY Hand Hygiene Products By End-Use

- Residential

- Commercial

- Educational Institutions

- Hotels & Restaurants

- Hospitals & Health Centers

- Corporate Offices

- Others

- ITALY Hand Hygiene Products By Distribution Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- Others

- SPAIN Outlook (USD Billion, 2018-2032)

- Spain Hand Hygiene Products by Type

- Soaps

- Hand Wash

- Hand Sanitizers

- Lotion & Creams

- Others

- Spain Hand Hygiene Products By End-Use

- Residential

- Commercial

- Educational Institutions

- Hotels & Restaurants

- Hospitals & Health Centers

- Corporate Offices

- Others

- Spain Hand Hygiene Products By Distribution Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- Others

- Rest Of Europe Outlook (USD Billion, 2018-2032)

- Rest Of Europe Hand Hygiene Products by Type

- Soaps

- Hand Wash

- Hand Sanitizers

- Lotion & Creams

- Others

- Rest Of Europe Hand Hygiene Products By End-Use

- Residential

- Commercial

- Educational Institutions

- Hotels & Restaurants

- Hospitals & Health Centers

- Corporate Offices

- Others

- Rest Of Europe Hand Hygiene Products By Distribution Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- Others

- Asia-Pacific Outlook (USD Billion, 2018-2032)

- Asia-Pacific Hand Hygiene Products by Type

- Soaps

- Hand Wash

- Hand Sanitizers

- Lotion & Creams

- Others

- Asia-Pacific Hand Hygiene Products By End-Use

- Residential

- Commercial

- Educational Institutions

- Hotels & Restaurants

- Hospitals & Health Centers

- Corporate Offices

- Others

- Asia-Pacific Hand Hygiene Products By Distribution Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- Others

- China Outlook (USD Billion, 2018-2032)

- China Hand Hygiene Products by Type

- Soaps

- Hand Wash

- Hand Sanitizers

- Lotion & Creams

- Others

- China Hand Hygiene Products By End-Use

- Residential

- Commercial

- Educational Institutions

- Hotels & Restaurants

- Hospitals & Health Centers

- Corporate Offices

- Others

- China Hand Hygiene Products By Distribution Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- Others

- Japan Outlook (USD Billion, 2018-2032)

- Japan Hand Hygiene Products by Type

- Soaps

- Hand Wash

- Hand Sanitizers

- Lotion & Creams

- Others

- Japan Hand Hygiene Products By End-Use

- Residential

- Commercial

- Educational Institutions

- Hotels & Restaurants

- Hospitals & Health Centers

- Corporate Offices

- Others

- Japan Hand Hygiene Products By Distribution Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- Others

- India Outlook (USD Billion, 2018-2032)

- India Hand Hygiene Products by Type

- Soaps

- Hand Wash

- Hand Sanitizers

- Lotion & Creams

- Others

- India Hand Hygiene Products By End-Use

- Residential

- Commercial

- Educational Institutions

- Hotels & Restaurants

- Hospitals & Health Centers

- Corporate Offices

- Others

- India Hand Hygiene Products By Distribution Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- Others

- Australia Outlook (USD Billion, 2018-2032)

- Australia Hand Hygiene Products by Type

- Soaps

- Hand Wash

- Hand Sanitizers

- Lotion & Creams

- Others

- Australia Hand Hygiene Products By End-Use

- Residential

- Commercial

- Educational Institutions

- Hotels & Restaurants

- Hospitals & Health Centers

- Corporate Offices

- Others

- Australia Hand Hygiene Products By Distribution Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- Others

- Rest of Asia-Pacific Outlook (USD Billion, 2018-2032)

- Rest of Asia-Pacific Hand Hygiene Products by Type

- Soaps

- Hand Wash

- Hand Sanitizers

- Lotion & Creams

- Others

- Rest of Asia-Pacific Hand Hygiene Products By End-Use

- Residential

- Commercial

- Educational Institutions

- Hotels & Restaurants

- Hospitals & Health Centers

- Corporate Offices

- Others

- Rest of Asia-Pacific Hand Hygiene Products By Distribution Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- Others

- Rest of the World Outlook (USD Billion, 2018-2032)

- Rest of the World Hand Hygiene Products by Type

- Soaps

- Hand Wash

- Hand Sanitizers

- Lotion & Creams

- Others

- Rest of the World Hand Hygiene Products By End-Use

- Residential

- Commercial

- Educational Institutions

- Hotels & Restaurants

- Hospitals & Health Centers

- Corporate Offices

- Others

- Rest of the World Hand Hygiene Products By Distribution Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- Others

- Middle East Outlook (USD Billion, 2018-2032)

- Middle East Hand Hygiene Products by Type

- Soaps

- Hand Wash

- Hand Sanitizers

- Lotion & Creams

- Others

- Middle East Hand Hygiene Products By End-Use

- Residential

- Commercial

- Educational Institutions

- Hotels & Restaurants

- Hospitals & Health Centers

- Corporate Offices

- Others

- Middle East Hand Hygiene Products By Distribution Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- Others

- Africa Outlook (USD Billion, 2018-2032)

- Africa Hand Hygiene Products by Type

- Soaps

- Hand Wash

- Hand Sanitizers

- Lotion & Creams

- Others

- Africa Hand Hygiene Products By End-Use

- Residential

- Commercial

- Educational Institutions

- Hotels & Restaurants

- Hospitals & Health Centers

- Corporate Offices

- Others

- Africa Hand Hygiene Products By Distribution Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- Others

- Latin America Outlook (USD Billion, 2018-2032)

- Latin America Hand Hygiene Products by Type

- Soaps

- Hand Wash

- Hand Sanitizers

- Lotion & Creams

- Others

- Latin America Hand Hygiene Products By End-Use

- Residential

- Commercial

- Educational Institutions

- Hotels & Restaurants

- Hospitals & Health Centers

- Corporate Offices

- Others

- Latin America Hand Hygiene Products By Distribution Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- Others

- Latin America Hand Hygiene Products By Distribution Channel

- Africa Hand Hygiene Products By Distribution Channel

- Middle East Hand Hygiene Products By Distribution Channel

- Rest of the World Hand Hygiene Products By Distribution Channel

- Rest of the World Hand Hygiene Products by Type

- Rest of Asia-Pacific Hand Hygiene Products By Distribution Channel

- Australia Hand Hygiene Products By Distribution Channel

- India Hand Hygiene Products By Distribution Channel

- Japan Hand Hygiene Products By Distribution Channel

- China Hand Hygiene Products By Distribution Channel

- Asia-Pacific Hand Hygiene Products By Distribution Channel

- Asia-Pacific Hand Hygiene Products by Type

- Rest Of Europe Hand Hygiene Products By Distribution Channel

- Spain Hand Hygiene Products By Distribution Channel

- ITALY Hand Hygiene Products By Distribution Channel

- UK Hand Hygiene Products By Distribution Channel

- France Hand Hygiene Products By Distribution Channel

- Germany Hand Hygiene Products By Distribution Channel

- Europe Hand Hygiene Products By Distribution Channel

- Europe Hand Hygiene Products by Type

- CANADA Hand Hygiene Products By Distribution Channel

- US Hand Hygiene Products By Distribution Channel

- North America Hand Hygiene Products By Distribution Channel

- North America Hand Hygiene Products by Type

Free Sample Request

Kindly complete the form below to receive a free sample of this Report

Customer Strories

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

Leave a Comment