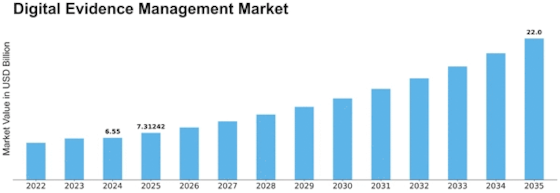

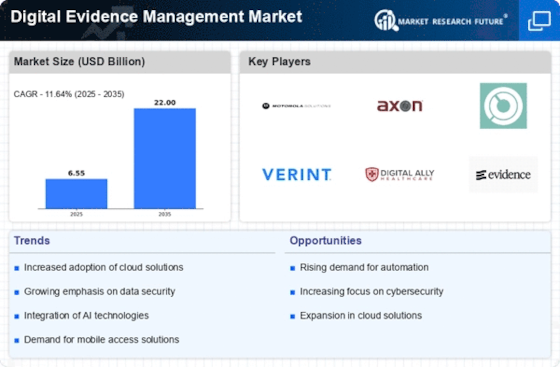

Digital Evidence Management Size

Digital Evidence Management Market Growth Projections and Opportunities

The Digital Evidence Management (DEM) marketplace is influenced by numerous key factors that together form its dynamics and growth trajectory. One pivotal factor is the growing incidence of cybercrime across industries and sectors. As cyber threats turn out to be extra sophisticated, there's a heightened demand for strong DEM answers that may efficiently manipulate the growing quantity of digital evidence generated during cyber investigations.

Law enforcement agencies, authorities, our bodies, and organizations are investing in advanced DEM systems to streamline the gathering, storage, and analysis of digital proof, thereby addressing the challenges posed by the aid of cyber threats. The sheer volume of digital records generated throughout industries is another element influencing the DEM marketplace. From frame-worn cameras in regulation enforcement to surveillance pictures in public areas and virtual communications in establishments, the exponential growth of digital evidence poses challenges in terms of garage, retrieval, and analysis. Interoperability is a vital aspect impacting the DEM market dynamics. As agencies use a whole lot of gear for virtual evidence series, analysis, and garages, there may be a growing need for seamless integration between one-of-a-kind systems.

Interoperability ensures a cohesive workflow for investigators, lowering the danger of statistics silos and improving the overall performance of Digital Evidence Management. Data protection and privacy issues are paramount factors influencing the DEM marketplace. With the sensitive nature of virtual proof, businesses are putting improved emphasis on ensuring the security and privacy of stored records. Encryption, stable statistics transmission, and stringent get entry to controls are getting necessary functions of DEM answers, addressing worries associated with unauthorized get entry to, tampering, or information breaches. Moreover, the geographical landscape and the range of criminal systems contribute to the market factors of DEM. Different areas and nations have various felony necessities and requirements for the management of digital proof.

Market players ought to navigate those numerous regulatory landscapes, considering elements inclusive of facts sovereignty, privacy legal guidelines, and compliance with nearby legal frameworks. The competitive panorama and technological innovations are additional elements shaping the DEM market. Established gamers and rising vendors are engaged in constant innovation to stay beforehand in the marketplace. Features consisting of synthetic intelligence, device studying, and advanced analytics are being incorporated into DEM solutions to decorate the skills of virtual proof evaluation. Market gamers are also focusing on consumer-friendly interfaces and intuitive design to cater to a large person base with various technical information.

Leave a Comment