Consumer Preferences

Shifting consumer preferences are a key driver of the Europe Paper Packaging For Tableware Market. As consumers become more health-conscious and environmentally aware, there is a marked shift towards products that are perceived as safer and more sustainable. In 2025, surveys indicate that over 70% of European consumers prefer paper packaging over plastic due to concerns about health risks associated with plastic leaching. This trend is particularly evident in the food service sector, where restaurants and catering services are increasingly opting for paper-based tableware. The growing demand for organic and natural products further reinforces this shift, as consumers seek packaging that aligns with their values. Consequently, businesses in the Europe Paper Packaging For Tableware Market are adapting their offerings to meet these evolving consumer demands, driving market growth.

Regulatory Framework

The regulatory environment significantly influences the Europe Paper Packaging For Tableware Market. The European Union has implemented stringent regulations aimed at reducing single-use plastics and promoting recyclable materials. For example, the Single-Use Plastics Directive, which came into effect in 2021, mandates that certain plastic products be phased out, thereby creating opportunities for paper-based alternatives. As a result, manufacturers are increasingly focusing on developing compliant packaging solutions that meet these regulations. In 2025, it is projected that compliance with these regulations will drive a 25% increase in the demand for paper packaging in the tableware sector. This regulatory push not only fosters innovation but also encourages companies to invest in sustainable practices, ultimately benefiting the Europe Paper Packaging For Tableware Market.

Technological Innovations

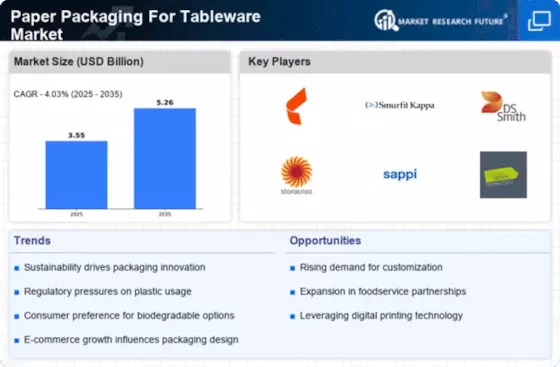

Technological advancements are playing a crucial role in shaping the Europe Paper Packaging For Tableware Market. Innovations in production processes, such as digital printing and automated manufacturing, have improved efficiency and reduced costs. For instance, the adoption of digital printing technology allows for customized designs and shorter production runs, catering to the diverse needs of consumers. In 2025, it is estimated that around 30% of tableware packaging in Europe will utilize advanced printing techniques. Furthermore, the integration of smart packaging solutions, which can provide information about product freshness and sustainability, is gaining traction. These technological innovations not only enhance product appeal but also contribute to the overall growth of the Europe Paper Packaging For Tableware Market, as companies strive to differentiate themselves in a competitive landscape.

Sustainability Initiatives

The Europe Paper Packaging For Tableware Market is experiencing a notable shift towards sustainability. With increasing consumer awareness regarding environmental issues, there is a growing demand for eco-friendly packaging solutions. In 2025, approximately 60% of consumers in Europe expressed a preference for sustainable packaging options, which has prompted manufacturers to innovate and adopt biodegradable materials. This trend is further supported by the European Union's commitment to reducing plastic waste, as outlined in the European Green Deal. Consequently, companies are investing in sustainable practices, which not only align with consumer preferences but also enhance brand reputation. The shift towards sustainability is likely to drive growth in the Europe Paper Packaging For Tableware Market, as businesses seek to meet the evolving expectations of environmentally conscious consumers.

Market Expansion Opportunities

The Europe Paper Packaging For Tableware Market is poised for expansion, driven by various opportunities across different sectors. The rise of the food delivery and takeout industry has created a substantial demand for paper-based packaging solutions. In 2025, it is estimated that the food delivery market in Europe will reach a value of EUR 30 billion, significantly boosting the need for sustainable packaging options. Additionally, the increasing popularity of events and gatherings, such as festivals and outdoor dining, is further propelling the demand for disposable tableware. Companies are likely to capitalize on these trends by developing innovative and attractive paper packaging solutions that cater to the needs of these growing markets. This expansion potential presents a favorable outlook for the Europe Paper Packaging For Tableware Market, as businesses seek to leverage new opportunities for growth.