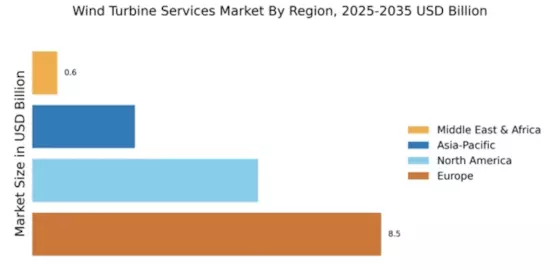

Market Growth Projections

The Global Wind Turbine Services Market Industry is projected to experience substantial growth in the coming years. The market is expected to reach 17.1 USD Billion in 2024 and is forecasted to expand to 40.8 USD Billion by 2035. This growth trajectory indicates a compound annual growth rate (CAGR) of 8.22% from 2025 to 2035. Such projections reflect the increasing adoption of wind energy solutions globally, driven by technological advancements, supportive government policies, and rising investments in renewable energy infrastructure. The anticipated growth presents significant opportunities for service providers in the wind turbine sector, as demand for maintenance, repair, and operational services continues to escalate.

Government Policies and Incentives

Government policies and incentives play a crucial role in shaping the Global Wind Turbine Services Market Industry. Many countries are establishing favorable regulatory frameworks to encourage investments in wind energy. For instance, tax credits, subsidies, and renewable portfolio standards are being implemented to stimulate the growth of wind power. In the United States, the Production Tax Credit has been instrumental in promoting wind energy projects, leading to a significant increase in installed capacity. Such supportive measures are likely to enhance the demand for wind turbine services, as operators seek to optimize their assets and comply with regulatory requirements, thereby driving market expansion.

Growing Demand for Renewable Energy

The Global Wind Turbine Services Market Industry is experiencing a surge in demand driven by the global shift towards renewable energy sources. Governments worldwide are implementing policies and incentives to promote clean energy, aiming to reduce carbon emissions. For instance, the European Union's Green Deal aims to make Europe climate-neutral by 2050, which includes significant investments in wind energy. This transition is expected to bolster the market, with the industry projected to reach 17.1 USD Billion in 2024. The increasing adoption of wind energy technologies is likely to create a robust demand for maintenance and operational services, further enhancing market growth.

Technological Advancements in Wind Turbines

Technological innovations are significantly influencing the Global Wind Turbine Services Market Industry. The development of larger and more efficient turbines, such as those with capacities exceeding 10 MW, is enhancing energy output and reducing the cost per megawatt-hour. These advancements not only improve the performance of wind farms but also necessitate specialized services for installation, maintenance, and repair. For example, the integration of predictive maintenance technologies using IoT and AI is becoming prevalent, allowing for real-time monitoring and reducing downtime. As these technologies evolve, they are expected to drive market growth, contributing to the projected increase to 40.8 USD Billion by 2035.

Rising Investment in Wind Energy Infrastructure

The Global Wind Turbine Services Market Industry is witnessing increased investment in wind energy infrastructure, which is pivotal for market growth. Countries are allocating substantial funds to develop offshore and onshore wind farms, recognizing their potential to meet energy demands sustainably. For example, the United Kingdom has committed to investing billions in offshore wind projects, aiming to generate 40 GW by 2030. This influx of capital is expected to create a robust demand for services related to installation, maintenance, and upgrades of wind turbines. As investments continue to rise, the market is likely to experience significant growth, aligning with the projected CAGR of 8.22% from 2025 to 2035.

Increasing Focus on Sustainability and Corporate Responsibility

The Global Wind Turbine Services Market Industry is increasingly influenced by the growing focus on sustainability and corporate responsibility among businesses. Companies are recognizing the importance of integrating sustainable practices into their operations, leading to a heightened demand for renewable energy solutions, including wind power. This trend is evident in various sectors, such as manufacturing and technology, where firms are committing to carbon neutrality goals. As organizations strive to enhance their sustainability profiles, the demand for wind turbine services is expected to rise, as they seek to invest in renewable energy projects that align with their corporate values and environmental commitments.