Flock Adhesives Size

Flock Adhesives Market Growth Projections and Opportunities

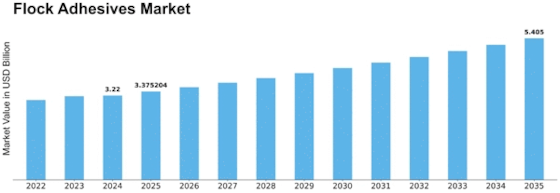

The global flock adhesive market, which refers to the market for a type of adhesive used for decorative purposes, was valued at USD 2,303.5 million in 2017. It is projected to reach USD 3,275.0 million by the end of the forecast period, with a Compound Annual Growth Rate (CAGR) of 6.04%. In terms of volume, the global market was 776.4 thousand tons in 2017 and is expected to grow at a CAGR of 5.22% during the forecast period. The growth of the global flock adhesive market is influenced by several factors, including the increasing production of automobiles and the rise in consumer purchasing power worldwide. Additionally, the application industry in the Asia Pacific region is experiencing significant growth, which is expected to further fuel the global flock adhesive market.

Flock adhesives are used in various industries to add decorative surfaces. Among these industries, the automotive sector is expected to drive the demand for flock adhesive. This is because flock adhesives offer flexibility and strong bonding properties, which are essential for the automotive industry. As consumers have a higher purchasing power, their expectations for vehicle comfort and interior quality also increase. This leads to a higher demand for flocking technology and, consequently, flock adhesive in the automotive industry.

Water borne flock adhesives are preferred in various industries due to their ease of use, cost-effectiveness, and environmental friendliness. They provide strong bonding properties and are suitable for applications where flexibility is required. The automotive industry, in particular, benefits from water borne flock adhesives as they meet the quality standards and requirements for vehicle interiors.

In conclusion, the global flock adhesive market is witnessing steady growth. Factors such as the increasing production of automobiles and the rise in consumer purchasing power are driving the demand for flock adhesive. The Asia Pacific region is experiencing significant growth in the application industry, which further fuels the global flock adhesive market. The water borne flock adhesive segment holds the largest market share and is expected to continue growing due to its ease of use, cost-effectiveness, and environmental benefits. As the market evolves, it is expected that the demand for flock adhesive will continue to rise, especially in industries such as automotive, textiles, and packaging.

Leave a Comment