Market Analysis

eSIM market (Global, 2022)

Introduction

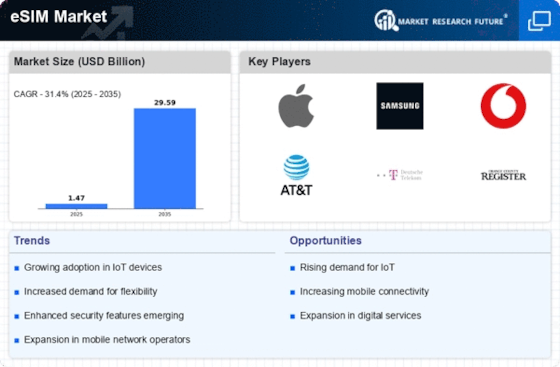

The eSIM market has emerged as a transforming force in the telecommunications industry, driven by the growing demand for seamless connectivity and the proliferation of IoT devices. The benefits of eSIMs, which are gaining ground as traditional SIMs lose ground, are being realised by consumers and businesses alike. They include increased flexibility, improved security and the ability to change carriers without the need to replace physical SIM cards. The shift is being accelerated by the development of 5G, which requires more efficient and versatile ways to connect devices. The eSIM market is a broad one, encompassing mobile operators, manufacturers and software developers. All are working together to develop a solid framework to support widespread eSIM deployment. The market is evolving, and as it does so it is presenting opportunities for innovation and growth. As it evolves, it is also shaping the way users connect and interact with their devices in an increasingly digital world.

PESTLE Analysis

- Political

- In 2022, the digital transformation and the global interconnectedness are in full swing. A series of government initiatives are promoting the use of eSIM technology. For example, the European Union has adopted the European Electronic Communications Code, which stipulates that all mobile devices sold in the EU by 2025 must have an eSIM. This policy will affect more than 500 million mobile phone users in Europe and will lead to a great demand for eSIM devices and services.

- Economic

- The economic framework of the eSIM market in 2022 is influenced by the increasing investment in telecommunications equipment. In the US, the Federal Communications Commission allocated $ 1.9 billion for the expansion of broadband services, which includes eSIM technology. The investment is expected to improve the coverage of about 1.5 million underserved households and thus increase the potential client base for eSIM services.

- Social

- Social trends indicate that consumers are looking for more flexibility and convenience in mobile communication. A survey in 2022 shows that 68% of urban users of smartphones prefer eSIM technology because of the ease of switching between carriers without the need for a physical SIM card. Among the millennials and generation Z users, eSIMs are expected to be adopted quickly.

- Technological

- In 2022, the capabilities of eSIM were greatly enhanced. By the end of the year, there were more than a billion 5G subscribers around the world. eSIMs were embedded in more and more equipment, including the Internet of Things. By 2025, the number of connected devices was expected to reach 30 billion.

- Legal

- The legal framework for eSIM is developing in several countries, which are establishing regulations to ensure the security of consumers and their personal data. In 2022, the Californian Personal Data Act was extended to include eSIMs, and companies were obliged to inform consumers about the way they handle data. This law, which applies to the forty million inhabitants of California, emphasizes the importance of eSIM service suppliers’ compliance with the law.

- Environmental

- In 2022 the eSIM's eco-friendly credentials are becoming increasingly important as the industry seeks to reduce the amount of discarded equipment. Estimates suggest that the production of traditional SIM cards produces about 20,000 tons of plastic waste a year. The switch to eSIMs eliminates the need for a physical card, reducing the amount of waste and helping the industry meet its sustainable development goals.

Porter's Five Forces

- Threat of New Entrants

- The e-SIM market is moderately difficult to enter, as a result of the need for technological expertise and considerable investment. Moreover, the established players have a strong brand loyalty and distribution network, which is a barrier to new entrants. However, the increasing demand for e-SIM solutions may encourage new entrants.

- Bargaining Power of Suppliers

- Suppliers' bargaining power in the eSIM market is relatively low. Suppliers of eSIM components, such as the chip, are numerous and the market is competitive. This allows the eSIM suppliers to negotiate more advantageous terms and prices.

- Bargaining Power of Buyers

- The buyer has high bargaining power in the eSIM market because of the growing number of possibilities available to him. The eSIM solution is offered by many companies. The customer can easily change from one provider to another, and this leads to price competition and better service. The increasing awareness of eSIM technology in the consumer population strengthens his bargaining power.

- Threat of Substitutes

- The threat of substitution in the eSIM market is moderate. SIM cards are still in use and are very common, but the convenience and flexibility of eSIM technology are driving its adoption. However, if the SIM card continues to evolve or if newer technology emerges, it may become a threat to the eSIM market.

- Competitive Rivalry

- Competition is fierce in the eSIM market, with many companies competing for a share of the market. There is considerable investment from the world’s leading telecommunications companies and technology companies in eSIM technology, resulting in a proliferation of products and services. This intense competition can drive down prices and speed up the development of new technology, which is good for consumers.

SWOT Analysis

Strengths

- Increased flexibility for consumers with multiple carrier options.

- Reduced physical SIM card production and waste, promoting sustainability.

- Enhanced security features compared to traditional SIM cards.

- Facilitates easier device activation and management for users.

- Growing adoption by major smartphone manufacturers.

Weaknesses

- Limited compatibility with older devices and networks.

- Consumer awareness and understanding of eSIM technology is still low.

- Potential for higher costs associated with eSIM-enabled devices.

- Challenges in transitioning from physical SIM to eSIM for some users.

- Regulatory hurdles in certain regions affecting adoption.

Opportunities

- Expansion of IoT devices utilizing eSIM technology.

- Potential for partnerships with mobile network operators for bundled services.

- Growing demand for remote management of devices in various industries.

- Increased focus on digital transformation and connectivity solutions.

- Emerging markets present untapped potential for eSIM adoption.

Threats

- Intense competition among telecom providers and device manufacturers.

- Rapid technological advancements may outpace current eSIM solutions.

- Cybersecurity threats targeting eSIM technology.

- Regulatory changes that could impact market dynamics.

- Consumer resistance to change from traditional SIM cards.

Summary

The eSIM market in 2022 has many advantages such as flexibility, availability and security, which are driving the market. But there are also challenges such as lack of compatibility and low awareness. Opportunities abound in the IoT sector and in emerging markets. The threat comes from competition and the risk of cyber attacks. In the future, it will be important for all stakeholders to focus on education, cooperation and innovation.

Leave a Comment