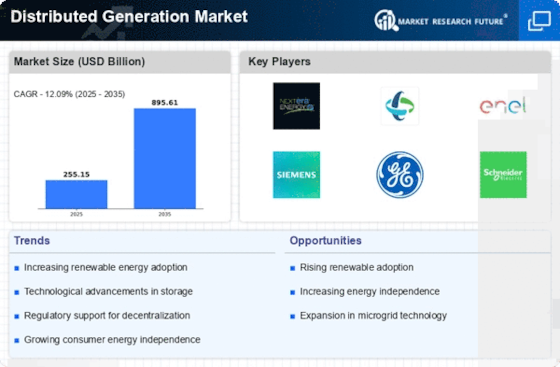

Market Share

Distributed Generation Market Share Analysis

The Distributed Generation (DG) market, marked by its diverse and decentralized energy production sources, relies heavily on strategic market share positioning to thrive in the dynamic energy landscape. One key strategy employed by companies in this sector is differentiation through technology. As advancements continue to redefine the energy sector, companies offering cutting-edge technologies gain a competitive edge. Whether it's enhanced efficiency in solar panels, innovative storage solutions, or intelligent grid management systems, staying at the forefront of technological innovation allows DG firms to attract a broader consumer base. Moreover, geographical positioning is another crucial aspect of market share strategies in the Distributed Generation market. Companies often tailor their offerings to suit the specific energy needs and available resources of different regions. For instance, in sun-rich areas, solar-focused solutions might dominate, while regions with abundant wind resources may see a surge in wind energy installations. By aligning their offerings with the unique characteristics of each location, DG firms can effectively capture market share in diverse geographic landscapes. Collaboration and strategic partnerships also play a pivotal role in shaping market share positioning in the DG market. As the industry evolves, companies recognize the significance of forming alliances to strengthen their market presence. This can involve collaborations with utility companies, technology providers, or even governmental bodies. By forging strategic partnerships, DG firms not only gain access to a wider customer base but also leverage the expertise and resources of their partners, enhancing their overall market positioning. Furthermore, a focus on customer-centric approaches is integral to market share strategies in the Distributed Generation sector. With an increasing emphasis on sustainable and eco-friendly practices, consumers are becoming more discerning about the energy sources they support. DG companies that prioritize customer needs, offering transparent and customizable solutions, are more likely to win over environmentally conscious consumers. By understanding and catering to customer preferences, these firms can carve out a significant market share and foster brand loyalty. Policy advocacy and regulatory navigation are additional factors influencing market share positioning in the DG market. Companies who actively participate in policy formation and regulatory change adaptation enjoy a competitive edge, as energy regulations are dynamic. DG companies establish themselves as compliant and progressive organizations by coordinating their business activities with changing requirements. This helps to build trust with investors and customers. To sum up, a variety of factors, including technology innovation, geographic adaptability, strategic collaborations, customer-centric methods, and regulatory savvy, influence the competitive landscape of the Distributed Generation industry for DG firms looking to expand sustainably in this dynamic and quickly changing industry, successfully navigating and combining these components into a coherent market share plan is crucial. With the increasing need for sustainable and decentralized energy solutions worldwide, businesses will need to position themselves to maintain a strong market share strategically.

Leave a Comment