-

Executive Summary

-

Market Introduction

-

2.1

-

Definition 18

-

Scope Of The Study 18

-

List

-

Of Assumptions 18

-

Market Structure 19

-

Research Methodology

-

Research Process

-

21

-

Primary Research 21

-

Secondary Research 22

-

Market

-

Size Estimation 23

-

Forecast Model 24

-

Market Dynamics

-

4.1

-

Introduction 26

-

Drivers 26

- Surging Demand For Both Passenger And Commercial Vehicles

- High Demand For Flock Adhesives From

-

27

-

Asia Pacific Region 28

-

Restraint 29

- Volatility In Raw Material Prices 29

-

Opportunity 29

-

4.4.1

-

Growing Demand For Low-VOC, Green, And Sustainable Flock Adhesives 29

-

Trend 30

- Growing

-

Demand In Textile Industry 30

-

Market Factor

-

Analysis

-

Supply Chain Analysis 32

- Raw Material Suppliers 32

- Flock Adhesive Producers 32

- Application 33

-

5.1.3

-

Distribution Channel 33

-

Porter’s Five Forces Analysis 33

- Threat Of New Entrants 33

- Threat Of Rivalry 34

- Threat

- Bargaining Power Of Supplier

- Bargaining Power Of Buyer 34

-

Of Substitute 34

-

34

-

Global Flock Adhesive Market, By Source

-

Introduction 36

-

Water

-

Borne 37

-

Solvent Borne 39

-

Global Flock Adhesive Market, By Type

-

Introduction 41

-

Acrylic

-

43

-

Epoxy 44

-

Polyurethane 45

-

Other 46

-

Global Flock Adhesive Market, By Application

-

Introduction 48

-

Automotive

-

50

-

Textile 51

-

Paper & Packaging 52

-

Printing

-

53

-

Other 54

-

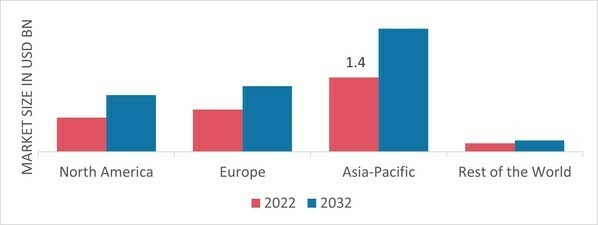

Global Flock Adhesive Market, By Region

-

9.1

-

Introduction 56

-

North America 60

- The U.S. 63

-

9.2.2

-

Canada 66

-

Europe 68

- Germany 72

- Russia 74

- France 77

- Italy 79

- UK 82

- Spain 84

- Rest Of Europe

-

87

-

Asia Pacific 89

- China 93

- India 95

- South East Asia 98

- Japan 100

- Rest Of Asia Pacific

-

103

-

Latin America 105

- Brazil 109

- Mexico 111

- Argentina 114

- Rest Of Latin America 116

-

Middle

- G.C.C. 122

- Turkey 124

- Rest Of Middle East & Africa

-

East & Africa 119

-

9.6.3

-

Iran 127

-

129

-

Competitive Landscape

-

Introduction 133

-

Global

-

Market Strategy 133

-

Key Developments Of

-

Major Market Players 133

-

Company Profiles

-

Henkel AG & Co. KGaA 136

- Company Overview 136

- Financial Overview 136

- Products

- Key Developments 137

- SWOT Analysis 138

- Key Strategy 138

-

Offerings 137

-

H.B. Fuller

- Company Overview 139

- Financial Overview 139

- Products Offerings 140

- Key Developments

- SWOT Analysis 140

- Key Strategy 140

-

139

-

140

-

Sika

- Company Overview 141

- Financial Overview 141

- Products Offerings 141

- Key Developments

- SWOT Analysis 142

- Key Strategy 142

-

AG 141

-

142

-

DowDuPont,

- Company Overview 143

- Financial Overview 143

- Products Offerings 144

- SWOT Analysis 145

- Key Strategy 145

-

Inc 143

-

11.4.4

-

Key Developments 144

-

Bostik 146

- Company Overview

- Financial Overview 146

- Products Offerings 146

- Key Developments 147

- SWOT Analysis

- Key Strategy 147

-

146

-

147

-

Lord Corporation 148

- Financial Overview

- Products Offerings 148

- Key Developments 148

- SWOT Analysis 149

- Key Strategy

-

11.6.1

-

Company Overview 148

-

148

-

149

-

KISSEL + WOLF GmbH 150

- Company Overview 150

- Financial Overview 150

- Products

- Key Developments 151

- SWOT Analysis 151

- Key Strategy 151

-

Offerings 150

-

Stahl Holdings

- Company Overview 152

- Financial Overview 152

- Products Offerings 152

- SWOT Analysis 153

- Key Strategy 153

-

B.V. 152

-

11.8.4

-

Key Developments 153

-

International Coatings 154

- Financial Overview

- Products Offerings 154

- Key Developments 154

- SWOT Analysis 154

- Key Strategy

-

11.9.1

-

Company Overview 154

-

154

-

154

-

Union Ink 155

- Company Overview 155

- Products Offerings

- Key Developments 155

- SWOT Analysis 155

-

11.10.2

-

Financial Overview 155

-

155

-

11.10.6

-

Key Strategy 155

-

Conclusion

-

List

-

Of Tables

-

LIST OF ASSUMPTIONS 18

-

GLOBAL FLOCK ADHESIVE MARKET, BY SOURCE, 2023-2032

-

(USD MILLION) 36

-

GLOBAL FLOCK ADHESIVE

-

MARKET, BY SOURCE, 2023-2032 (THOUSAND TONS) 37

-

WATER BORNE FLOCK ADHESIVE MARKET, BY REGION, 2023-2032 (USD MILLION)

-

38

-

WATER BORNE FLOCK ADHESIVE MARKET,

-

BY REGION, 2023-2032 (THOUSAND TONS) 38

-

TABLE

-

SOLVENT BORNE FLOCK ADHESIVE MARKET, BY REGION, 2023-2032 (USD MILLION) 39

-

SOLVENT BORNE FLOCK ADHESIVE MARKET, BY

-

REGION, 2023-2032 (THOUSAND TONS) 39

-

TABLE 8

-

GLOBAL FLOCK ADHESIVE MARKET, BY TYPE, 2023-2032 (USD MILLION) 41

-

GLOBAL FLOCK ADHESIVE MARKET, BY TYPE, 2023-2032 (THOUSAND

-

TONS) 42

-

ACRYLIC FLOCK ADHESIVE MARKET,

-

BY REGION, 2023-2032 (USD MILLION) 43

-

TABLE 11

-

ACRYLIC FLOCK ADHESIVE MARKET, BY REGION, 2023-2032 (THOUSAND TONS) 43

-

EPOXY FLOCK ADHESIVE MARKET, BY REGION, 2023-2032

-

(USD MILLION) 44

-

EPOXY FLOCK ADHESIVE

-

MARKET, BY REGION, 2023-2032 (THOUSAND TONS) 44

-

POLYURETHANE FLOCK ADHESIVE MARKET, BY REGION, 2023-2032 (USD MILLION)

-

45

-

POLYURETHANE FLOCK ADHESIVE MARKET,

-

BY REGION, 2023-2032 (THOUSAND TONS) 45

-

TABLE

-

OTHER FLOCK ADHESIVE MARKET, BY REGION, 2023-2032 (USD MILLION) 46

-

OTHER FLOCK ADHESIVE MARKET, BY REGION, 2023-2032 (THOUSAND

-

TONS) 46

-

GLOBAL FLOCK ADHESIVE MARKET,

-

BY APPLICATION, 2023-2032 (USD MILLION) 48

-

TABLE

-

GLOBAL FLOCK ADHESIVE MARKET, BY APPLICATION, 2023-2032 (THOUSAND TONS) 49

-

GLOBAL FLOCK ADHESIVE MARKET FOR AUTOMOTIVE,

-

BY REGION, 2023-2032 (USD MILLION) 50

-

TABLE 21

-

GLOBAL FLOCK ADHESIVE MARKET FOR AUTOMOTIVE, BY REGION, 2023-2032 (THOUSAND TONS)

-

50

-

GLOBAL FLOCK ADHESIVE MARKET FOR

-

TEXTILE, BY REGION, 2023-2032 (USD MILLION) 51

-

GLOBAL FLOCK ADHESIVE MARKET FOR TEXTILE, BY REGION, 2023-2032 (THOUSAND

-

TONS) 51

-

GLOBAL FLOCK ADHESIVE MARKET

-

FOR PAPER & PACKAGING, BY REGION, 2023-2032 (USD MILLION) 52

-

GLOBAL FLOCK ADHESIVE MARKET FOR PAPER & PACKAGING,

-

BY REGION, 2023-2032 (THOUSAND TONS) 52

-

TABLE

-

GLOBAL FLOCK ADHESIVE MARKET FOR PRINTING, BY REGION, 2023-2032 (USD MILLION)

-

53

-

GLOBAL FLOCK ADHESIVE MARKET FOR

-

PRINTING, BY REGION, 2023-2032 (THOUSAND TONS) 53

-

GLOBAL FLOCK ADHESIVE MARKET FOR OTHER, BY REGION, 2023-2032 (USD MILLION)

-

54

-

GLOBAL FLOCK ADHESIVE MARKET FOR

-

OTHER, BY REGION, 2023-2032 (THOUSAND TONS) 54

-

GLOBAL FLOCK ADHESIVE MARKET, BY REGION (USD MILLION) 56

-

GLOBAL FLOCK ADHESIVE MARKET, BY REGION (THOUSAND TONS)

-

57

-

GLOBAL FLOCK ADHESIVE MARKET, BY

-

SOURCE (USD MILLION) 58

-

GLOBAL FLOCK

-

ADHESIVE MARKET, BY SOURCE (THOUSAND TONS) 58

-

TABLE

-

GLOBAL FLOCK ADHESIVE MARKET, BY TYPE (USD MILLION) 58

-

GLOBAL FLOCK ADHESIVE MARKET, BY TYPE (THOUSAND TONS) 59

-

GLOBAL FLOCK ADHESIVE MARKET, BY APPLICATION

-

(USD MILLION) 59

-

GLOBAL FLOCK ADHESIVE

-

MARKET, BY APPLICATION (THOUSAND TONS) 60

-

TABLE

-

NORTH AMERICA FLOCK ADHESIVE MARKET, BY COUNTRY (USD MILLION) 60

-

NORTH AMERICA FLOCK ADHESIVE MARKET, BY COUNTRY (THOUSAND

-

TONS) 60

-

NORTH AMERICA FLOCK ADHESIVE

-

MARKET, BY SOURCE (USD MILLION) 61

-

NORTH

-

AMERICA FLOCK ADHESIVE MARKET, BY SOURCE (THOUSAND TONS) 61

-

NORTH AMERICA FLOCK ADHESIVE MARKET, BY TYPE (USD MILLION)

-

61

-

NORTH AMERICA FLOCK ADHESIVE MARKET,

-

BY TYPE (THOUSAND TONS) 62

-

NORTH AMERICA

-

FLOCK ADHESIVE MARKET, BY APPLICATION (USD MILLION) 62

-

NORTH AMERICA FLOCK ADHESIVE MARKET, BY APPLICATION (THOUSAND TONS)

-

63

-

U.S. FLOCK ADHESIVE MARKET, BY SOURCE

-

(USD MILLION) 63

-

U.S. FLOCK ADHESIVE

-

MARKET, BY SOURCE (THOUSAND TONS) 63

-

TABLE 48

-

U.S. FLOCK ADHESIVE MARKET, BY TYPE (USD MILLION) 64

-

U.S. FLOCK ADHESIVE MARKET, BY TYPE (THOUSAND TONS) 64

-

U.S. FLOCK ADHESIVE MARKET, BY APPLICATION (USD

-

MILLION) 65

-

U.S. FLOCK ADHESIVE MARKET,

-

BY APPLICATION (THOUSAND TONS) 65

-

CANADA

-

FLOCK ADHESIVE MARKET, BY SOURCE (USD MILLION) 66

-

CANADA FLOCK ADHESIVE MARKET, BY SOURCE (THOUSAND TONS) 66

-

CANADA FLOCK ADHESIVE MARKET, BY TYPE (USD MILLION)

-

66

-

CANADA FLOCK ADHESIVE MARKET, BY

-

TYPE (THOUSAND TONS) 67

-

CANADA FLOCK

-

ADHESIVE MARKET, BY APPLICATION (USD MILLION) 67

-

CANADA FLOCK ADHESIVE MARKET, BY APPLICATION (THOUSAND TONS) 68

-

EUROPE FLOCK ADHESIVE MARKET, BY COUNTRY (USD

-

MILLION) 68

-

EUROPE FLOCK ADHESIVE MARKET,

-

BY COUNTRY (THOUSAND TONS) 69

-

EUROPE

-

FLOCK ADHESIVE MARKET, BY SOURCE (USD MILLION) 69

-

EUROPE FLOCK ADHESIVE MARKET, BY SOURCE (THOUSAND TONS) 69

-

EUROPE FLOCK ADHESIVE MARKET, BY TYPE (USD MILLION)

-

70

-

EUROPE FLOCK ADHESIVE MARKET, BY

-

TYPE (THOUSAND TONS) 70

-

EUROPE FLOCK

-

ADHESIVE MARKET, BY APPLICATION (USD MILLION) 71

-

EUROPE FLOCK ADHESIVE MARKET, BY APPLICATION (THOUSAND TONS) 71

-

GERMANY FLOCK ADHESIVE MARKET, BY SOURCE (USD

-

MILLION) 72

-

GERMANY FLOCK ADHESIVE MARKET,

-

BY SOURCE (THOUSAND TONS) 72

-

GERMANY

-

FLOCK ADHESIVE MARKET, BY TYPE (USD MILLION) 72

-

GERMANY FLOCK ADHESIVE MARKET, BY TYPE (THOUSAND TONS) 73

-

GERMANY FLOCK ADHESIVE MARKET, BY APPLICATION (USD

-

MILLION) 73

-

GERMANY FLOCK ADHESIVE MARKET,

-

BY APPLICATION (THOUSAND TONS) 74

-

RUSSIA

-

FLOCK ADHESIVE MARKET, BY SOURCE (USD MILLION) 74

-

RUSSIA FLOCK ADHESIVE MARKET, BY SOURCE (THOUSAND TONS) 74

-

RUSSIA FLOCK ADHESIVE MARKET, BY TYPE (USD MILLION)

-

75

-

RUSSIA FLOCK ADHESIVE MARKET, BY

-

TYPE (THOUSAND TONS) 75

-

RUSSIA FLOCK

-

ADHESIVE MARKET, BY APPLICATION (USD MILLION) 76

-

RUSSIA FLOCK ADHESIVE MARKET, BY APPLICATION (THOUSAND TONS) 76

-

FRANCE FLOCK ADHESIVE MARKET, BY SOURCE (USD

-

MILLION) 77

-

FRANCE FLOCK ADHESIVE MARKET,

-

BY SOURCE (THOUSAND TONS) 77

-

FRANCE FLOCK ADHESIVE

-

MARKET, BY TYPE (USD MILLION) 77

-

FRANCE FLOCK ADHESIVE

-

MARKET, BY TYPE (THOUSAND TONS) 78

-

FRANCE FLOCK

-

ADHESIVE MARKET, BY APPLICATION (USD MILLION) 78

-

TABLE 83

-

FRANCE FLOCK ADHESIVE MARKET, BY APPLICATION (THOUSAND TONS) 79

-

ITALY FLOCK ADHESIVE MARKET, BY SOURCE (USD MILLION) 79

-

ITALY FLOCK ADHESIVE MARKET, BY SOURCE (THOUSAND TONS) 79

-

ITALY FLOCK ADHESIVE MARKET, BY TYPE (USD MILLION) 80

-

ITALY FLOCK ADHESIVE MARKET, BY TYPE (THOUSAND TONS) 80

-

ITALY FLOCK ADHESIVE MARKET, BY APPLICATION (USD MILLION)

-

81

-

ITALY FLOCK ADHESIVE MARKET, BY APPLICATION (THOUSAND

-

TONS) 81

-

UK FLOCK ADHESIVE MARKET, BY SOURCE (USD

-

MILLION) 82

-

UK FLOCK ADHESIVE MARKET, BY SOURCE

-

(THOUSAND TONS) 82

-

UK FLOCK ADHESIVE MARKET, BY

-

TYPE (USD MILLION) 82

-

UK FLOCK ADHESIVE MARKET,

-

BY TYPE (THOUSAND TONS) 83

-

UK FLOCK ADHESIVE MARKET,

-

BY APPLICATION (USD MILLION) 83

-

UK FLOCK ADHESIVE

-

MARKET, BY APPLICATION (THOUSAND TONS) 84

-

SPAIN

-

FLOCK ADHESIVE MARKET, BY SOURCE (USD MILLION) 84

-

SPAIN

-

FLOCK ADHESIVE MARKET, BY SOURCE (THOUSAND TONS) 84

-

TABLE

-

SPAIN FLOCK ADHESIVE MARKET, BY TYPE (USD MILLION) 85

-

TABLE

-

SPAIN FLOCK ADHESIVE MARKET, BY TYPE (THOUSAND TONS) 85

-

SPAIN FLOCK ADHESIVE MARKET, BY APPLICATION (USD MILLION) 86

-

SPAIN FLOCK ADHESIVE MARKET, BY APPLICATION (THOUSAND TONS)

-

86

-

REST OF EUROPE FLOCK ADHESIVE MARKET, BY SOURCE

-

(USD MILLION) 87

-

REST OF EUROPE FLOCK ADHESIVE

-

MARKET, BY SOURCE (THOUSAND TONS) 87

-

REST OF EUROPE

-

FLOCK ADHESIVE MARKET, BY TYPE (USD MILLION) 87

-

TABLE 105

-

REST OF EUROPE FLOCK ADHESIVE MARKET, BY TYPE (THOUSAND TONS) 88

-

REST OF EUROPE FLOCK ADHESIVE MARKET, BY APPLICATION (USD MILLION)

-

88

-

REST OF EUROPE FLOCK ADHESIVE MARKET, BY APPLICATION

-

(THOUSAND TONS) 89

-

ASIA PACIFIC FLOCK ADHESIVE

-

MARKET, BY COUNTRY (USD MILLION) 89

-

ASIA PACIFIC

-

FLOCK ADHESIVE MARKET, BY COUNTRY (THOUSAND TONS) 90

-

TABLE 110

-

ASIA PACIFIC FLOCK ADHESIVE MARKET, BY SOURCE (USD MILLION) 90

-

ASIA PACIFIC FLOCK ADHESIVE MARKET, BY SOURCE (THOUSAND TONS) 90

-

ASIA PACIFIC FLOCK ADHESIVE MARKET, BY TYPE (USD MILLION)

-

91

-

ASIA PACIFIC FLOCK ADHESIVE MARKET, BY TYPE

-

(THOUSAND TONS) 91

-

ASIA PACIFIC FLOCK ADHESIVE

-

MARKET, BY APPLICATION (USD MILLION) 92

-

ASIA PACIFIC

-

FLOCK ADHESIVE MARKET, BY APPLICATION (THOUSAND TONS) 92

-

TABLE

-

CHINA FLOCK ADHESIVE MARKET, BY SOURCE (USD MILLION) 93

-

CHINA FLOCK ADHESIVE MARKET, BY SOURCE (THOUSAND TONS) 93

-

CHINA FLOCK ADHESIVE MARKET, BY TYPE (USD MILLION) 93

-

CHINA FLOCK ADHESIVE MARKET, BY TYPE (THOUSAND TONS) 94

-

CHINA FLOCK ADHESIVE MARKET, BY APPLICATION (USD MILLION)

-

94

-

CHINA FLOCK ADHESIVE MARKET, BY APPLICATION

-

(THOUSAND TONS) 95

-

INDIA FLOCK ADHESIVE MARKET,

-

BY SOURCE (USD MILLION) 95

-

INDIA FLOCK ADHESIVE

-

MARKET, BY SOURCE (THOUSAND TONS) 95

-

INDIA FLOCK

-

ADHESIVE MARKET, BY TYPE (USD MILLION) 96

-

INDIA

-

FLOCK ADHESIVE MARKET, BY TYPE (THOUSAND TONS) 96

-

TABLE 126

-

INDIA FLOCK ADHESIVE MARKET, BY APPLICATION (USD MILLION) 97

-

INDIA FLOCK ADHESIVE MARKET, BY APPLICATION (THOUSAND TONS) 97

-

SOUTH EAST ASIA FLOCK ADHESIVE MARKET, BY SOURCE (USD MILLION)

-

98

-

SOUTH EAST ASIA FLOCK ADHESIVE MARKET, BY SOURCE (THOUSAND

-

TONS) 98

-

SOUTH EAST ASIA FLOCK ADHESIVE

-

MARKET, BY TYPE (USD MILLION) 98

-

SOUTH

-

EAST ASIA FLOCK ADHESIVE MARKET, BY TYPE (THOUSAND TONS) 99

-

SOUTH EAST ASIA FLOCK ADHESIVE MARKET, BY APPLICATION (USD

-

MILLION) 99

-

SOUTH EAST ASIA FLOCK ADHESIVE

-

MARKET, BY APPLICATION (THOUSAND TONS) 100

-

TABLE

-

JAPAN FLOCK ADHESIVE MARKET, BY SOURCE (USD MILLION) 100

-

JAPAN FLOCK ADHESIVE MARKET, BY SOURCE (THOUSAND TONS) 100

-

JAPAN FLOCK ADHESIVE MARKET, BY TYPE (USD

-

MILLION) 101

-

JAPAN FLOCK ADHESIVE MARKET,

-

BY TYPE (THOUSAND TONS) 101

-

JAPAN FLOCK

-

ADHESIVE MARKET, BY APPLICATION (USD MILLION) 102

-

JAPAN FLOCK ADHESIVE MARKET, BY APPLICATION (THOUSAND TONS) 102

-

REST OF ASIA PACIFICFLOCK ADHESIVE MARKET, BY

-

SOURCE (USD MILLION) 103

-

REST OF ASIA

-

PACIFICFLOCK ADHESIVE MARKET, BY SOURCE (THOUSAND TONS) 103

-

REST OF ASIA PACIFICFLOCK ADHESIVE MARKET, BY TYPE (USD

-

MILLION) 103

-

REST OF ASIA PACIFICFLOCK

-

ADHESIVE MARKET, BY TYPE (THOUSAND TONS) 104

-

TABLE

-

REST OF ASIA PACIFICFLOCK ADHESIVE MARKET, BY APPLICATION (USD MILLION) 104

-

REST OF ASIA PACIFICFLOCK ADHESIVE MARKET,

-

BY APPLICATION (THOUSAND TONS) 105

-

TABLE 146

-

LATIN AMERICA FLOCK ADHESIVE MARKET, BY COUNTRY (USD MILLION) 105

-

LATIN AMERICA FLOCK ADHESIVE MARKET, BY COUNTRY (THOUSAND

-

TONS) 106

-

LATIN AMERICA FLOCK ADHESIVE

-

MARKET, BY SOURCE (USD MILLION) 106

-

TABLE 149

-

LATIN AMERICA FLOCK ADHESIVE MARKET, BY SOURCE (THOUSAND TONS) 106

-

LATIN AMERICA FLOCK ADHESIVE MARKET, BY TYPE (USD

-

MILLION) 107

-

LATIN AMERICA FLOCK ADHESIVE

-

MARKET, BY TYPE (THOUSAND TONS) 107

-

TABLE 152

-

LATIN AMERICA FLOCK ADHESIVE MARKET, BY APPLICATION (USD MILLION) 108

-

LATIN AMERICA FLOCK ADHESIVE MARKET, BY APPLICATION

-

(THOUSAND TONS) 108

-

BRAZIL FLOCK ADHESIVE

-

MARKET, BY SOURCE (USD MILLION) 109

-

TABLE 155

-

BRAZIL FLOCK ADHESIVE MARKET, BY SOURCE (THOUSAND TONS) 109

-

BRAZIL FLOCK ADHESIVE MARKET, BY TYPE (USD MILLION) 109

-

BRAZIL FLOCK ADHESIVE MARKET, BY TYPE

-

(THOUSAND TONS) 110

-

BRAZIL FLOCK ADHESIVE

-

MARKET, BY APPLICATION (USD MILLION) 110

-

TABLE

-

BRAZIL FLOCK ADHESIVE MARKET, BY APPLICATION (THOUSAND TONS) 111

-

MEXICO FLOCK ADHESIVE MARKET, BY SOURCE (USD MILLION)

-

111

-

MEXICO FLOCK ADHESIVE MARKET, BY

-

SOURCE (THOUSAND TONS) 111

-

MEXICO FLOCK

-

ADHESIVE MARKET, BY TYPE (USD MILLION) 112

-

TABLE

-

MEXICO FLOCK ADHESIVE MARKET, BY TYPE (THOUSAND TONS) 112

-

MEXICO FLOCK ADHESIVE MARKET, BY APPLICATION (USD MILLION)

-

113

-

MEXICO FLOCK ADHESIVE MARKET, BY

-

APPLICATION (THOUSAND TONS) 113

-

ARGENTINA

-

FLOCK ADHESIVE MARKET, BY SOURCE (USD MILLION) 114

-

ARGENTINA FLOCK ADHESIVE MARKET, BY SOURCE (THOUSAND TONS) 114

-

ARGENTINA FLOCK ADHESIVE MARKET, BY TYPE (USD

-

MILLION) 114

-

ARGENTINA FLOCK ADHESIVE

-

MARKET, BY TYPE (THOUSAND TONS) 115

-

TABLE 170

-

ARGENTINA FLOCK ADHESIVE MARKET, BY APPLICATION (USD MILLION) 115

-

ARGENTINA FLOCK ADHESIVE MARKET, BY APPLICATION (THOUSAND

-

TONS) 116

-

REST OF LATIN AMERICA FLOCK

-

ADHESIVE MARKET, BY SOURCE (USD MILLION) 116

-

TABLE

-

REST OF LATIN AMERICA FLOCK ADHESIVE MARKET, BY SOURCE (THOUSAND TONS) 116

-

REST OF LATIN AMERICA FLOCK ADHESIVE MARKET,

-

BY TYPE (USD MILLION) 117

-

REST OF LATIN

-

AMERICA FLOCK ADHESIVE MARKET, BY TYPE (THOUSAND TONS) 117

-

REST OF LATIN AMERICA FLOCK ADHESIVE MARKET, BY APPLICATION

-

(USD MILLION) 118

-

REST OF LATIN AMERICA

-

FLOCK ADHESIVE MARKET, BY APPLICATION (THOUSAND TONS) 118

-

MIDDLE EAST & AFRICA FLOCK ADHESIVE MARKET, BY COUNTRY (USD

-

MILLION) 119

-

MIDDLE EAST & AFRICA

-

FLOCK ADHESIVE MARKET, BY COUNTRY (THOUSAND TONS) 119

-

MIDDLE EAST & AFRICA FLOCK ADHESIVE MARKET, BY SOURCE (USD

-

MILLION) 119

-

MIDDLE EAST & AFRICA

-

FLOCK ADHESIVE MARKET, BY SOURCE (THOUSAND TONS) 120

-

MIDDLE EAST & AFRICA FLOCK ADHESIVE MARKET, BY TYPE (USD MILLION)

-

120

-

MIDDLE EAST & AFRICA FLOCK

-

ADHESIVE MARKET, BY TYPE (THOUSAND TONS) 120

-

TABLE

-

MIDDLE EAST & AFRICA FLOCK ADHESIVE MARKET, BY APPLICATION (USD MILLION)

-

121

-

MIDDLE EAST & AFRICA FLOCK

-

ADHESIVE MARKET, BY APPLICATION (THOUSAND TONS) 121

-

G.C.C. FLOCK ADHESIVE MARKET, BY SOURCE (USD MILLION) 122

-

G.C.C. FLOCK ADHESIVE MARKET, BY SOURCE (THOUSAND

-

TONS) 122

-

G.C.C. FLOCK ADHESIVE MARKET,

-

BY TYPE (USD MILLION) 122

-

G.C.C. FLOCK

-

ADHESIVE MARKET, BY TYPE (THOUSAND TONS) 123

-

TABLE

-

G.C.C. FLOCK ADHESIVE MARKET, BY APPLICATION (USD MILLION) 123

-

G.C.C. FLOCK ADHESIVE MARKET, BY APPLICATION (THOUSAND

-

TONS) 124

-

TURKEY FLOCK ADHESIVE MARKET,

-

BY SOURCE (USD MILLION) 124

-

TURKEY

-

FLOCK ADHESIVE MARKET, BY SOURCE (THOUSAND TONS) 124

-

TURKEY FLOCK ADHESIVE MARKET, BY TYPE (USD MILLION) 125

-

TURKEY FLOCK ADHESIVE MARKET, BY TYPE (THOUSAND

-

TONS) 125

-

TURKEY FLOCK ADHESIVE MARKET,

-

BY APPLICATION (USD MILLION) 126

-

TURKEY

-

FLOCK ADHESIVE MARKET, BY APPLICATION (THOUSAND TONS) 126

-

IRAN FLOCK ADHESIVE MARKET, BY SOURCE (USD MILLION) 127

-

IRAN FLOCK ADHESIVE MARKET, BY SOURCE (THOUSAND

-

TONS) 127

-

IRAN FLOCK ADHESIVE MARKET,

-

BY TYPE (USD MILLION) 127

-

IRAN FLOCK

-

ADHESIVE MARKET, BY TYPE (THOUSAND TONS) 128

-

TABLE

-

IRAN FLOCK ADHESIVE MARKET, BY APPLICATION (USD MILLION) 128

-

IRAN FLOCK ADHESIVE MARKET, BY APPLICATION (THOUSAND

-

TONS) 129

-

REST OF MIDDLE EAST &

-

AFRICA FLOCK ADHESIVE MARKET, BY SOURCE (USD MILLION) 129

-

REST OF MIDDLE EAST & AFRICA FLOCK ADHESIVE MARKET, BY SOURCE

-

(THOUSAND TONS) 129

-

REST OF MIDDLE

-

EAST & AFRICA FLOCK ADHESIVE MARKET, BY TYPE (USD MILLION) 130

-

REST OF MIDDLE EAST & AFRICA FLOCK ADHESIVE MARKET,

-

BY TYPE (THOUSAND TONS) 130

-

REST OF

-

MIDDLE EAST & AFRICA FLOCK ADHESIVE MARKET, BY APPLICATION (USD MILLION) 131

-

REST OF MIDDLE EAST & AFRICA FLOCK

-

ADHESIVE MARKET, BY APPLICATION (THOUSAND TONS) 131

-

KEY DEVELOPMENTS 133

-

-

List Of Figures

-

FIGURE

-

GLOBAL FLOCK ADHESIVE MARKET: MARKET STRUCTURE 19

-

RESEARCH PROCESS OF MRFR 21

-

FIGURE

-

TOP DOWN & BOTTOM UP APPROACH 23

-

FIGURE

-

DROT OF GLOBAL FLOCK ADHESIVE MARKET 26

-

FIGURE

-

GROWTH DRIVERS: IMPACT ANALYSIS 26

-

FIGURE 6

-

GLOBAL NEW VEHICLE MARKET (MILLION UNITS) 27

-

FIGURE

-

GLOBAL COMMERCIAL VEHICLE MARKET (MILLION UNITS) 27

-

GLOBAL PASSANGER CAR MARKET (MILLION UNITS) 28

-

RESTRAINTS: IMPACT ANALYSIS 29

-

OPPORTUNITY: IMPACT ANALYSIS

Leave a Comment