Sustainability Trends

The Global Europe Paper Packaging for Tableware Market Industry is experiencing a notable shift towards sustainability, driven by increasing consumer awareness regarding environmental issues. As consumers demand eco-friendly alternatives to plastic, paper packaging emerges as a viable solution. In 2024, the market is projected to reach 3250 USD Million, reflecting a growing preference for biodegradable materials. This trend is further supported by government regulations aimed at reducing plastic waste, which encourage the adoption of paper-based products. Consequently, manufacturers are investing in sustainable practices, which not only align with consumer expectations but also enhance brand loyalty and market competitiveness.

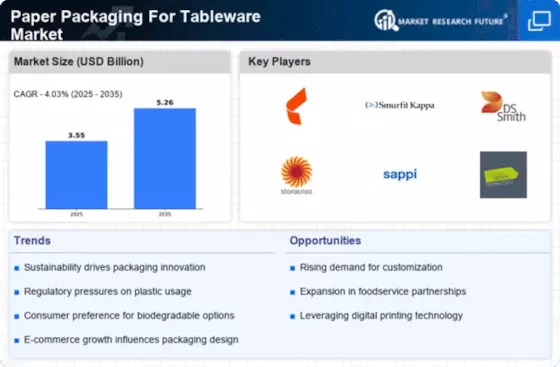

Market Growth Projections

The Global Europe Paper Packaging for Tableware Market Industry is poised for substantial growth, with projections indicating a market size of 3250 USD Million in 2024 and an anticipated increase to 5500 USD Million by 2035. This growth trajectory suggests a robust CAGR of 4.9% from 2025 to 2035, driven by various factors including sustainability trends, technological advancements, and changing consumer preferences. The market dynamics reflect a shift towards eco-friendly packaging solutions, which are increasingly favored by both consumers and regulatory bodies. As the industry evolves, it is likely that innovative packaging solutions will emerge, further enhancing market potential.

Technological Advancements

Technological innovations play a crucial role in shaping the Global Europe Paper Packaging for Tableware Market Industry. Advancements in production techniques, such as digital printing and automated manufacturing processes, enhance the efficiency and customization of paper packaging solutions. These technologies allow for the creation of intricate designs and personalized packaging, catering to diverse consumer preferences. As a result, companies can differentiate their products in a competitive landscape. The integration of smart technologies, such as QR codes for traceability, further adds value to paper packaging, appealing to environmentally conscious consumers. This evolving landscape indicates a promising growth trajectory for the market.

Health and Safety Regulations

Health and safety regulations are pivotal in influencing the Global Europe Paper Packaging for Tableware Market Industry. Stringent guidelines regarding food safety and hygiene compel manufacturers to adopt packaging materials that are safe for food contact. Paper packaging, being a natural and non-toxic option, aligns with these regulations, thereby enhancing its appeal in the market. Additionally, the increasing scrutiny on plastic packaging due to health concerns further propels the demand for paper alternatives. As a result, companies are likely to invest in compliance with these regulations, ensuring that their products not only meet safety standards but also resonate with health-conscious consumers.

Rising Food Delivery Services

The surge in food delivery services significantly impacts the Global Europe Paper Packaging for Tableware Market Industry. With the increasing popularity of online food ordering, there is a heightened demand for convenient and sustainable packaging solutions. Paper packaging is favored for its lightweight and recyclable properties, making it an ideal choice for takeout and delivery. As the market evolves, it is anticipated that by 2035, the industry will reach 5500 USD Million, driven by the growing reliance on food delivery platforms. This trend underscores the necessity for innovative packaging solutions that meet both consumer convenience and environmental standards.

Consumer Preferences for Convenience

Consumer preferences for convenience are reshaping the Global Europe Paper Packaging for Tableware Market Industry. The fast-paced lifestyle of modern consumers drives the demand for easy-to-use and disposable packaging solutions. Paper packaging, known for its lightweight and portable nature, caters to this need effectively. As consumers increasingly seek hassle-free dining experiences, the market is poised for growth, with a projected CAGR of 4.9% from 2025 to 2035. This trend highlights the importance of developing packaging solutions that not only offer convenience but also align with sustainability goals, thereby appealing to a broader audience.