Market Share

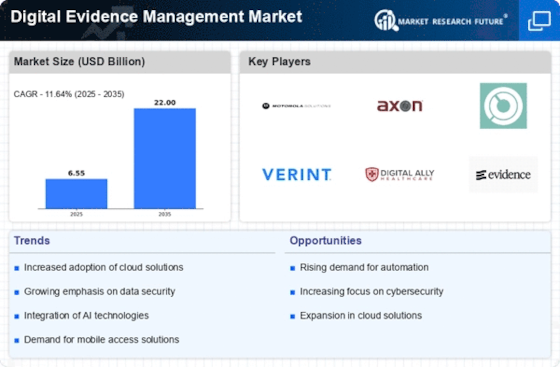

Digital Evidence Management Market Share Analysis

Market proportion positioning techniques in the Digital Evidence Management (DEM) market involve a multifaceted technique adopted via organizations to establish a strong presence, gain an aggressive facet, and seize an enormous percentage of the marketplace. One common approach is differentiation via technological innovation. Companies aim to distinguish their DEM solutions by incorporating superior functions, including artificial intelligence, machine mastering, and predictive analytics. Innovations in information analysis, facial recognition, and automation enhance the performance of Digital Evidence Management, attracting customers searching for modern solutions.

Scalability is a key attention in market share positioning techniques. As the quantity of virtual proof continues to develop exponentially, organizations recognize growing scalable DEM answers that can accommodate large datasets. Scalability is critical for meeting the evolving desires of law enforcement groups and firms handling substantial quantities of virtual facts. Geographical growth is any other strategy hired by companies to beautify marketplace proportion positioning. By getting into new markets and areas, organizations can tap into untapped opportunities and develop their customer base. Understanding and adapting to nearby legal and regulatory nuances is critical in a successful geographical enlargement. Customer-centric techniques are pivotal in marketplace share positioning in the DEM sector.

Companies attempt to understand the particular requirements of their goal customers, whether they may be law enforcement companies, authorities' entities, or enterprises. Tailoring DEM solutions to cope with the precise challenges faced by customers fosters brand loyalty and strengthens the business enterprise's function within the market. Offering customization options, person-pleasant interfaces, and comprehensive guide offerings contribute to constructing lasting relationships with customers.

Moreover, pricing techniques play a tremendous role in market share positioning. Companies need to strike a balance between imparting competitive pricing to attract fee-aware clients and ensuring that the pricing shape reflects the fee of their DEM solutions. Flexible pricing fashions, subscription-based services, and obvious fee structures contribute to an organization's ability to seize marketplace share by appealing to a range of budgetary possibilities within their target customer base.

Leave a Comment