Top Industry Leaders in the Distributed Generation Market

*Disclaimer: List of key companies in no particular order

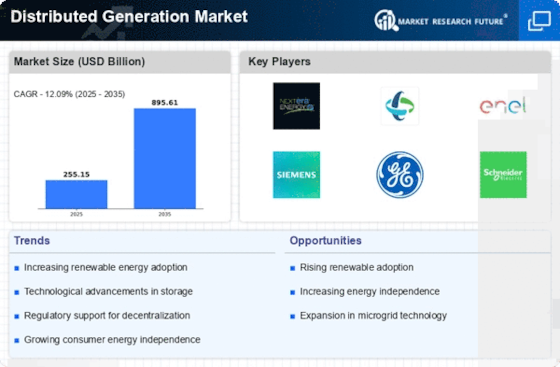

The Distributed Generation (DG) Market is undergoing rapid transformations fueled by escalating energy costs, escalating environmental concerns, and technological advancements. With solar photovoltaic (PV), wind turbines, microturbines, fuel cells, and combined heat and power (CHP) systems installed in close proximity to end-users, the DG market is witnessing intensified competition. This evolution prompts market players to deploy diverse strategies to secure market share and gain a competitive advantage.

Key Player Strategies:

Product Innovation: Leading companies such as General Electric Company, Ansaldo Energia, Bloom Energy, and others are focusing on developing efficient, cost-effective, and modular DG technologies. This includes advancements in solar panels, wind turbine designs, microturbine technology, and fuel cell efficiency. Moreover, investments in advanced battery storage solutions are being made to enhance the grid integration of intermittent renewable sources.

Market Expansion: Players are expanding their reach by venturing into new markets and exploring opportunities in emerging economies. Strategic partnerships with local companies are also being established to leverage their expertise and distribution networks.

Mergers and Acquisitions: Mergers and acquisitions are increasingly prevalent as companies seek to broaden their product portfolios, acquire new technologies, and consolidate market share, particularly in the solar and wind energy sectors.

Vertical Integration: Some market players are pursuing vertical integration by developing manufacturing, financing, and installation capabilities. This approach allows them to offer customers a comprehensive solution and exercise control over the entire value chain.

Digitalization: Leveraging digital technologies like IoT, data analytics, and AI, companies aim to optimize operations, enhance customer service, and develop new business models.

Factors for Market Share Analysis:

Market Share by Technology: Solar PV currently dominates the DG market, followed by wind and fuel cells. However, the market share of technologies like microturbines and CHP systems is expected to rise in the future.

Market Share by Application: The residential sector is the largest consumer of DG solutions, with the industrial sector expected to witness significant growth due to its demand for reliable and cost-effective power.

Market Share by Region: Asia Pacific leads the global DG market, followed by North America and Europe. However, the Middle East and Africa are emerging as potential growth markets due to favorable government policies and abundant renewable resources.

New and Emerging Trends:

Microgrids: Businesses and communities are increasingly adopting microgrids to enhance energy security and resilience, combining DG technologies with energy storage and control systems to operate independently from the main grid.

Peer-to-peer Energy Trading: Blockchain technology is facilitating peer-to-peer energy trading, enabling individuals and businesses to sell excess energy. This trend is expected to accelerate DG adoption and promote energy independence.

Renewable Energy Hybrids: Companies are developing hybrid systems combining multiple DG technologies, such as solar PV and wind turbines, to create a more reliable and resilient power source.

Virtual Power Plants (VPPs): VPPs aggregate the capacity of distributed energy resources, allowing them to participate in energy markets and provide grid services. This trend is anticipated to unlock the full potential of DG and accelerate its integration into the broader energy system.

Characterized by technological advancements, evolving regulatory landscapes, and increasing customer demand for sustainable energy solutions, market players must adopt a strategic approach focusing on innovation, market expansion, and digitalization. Collaboration and partnerships will be pivotal for companies to overcome challenges and achieve long-term success in this dynamic environment.

Industry Developments and Latest Updates:

General Electric (GE): In October 2023, GE launched the GE Hybex™ modular hybrid power system, combining solar, wind, and hydrogen technologies for off-grid and microgrid applications.

Ansaldo Energia: In November 2023, Ansaldo Energia secured a contract to supply three gas turbines for a 450 MW combined cycle power plant in Oman.

Bloom Energy: In December 2023, Bloom Energy announced a collaboration with Chevron to explore opportunities for hydrogen fuel cell deployments in California.

Schneider Electric SE: In December 2023, Schneider Electric SE acquired a majority stake in French solar inverter manufacturer Imeon, expanding its offerings for distributed solar energy.

Caterpillar Inc.: In November 2023, Caterpillar Inc. unveiled a new line of natural gas-powered generators featuring enhanced efficiency and emissions reductions.