Increased Focus on Security

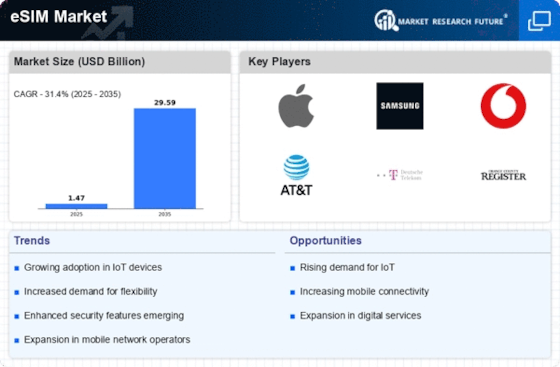

The heightened focus on security in telecommunications is emerging as a crucial driver for the eSIM Market. As cyber threats become more sophisticated, the need for secure communication channels is paramount. eSIM Market technology offers enhanced security features, such as secure element integration and remote management capabilities, which can mitigate risks associated with traditional SIM cards. According to industry reports, The eSIM Market is projected to reach over 300 billion by 2024, underscoring the importance of security in technology adoption. This emphasis on security is likely to encourage more businesses and consumers to transition to eSIM Market solutions, thereby fostering growth within the eSIM Market. As organizations prioritize data protection and secure communications, the demand for eSIM Market technology is expected to rise.

Expansion of IoT Applications

The expansion of Internet of Things (IoT) applications is significantly influencing the eSIM Market. With the proliferation of connected devices, ranging from smart home appliances to industrial sensors, the need for reliable and scalable connectivity solutions has never been greater. eSIM Market technology is particularly well-suited for IoT applications, as it allows for remote provisioning and management of devices without the need for physical SIM card replacements. Market data suggests that the number of connected IoT devices is expected to exceed 30 billion by 2030, creating a substantial opportunity for eSIM Market adoption. This growth in IoT applications is likely to drive innovation within the eSIM Market, as manufacturers and service providers seek to develop tailored solutions that meet the unique connectivity needs of various sectors.

Advancements in Mobile Technology

Advancements in mobile technology are significantly propelling the eSIM Market forward. The rapid evolution of smartphones and other mobile devices has created a conducive environment for the adoption of eSIM Market technology. As manufacturers integrate eSIM Market capabilities into their devices, consumers are increasingly exposed to the benefits of this technology, such as the ability to switch carriers without changing SIM cards. Market analysis indicates that the smartphone segment is expected to account for a substantial share of the eSIM Market, with projections suggesting that eSIM Market-enabled devices will surpass 1 billion units by 2025. This trend is likely to drive consumer awareness and acceptance of eSIM Market technology, further solidifying its position within the eSIM Market. As mobile technology continues to advance, the relevance and appeal of eSIM Market solutions are expected to grow.

Regulatory Support for eSIM Adoption

Regulatory support for eSIM Market adoption is playing a pivotal role in shaping the eSIM Market. Governments and regulatory bodies are increasingly recognizing the benefits of eSIM Market technology, including its potential to enhance competition and consumer choice in telecommunications. Initiatives aimed at standardizing eSIM Market technology and promoting interoperability among service providers are likely to facilitate broader adoption. For instance, regulatory frameworks that encourage the use of eSIMs in mobile devices can lead to increased market penetration. As more countries implement supportive regulations, the eSIM Market is expected to experience accelerated growth. This regulatory environment may also stimulate innovation, as companies seek to comply with new standards and leverage eSIM Market technology to differentiate their offerings.

Growing Demand for Mobile Connectivity

The increasing demand for mobile connectivity is a primary driver of the eSIM Market. As consumers and businesses alike seek seamless connectivity solutions, eSIM Market technology offers a flexible and efficient alternative to traditional SIM cards. According to recent data, the number of mobile subscriptions is projected to reach over 8 billion by 2026, indicating a robust growth trajectory. This surge in mobile subscriptions is likely to propel the adoption of eSIMs, as they facilitate easier management of multiple network profiles. Furthermore, the eSIM Market is expected to benefit from the rise of 5G networks, which require advanced connectivity solutions to support their high-speed capabilities. As such, the demand for mobile connectivity is anticipated to remain a significant driver in the evolution of the eSIM Market.