Dietary Supplements Market Trends

Dietary Supplements Market Research Report By Form (Tablets, Capsules, Powders, Liquids, Soft gels), By Ingredients (Vitamins, Minerals, Herbs, Amino Acids, Enzymes), By Distribution Channel (Online, Supermarkets, Health Food Stores, Pharmacies, Direct Sales), By End-user (Adults, Children, Pregnant Women, Elderly), and By Regional (North America, Europe, South America, Asia Pacific, Middle Eas...

Market Summary

As per Market Research Future Analysis, the Global Dietary Supplements Market was valued at 178.4 USD Billion in 2023 and is projected to grow to 300 USD Billion by 2035, reflecting a CAGR of 4.43% from 2025 to 2035. The market is driven by rising health consciousness, an aging population, and a shift towards preventive healthcare, with significant opportunities in plant-based and personalized supplements.

Key Market Trends & Highlights

The Global Dietary Supplements Market is experiencing transformative trends driven by health awareness and consumer preferences.

- Rising health consciousness: Over 70% of consumers prioritize health and wellness, boosting demand for dietary supplements.

- Aging population: By 2050, 2.1 billion people will be aged 60+, increasing the need for age-related health supplements.

- E-commerce growth: Online sales of dietary supplements surged over 50% during the COVID-19 pandemic, reshaping consumer purchasing behavior.

- Focus on transparency: Consumers prefer brands with responsible sourcing and eco-friendly practices.

Market Size & Forecast

| 2023 Market Size | USD 178.4 Billion |

| 2024 Market Size | USD 186.3 Billion |

| 2035 Market Size | USD 300 Billion |

| CAGR (2025-2035) | 4.43% |

| Largest Regional Market Share in 2024 | North America (75.0 USD Billion). |

Major Players

Key players include Pfizer, Nature Made, Garden of Life, GNC Holdings, Amway, New Chapter, Nestle, Procter and Gamble, Abbott, Vitamin Shoppe, Blackmores, Herbalife, Bayer, Nutraceutical, Nature's Bounty.

Market Trends

A number of significant market factors are causing a noticeable shift in the global dietary supplements industry. The market for dietary supplements is being driven by consumers' growing health consciousness as they want to prevent chronic illnesses and enhance their general well-being.

Furthermore, a growing interest in supplements that promote older people' health is being fueled by the aging of populations in several nations, especially North America and Europe. More customers are purchasing dietary supplements as a result of this trend, which is characterized by an increased emphasis on nutrition and preventative care.

Adopting cutting-edge delivery forms like candies, powders, and liquids—which are becoming more and more popular with younger audiences—can help you seize market opportunities.Additionally, businesses have an opportunity to position themselves positively due to the clean label movement, which is characterized by customers favoring products with transparent and natural ingredient lists.

Technological developments are also helping the market by resulting in novel product formulations that address certain health issues including immunity, digestive health, and mental health. The expansion of e-commerce and digital marketing tactics has led to a recent spike in online sales channels.

Because internet platforms are more convenient, accessible, and allow for easier product research, consumers are increasingly using them to buy supplements.

Furthermore, the COVID-19 pandemic has strengthened the focus on health and wellbeing, which has increased the use of supplements meant to strengthen immunity. In order to improve their market placement, businesses in the Dietary Supplements Market must continue to be flexible and sensitive to consumer preferences as these trends develop.

The growing consumer awareness regarding health and wellness is driving a notable shift towards dietary supplements, reflecting a broader trend of preventive healthcare and self-care practices.

U.S. Food and Drug Administration (FDA)

Dietary Supplements Market Market Drivers

Rising Health Consciousness

The Global Dietary Supplements Market Industry is experiencing a notable surge in demand, driven by an increasing awareness of health and wellness among consumers. Individuals are becoming more proactive about their health, seeking preventive measures through dietary supplements. This trend is reflected in the projected market value of 186.3 USD Billion in 2024, as consumers prioritize nutritional supplements to enhance their overall well-being. The growing inclination towards self-care and preventive health strategies indicates a shift in consumer behavior, suggesting that the market will continue to expand as health consciousness becomes a central aspect of lifestyle choices.

Market Segment Insights

Dietary Supplements Market Form Insights

The Dietary Supplements Market experienced noteworthy growth, particularly in the Form segment, which encompassed various product types such as Tablets, Capsules, Powders, Liquids, and Soft gels.The Tablets form held a significant market share, valued at 45.3 USD Billion in 2024 and projected to grow to 70.0 USD Billion by 2035, showcasing its majority holding in the segment due to affordability and ease of delivery, appealing to a broad demographic.

Similarly, the Capsules form followed closely, with a 2024 valuation of 38.6 USD Billion, expected to rise to 60.0 USD Billion by 2035, favored for their convenience and quick absorption properties.The Powders segment was also an important player, valued at 30.2 USD Billion in 2024 and projected to increase to 45.0 USD Billion by 2035, catering to the fitness-conscious consumers looking for customizable protein and energy-boosting options.

Liquids, with a valuation of 20.5 USD Billion in 2024, are projected to surge to 35.0 USD Billion by 2035, primarily due to their palatability and absorption efficiency, especially in the senior demographic and those with swallowing difficulties.Lastly, Soft gels were significant within the market, valued at 51.7 USD Billion in 2024 and estimated to grow to 90.0 USD Billion by 2035, dominating the segment due to their enhanced bioavailability and consumer preference for softer dosage forms.

The diverse preferences in the Form segment highlighted the market's adaptability and the growing awareness of dietary health, influenced by trends such as clean-label products and the increasing popularity of preventive healthcare measures.

With various forms available, the Dietary Supplements Market segmentation is poised to cater to diverse consumer needs, ultimately driving market growth. Factors like rising disposable incomes and globalization have also amplified the demand for these supplements, indicating a promising road ahead for each form in the global landscape.

Dietary Supplements Market Ingredients Insights

The Dietary Supplements Market, particularly the Ingredients segment, plays a crucial role in the overall market. This segment encompasses a variety of essential components including Vitamins, Minerals, Herbs, Amino Acids, and Enzymes, each contributing uniquely to consumers' health and wellness.

Vitamins and Minerals continue to dominate due to their fundamental role in supporting overall health and supplementing dietary gaps. Herbs, known for their natural properties, are becoming increasingly popular for wellness and preventive health, while Amino Acids are essential for muscle health and recovery, driving demand among fitness enthusiasts.

Enzymes play a significant role as they assist in digestion, enhancing nutrient absorption. The market growth for these ingredients is bolstered by rising health awareness and an increasing consumer preference for preventive healthcare solutions.

Moreover, the expanding elderly population and the rising trend towards natural and organic products further support the demand for diverse dietary ingredients. The continuous evolution of product formulations and consumer education about ingredient benefits are key trends shaping this segment of the Dietary Supplements Market.

Dietary Supplements Market Distribution Channel Insights

The Distribution Channel for the Dietary Supplements Market plays a crucial role in determining how products reach consumers. Online channels are becoming increasingly significant, driven by the convenience of e-commerce and a growing consumer preference for online shopping.

Supermarkets and health food stores remain popular, providing tangible shopping experiences where consumers can access various options and expert advice. Pharmacies also play an essential role, offering dietary supplements alongside other health products, thus enhancing their credibility.

Direct sales present another vital avenue, leveraging personal relationships to effectively promote products. These channels not only facilitate access but also significantly influence consumer buying behavior, contributing to the overall revenue of the Dietary Supplements Market.

Understanding these distribution methods is critical as they often reflect changing consumer preferences and the overall health consciousness among populations globally, thereby shaping market dynamics and opportunities for growth.

Dietary Supplements Market End-user Insights

The Dietary Supplements Market showcases a diverse segmentation based on End-users, which encompasses Adults, Children, Pregnant Women, and the Elderly. The Adults segment significantly contributes to the Dietary Supplements Market revenue, with various products targeting specific health concerns such as weight management, fitness, and immunity support.

Children’s dietary needs are growing awareness, highlighting the importance of vitamins and minerals vital for development. Pregnant Women form another crucial segment, as prenatal supplements are essential for maternal and fetal health, reflecting the rising focus on pregnancy wellness.

The Elderly population, increasingly seeking nutritional support to manage health issues related to aging, plays a significant role in the market growth, driving demand for osteoporosis and cognitive health supplements.

Trends such as the shift towards natural and organic products, increasing health consciousness, and a growing aging population contribute to expanding market opportunities. However, challenges such as regulatory scrutiny and misinformation present hurdles that the industry must navigate.

Overall, the Dietary Supplements Market statistics reveal that the segmentation not only influences purchasing behavior but also shapes product offerings as consumer preferences evolve.

Get more detailed insights about Dietary Supplements Market Research Report - Forecast till 2035

Regional Insights

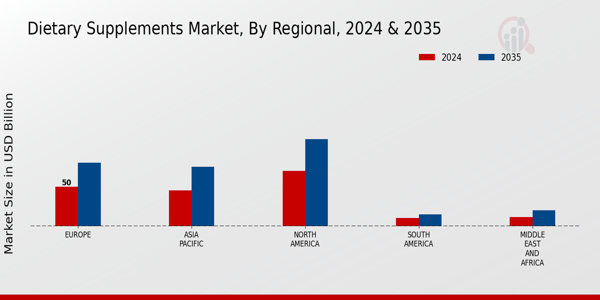

The Dietary Supplements Market showed a diverse regional landscape, with substantial variances in market valuation across different areas. In 2024, North America led at 70.0 USD Billion, representing a majority holding in the market due to increased health awareness and a robust retail environment.

Europe followed closely with a value of 50.0 USD Billion, demonstrating a strong consumer preference for natural products. The Asia Pacific segment, valued at 45.0 USD Billion, was rapidly growing, fueled by rising disposable incomes and a shift toward preventive healthcare.

South America and the Middle East and Africa were smaller segments, valued at 10.0 USD Billion and 11.3 USD Billion respectively, but they represented regions of significant potential for growth in the dietary supplements industry due to increasing health concerns.

By 2035, North America and Europe are expected to maintain their significant contributions, projecting values of 110.0 USD Billion and 80.0 USD Billion respectively, while Asia Pacific's anticipated rise to 75.0 USD Billion underscores its key role in future market dynamics.Overall, the Dietary Supplements Market segmentation revealed insights into consumer behaviors, market growth drivers, and opportunities for expansion across various regions.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Key Players and Competitive Insights

The Dietary Supplements Market has experienced significant growth in recent years due to an increasing awareness of health and wellness among consumers, coupled with a shift towards preventive healthcare. Within this competitive landscape, various companies are continuously innovating and expanding their product lines to meet the diverse needs of consumers.

The market is characterized by both established players and emerging brands that seek to carve out a niche. Competition is driven not just by product offerings but also by brand loyalty, distribution strategies, and marketing campaigns that resonate with specific demographics.

As consumer preferences evolve towards natural and organic options, companies are challenged to adapt quickly, highlighting the dynamic nature of the industry. Increasing regulatory scrutiny also adds to the complexity, prompting companies to prioritize quality and transparency to build trust among consumers.

Bayer AG has established itself as a formidable player in the Dietary Supplements Market, leveraging its extensive portfolio of products that span various health sectors. The company is known for its commitment to research and development, which underpins its ability to introduce innovative solutions that align with consumer trends.

Bayer AG emphasizes quality and efficacy, which strengthens consumer trust and brand loyalty. Its market presence is bolstered not only by a diverse product range but also by well-established sales and distribution networks.

The company’s strategic focus on over-the-counter products and targeted formulations allows it to address specific health needs, catering to a broad customer base. Additionally, Bayer AG’s ongoing investments in marketing and consumer education elevate its brand recognition and influence within the global market.

Pfizer operates within the Dietary Supplements Market with a strong emphasis on scientific backing and quality assurance. The company offers a variety of health-oriented products designed to meet the needs of varying consumer segments. Pfizer is recognized for its key offerings, which include multivitamins and specialized supplements aimed at different health concerns.

Its considerable investment in research and clinical trials ensures that products are supported by substantiated health claims, giving it a competitive edge. Pfizer's market presence is reflected through strategic partnerships and collaborations that enhance its distribution capabilities in various regions.

The company has undertaken several mergers and acquisitions to broaden its portfolio, thus allowing it to tap into emerging trends and identify synergies within the dietary supplement sector. By maintaining a focus on innovation and quality, Pfizer aims to position itself as a trusted leader in the global marketplace.

Key Companies in the Dietary Supplements Market market include

Industry Developments

A ResearchAndMarkets research from May 2025 noted that, because to China's high consumption and growing health consciousness in the Americas, Asia-Pacific accounted for 46.1% of the worldwide market for vitamins and dietary supplements.

With a focus on sustainability, ethical sourcing, and quality control, MarketsandMarkets reported a boom in AI-driven customized nutrition, plant-based components, nano-encapsulation, microalgae-based supplements, and probiotic/omega-3 breakthroughs in March 2025.

Lion's-mane mushrooms for cognition, clear whey protein, NAD boosters for cellular aging, berberine for glucose control, tailored probiotics, and magnesium L-threonate for brain health were among the growing trends for 2025 that Health.com recognized in January 2025.

In order to address health hazards and regulatory inadequacies, the U.S. states of New Jersey and New York banned weight-loss and muscle-building supplements for minors in February 2025 and imposed civil fines.In June 2024, Evonik strengthened its sustainability approach by expanding its Healthberry line in the U.S. and introducing AvailOm (an omega-3 powder with Boswellia) and INVIVOBIOTICS synbiotics for gut health at Vitafoods Europe.

In addition to these, Grand View Research and Future Market Insights noted that consumer demand for supplements related to women's health, weight management, gut health, and immunity was increasing. In 2025, automation, artificial intelligence, smart packaging, and 3D-printed customized tablets were the top manufacturing innovations.

Future Outlook

Dietary Supplements Market Future Outlook

The Global Dietary Supplements Market is projected to grow at a 4.43% CAGR from 2024 to 2035, driven by increasing health awareness, aging populations, and rising demand for preventive healthcare solutions.

New opportunities lie in:

- Develop personalized supplements utilizing AI-driven health assessments.

- Expand into emerging markets with tailored product offerings.

- Leverage e-commerce platforms for direct-to-consumer sales strategies.

By 2035, the market is expected to exhibit robust growth, reflecting evolving consumer preferences and innovative product developments.

Market Segmentation

Dietary Supplements Market Form Outlook

- Tablets

- Capsules

- Powders

- Liquids

- Soft gels

Dietary Supplements Market End-user Outlook

- Adults

- Children

- Pregnant Women

- Elderly

Dietary Supplements Market Regional Outlook

- North America

- Europe

- South America

- Asia Pacific

- Middle East and Africa

Dietary Supplements Market Ingredients Outlook

- Vitamins

- Minerals

- Herbs

- Amino Acids

- Enzymes

Dietary Supplements Market Distribution Channel Outlook

- Online

- Supermarkets

- Health Food Stores

- Pharmacies

- Direct Sales

Report Scope

| Report Attribute/Metric | Details |

| Market Size 2023 | 178.4(USD Billion) |

| Market Size 2024 | 186.3(USD Billion) |

| Market Size 2035 | 300.0(USD Billion) |

| Compound Annual Growth Rate (CAGR) | 4.43% (2025 - 2035) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Base Year | 2024 |

| Market Forecast Period | 2025 - 2035 |

| Historical Data | 2019 - 2024 |

| Market Forecast Units | USD Billion |

| Key Companies Profiled | Bayer AG, Pfizer, Blackmores, GNC Holdings, Nature's Bounty, Thorne Research, Herbalife, Nestle, Archer Daniels Midland, GSK, BASF, Otsuka Pharmaceutical, Amway, Abbott Laboratories, DuPont |

| Segments Covered | Form, Ingredients, Distribution Channel, End-user, Regional |

| Key Market Opportunities | Personalized nutrition solutions, Plant-based supplements demand, Immune support products growth, Online sales channel expansion, Aging population health focus |

| Key Market Dynamics | Rising health consciousness, Increasing aging population, Growth in e-commerce sales, Innovation in supplement formulations, Regulatory challenges and compliance |

| Countries Covered | North America, Europe, APAC, South America, MEA |

Market Highlights

Author

Latest Comments

This is a great article! Really helped me understand the topic better.

Thanks for sharing this. I’ve bookmarked it for later reference.

FAQs

What is the projected market size of the Dietary Supplements Market by 2035?

The Dietary Supplements Market is expected to be valued at 300.0 USD Billion by 2035.

What was the market value of the Dietary Supplements Market in 2024?

In 2024, the Dietary Supplements Market was valued at 186.3 USD Billion.

What is the expected CAGR for the Dietary Supplements Market from 2025 to 2035?

The expected CAGR for the Dietary Supplements Market from 2025 to 2035 is 4.43%.

Which region had the largest market share in the Dietary Supplements Market for 2024?

North America held the largest market share in the Dietary Supplements Market with a value of 70.0 USD Billion in 2024.

What will be the market value of dietary supplements in Europe by 2035?

The market value of dietary supplements in Europe is projected to reach 80.0 USD Billion by 2035.

Who are the key players in the Dietary Supplements Market?

Key players in the Dietary Supplements Market include Bayer AG, Pfizer, Blackmores, GNC Holdings, and Herbalife.

What segment of dietary supplements had the highest market value in 2024?

Soft gels held the highest market value in the Dietary Supplements Market at 51.7 USD Billion in 2024.

What is the market growth rate for the Asia Pacific region in the Dietary Supplements Market?

The Asia Pacific region's market is expected to grow from 45.0 USD Billion in 2024 to 75.0 USD Billion by 2035.

What opportunities are present in the Dietary Supplements Market?

Growing health consciousness and increasing demand for natural products present significant opportunities in the Dietary Supplements Market.

How did the liquid form of dietary supplements compare in market size to other forms in 2024?

The liquid form of dietary supplements was valued at 20.5 USD Billion in 2024, which was relatively lower compared to tablets and soft gels.

-

Bargaining Power of Buyers

-

Threat of New Entrants

- Threat of Substitutes

- Intensity of Rivalry

-

COVID-19 Impact Analysis

- Market Impact Analysis

- Regional Impact

- Opportunity and Threat Analysis

- Tablets

- Capsules

- Powders

- Liquids

- Soft gels

- Vitamins

- Minerals

- Herbs

- Amino Acids

- Enzymes

- Online

- Supermarkets

- Health Food Stores

- Pharmacies

- Direct Sales

-

Threat of New Entrants

-

SUPPLEMENTS MARKET, BY END USER (USD BILLION)

- Adults

- Children

- Pregnant Women

- Elderly

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Russia

- Italy

- Spain

- Rest of Europe

-

APAC

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Indonesia

- Rest of APAC

-

South America

- Brazil

- Mexico

- Argentina

- Rest of South America

-

MEA

- GCC Countries

- South Africa

- Rest of MEA

- Overview

- Competitive Analysis

- Market share Analysis

- Major Growth Strategy in the Dietary Supplements Market

- Competitive Benchmarking

-

Leading Players in Terms of Number of Developments in the Dietary Supplements Market

- Key developments and growth strategies

-

New Product Launch/Service Deployment

-

Merger & Acquisitions

- Joint Ventures

-

Major Players Financial Matrix

- Sales and Operating Income

- Major Players R&D Expenditure. 2023

-

Pfizer

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Nature Made

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Garden of Life

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

GNC Holdings

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Amway

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

New Chapter

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Nestle

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Procter and Gamble

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Abbott

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Vitamin Shoppe

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Blackmores

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Herbalife

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Bayer

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Nutraceutical

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Nature's Bounty

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

- References

- Related Reports OF ASSUMPTIONS

-

Merger & Acquisitions

-

SIZE ESTIMATES & FORECAST, BY FORM, 2019-2035 (USD BILLIONS)

-

2019-2035 (USD BILLIONS)

-

SUPPLEMENTS MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS) SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD BILLIONS)

-

2019-2035 (USD BILLIONS)

-

MARKET SIZE ESTIMATES & FORECAST, BY FORM, 2019-2035 (USD BILLIONS)

-

2019-2035 (USD BILLIONS)

-

MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS) & FORECAST, BY END USER, 2019-2035 (USD BILLIONS) US DIETARY SUPPLEMENTS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS) ESTIMATES & FORECAST, BY FORM, 2019-2035 (USD BILLIONS) CANADA DIETARY SUPPLEMENTS MARKET SIZE ESTIMATES & FORECAST, BY INGREDIENTS

-

2019-2035 (USD BILLIONS)

-

MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS) & FORECAST, BY END USER, 2019-2035 (USD BILLIONS) CANADA DIETARY SUPPLEMENTS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS) ESTIMATES & FORECAST, BY FORM, 2019-2035 (USD BILLIONS) EUROPE DIETARY SUPPLEMENTS MARKET SIZE ESTIMATES & FORECAST, BY INGREDIENTS

-

2019-2035 (USD BILLIONS)

-

MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS) & FORECAST, BY END USER, 2019-2035 (USD BILLIONS) EUROPE DIETARY SUPPLEMENTS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS) ESTIMATES & FORECAST, BY FORM, 2019-2035 (USD BILLIONS) GERMANY DIETARY SUPPLEMENTS MARKET SIZE ESTIMATES & FORECAST, BY INGREDIENTS

-

2019-2035 (USD BILLIONS)

-

MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS) & FORECAST, BY END USER, 2019-2035 (USD BILLIONS) GERMANY DIETARY SUPPLEMENTS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS) & FORECAST, BY FORM, 2019-2035 (USD BILLIONS) UK DIETARY SUPPLEMENTS MARKET SIZE ESTIMATES & FORECAST, BY INGREDIENTS, 2019-2035 (USD BILLIONS) & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

-

& FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS) FRANCE DIETARY SUPPLEMENTS MARKET SIZE ESTIMATES & FORECAST, BY FORM, 2019-2035 (USD BILLIONS) ESTIMATES & FORECAST, BY INGREDIENTS, 2019-2035 (USD BILLIONS)

-

CHANNEL, 2019-2035 (USD BILLIONS) MARKET SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD BILLIONS)

-

2019-2035 (USD BILLIONS)

-

MARKET SIZE ESTIMATES & FORECAST, BY FORM, 2019-2035 (USD BILLIONS)

-

2019-2035 (USD BILLIONS)

-

MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS) & FORECAST, BY END USER, 2019-2035 (USD BILLIONS) RUSSIA DIETARY SUPPLEMENTS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS) ESTIMATES & FORECAST, BY FORM, 2019-2035 (USD BILLIONS) ITALY DIETARY SUPPLEMENTS MARKET SIZE ESTIMATES & FORECAST, BY INGREDIENTS

-

2019-2035 (USD BILLIONS)

-

MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS) & FORECAST, BY END USER, 2019-2035 (USD BILLIONS) ITALY DIETARY SUPPLEMENTS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS) ESTIMATES & FORECAST, BY FORM, 2019-2035 (USD BILLIONS) SPAIN DIETARY SUPPLEMENTS MARKET SIZE ESTIMATES & FORECAST, BY INGREDIENTS

-

2019-2035 (USD BILLIONS)

-

MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS) & FORECAST, BY END USER, 2019-2035 (USD BILLIONS) SPAIN DIETARY SUPPLEMENTS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS) SIZE ESTIMATES & FORECAST, BY FORM, 2019-2035 (USD BILLIONS)

-

INGREDIENTS, 2019-2035 (USD BILLIONS) SUPPLEMENTS MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS) SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD BILLIONS)

-

REGIONAL, 2019-2035 (USD BILLIONS) MARKET SIZE ESTIMATES & FORECAST, BY FORM, 2019-2035 (USD BILLIONS)

-

2019-2035 (USD BILLIONS)

-

MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS) & FORECAST, BY END USER, 2019-2035 (USD BILLIONS) APAC DIETARY SUPPLEMENTS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS) ESTIMATES & FORECAST, BY FORM, 2019-2035 (USD BILLIONS) CHINA DIETARY SUPPLEMENTS MARKET SIZE ESTIMATES & FORECAST, BY INGREDIENTS

-

2019-2035 (USD BILLIONS)

-

MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS) & FORECAST, BY END USER, 2019-2035 (USD BILLIONS) CHINA DIETARY SUPPLEMENTS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS) ESTIMATES & FORECAST, BY FORM, 2019-2035 (USD BILLIONS) INDIA DIETARY SUPPLEMENTS MARKET SIZE ESTIMATES & FORECAST, BY INGREDIENTS

-

2019-2035 (USD BILLIONS)

-

MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS) & FORECAST, BY END USER, 2019-2035 (USD BILLIONS) INDIA DIETARY SUPPLEMENTS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS) ESTIMATES & FORECAST, BY FORM, 2019-2035 (USD BILLIONS) JAPAN DIETARY SUPPLEMENTS MARKET SIZE ESTIMATES & FORECAST, BY INGREDIENTS

-

2019-2035 (USD BILLIONS)

-

MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS) & FORECAST, BY END USER, 2019-2035 (USD BILLIONS) JAPAN DIETARY SUPPLEMENTS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS) SIZE ESTIMATES & FORECAST, BY FORM, 2019-2035 (USD BILLIONS)

-

2019-2035 (USD BILLIONS)

-

SUPPLEMENTS MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS) SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD BILLIONS)

-

2019-2035 (USD BILLIONS)

-

SUPPLEMENTS MARKET SIZE ESTIMATES & FORECAST, BY FORM, 2019-2035 (USD BILLIONS) & FORECAST, BY INGREDIENTS, 2019-2035 (USD BILLIONS) MALAYSIA DIETARY SUPPLEMENTS MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS) SUPPLEMENTS MARKET SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD BILLIONS) & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS) THAILAND DIETARY SUPPLEMENTS MARKET SIZE ESTIMATES & FORECAST, BY FORM, 2019-2035 (USD BILLIONS) ESTIMATES & FORECAST, BY INGREDIENTS, 2019-2035 (USD BILLIONS)

-

CHANNEL, 2019-2035 (USD BILLIONS) SUPPLEMENTS MARKET SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD BILLIONS) & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS) INDONESIA DIETARY SUPPLEMENTS MARKET SIZE ESTIMATES & FORECAST, BY FORM, 2019-2035 (USD BILLIONS) ESTIMATES & FORECAST, BY INGREDIENTS, 2019-2035 (USD BILLIONS)

-

CHANNEL, 2019-2035 (USD BILLIONS) SUPPLEMENTS MARKET SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD BILLIONS) & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS) REST OF APAC DIETARY SUPPLEMENTS MARKET SIZE ESTIMATES & FORECAST, BY FORM

-

2019-2035 (USD BILLIONS)

-

SUPPLEMENTS MARKET SIZE ESTIMATES & FORECAST, BY INGREDIENTS, 2019-2035 (USD BILLIONS) SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS) ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD BILLIONS)

-

2019-2035 (USD BILLIONS)

-

SUPPLEMENTS MARKET SIZE ESTIMATES & FORECAST, BY FORM, 2019-2035 (USD BILLIONS) ESTIMATES & FORECAST, BY INGREDIENTS, 2019-2035 (USD BILLIONS)

-

DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS) SOUTH AMERICA DIETARY SUPPLEMENTS MARKET SIZE ESTIMATES & FORECAST, BY END USER

-

2019-2035 (USD BILLIONS)

-

SUPPLEMENTS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS) & FORECAST, BY FORM, 2019-2035 (USD BILLIONS) BRAZIL DIETARY SUPPLEMENTS MARKET SIZE ESTIMATES & FORECAST, BY INGREDIENTS

-

2019-2035 (USD BILLIONS)

-

MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS) & FORECAST, BY END USER, 2019-2035 (USD BILLIONS) BRAZIL DIETARY SUPPLEMENTS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS) ESTIMATES & FORECAST, BY FORM, 2019-2035 (USD BILLIONS) MEXICO DIETARY SUPPLEMENTS MARKET SIZE ESTIMATES & FORECAST, BY INGREDIENTS

-

2019-2035 (USD BILLIONS)

-

MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS) & FORECAST, BY END USER, 2019-2035 (USD BILLIONS) MEXICO DIETARY SUPPLEMENTS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS) SIZE ESTIMATES & FORECAST, BY FORM, 2019-2035 (USD BILLIONS)

-

2019-2035 (USD BILLIONS)

-

SUPPLEMENTS MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS) SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD BILLIONS)

-

2019-2035 (USD BILLIONS)

-

DIETARY SUPPLEMENTS MARKET SIZE ESTIMATES & FORECAST, BY FORM, 2019-2035 (USD BILLIONS) MARKET SIZE ESTIMATES & FORECAST, BY INGREDIENTS, 2019-2035 (USD BILLIONS)

-

BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS) REST OF SOUTH AMERICA DIETARY SUPPLEMENTS MARKET SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD BILLIONS) DIETARY SUPPLEMENTS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS) & FORECAST, BY FORM, 2019-2035 (USD BILLIONS) MEA DIETARY SUPPLEMENTS MARKET SIZE ESTIMATES & FORECAST, BY INGREDIENTS, 2019-2035 (USD BILLIONS) & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

-

2019-2035 (USD BILLIONS)

-

MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

-

FORM, 2019-2035 (USD BILLIONS) SUPPLEMENTS MARKET SIZE ESTIMATES & FORECAST, BY INGREDIENTS, 2019-2035 (USD BILLIONS) SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS) ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD BILLIONS)

-

REGIONAL, 2019-2035 (USD BILLIONS) SUPPLEMENTS MARKET SIZE ESTIMATES & FORECAST, BY FORM, 2019-2035 (USD BILLIONS) ESTIMATES & FORECAST, BY INGREDIENTS, 2019-2035 (USD BILLIONS)

-

CHANNEL, 2019-2035 (USD BILLIONS) SUPPLEMENTS MARKET SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD BILLIONS) ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

-

2019-2035 (USD BILLIONS)

-

SUPPLEMENTS MARKET SIZE ESTIMATES & FORECAST, BY INGREDIENTS, 2019-2035 (USD BILLIONS) SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS) ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD BILLIONS)

-

2019-2035 (USD BILLIONS) DEVELOPMENT/APPROVAL LIST OF FIGURES

-

NORTH AMERICA DIETARY SUPPLEMENTS MARKET ANALYSIS US DIETARY SUPPLEMENTS MARKET ANALYSIS BY FORM US DIETARY SUPPLEMENTS MARKET ANALYSIS BY INGREDIENTS US DIETARY SUPPLEMENTS MARKET ANALYSIS BY DISTRIBUTION CHANNEL

-

US DIETARY SUPPLEMENTS MARKET ANALYSIS BY REGIONAL CANADA DIETARY SUPPLEMENTS MARKET ANALYSIS BY FORM CANADA DIETARY SUPPLEMENTS MARKET ANALYSIS BY INGREDIENTS CANADA DIETARY SUPPLEMENTS MARKET ANALYSIS BY DISTRIBUTION CHANNEL

-

CANADA DIETARY SUPPLEMENTS MARKET ANALYSIS BY REGIONAL EUROPE DIETARY SUPPLEMENTS MARKET ANALYSIS GERMANY DIETARY SUPPLEMENTS MARKET ANALYSIS BY FORM GERMANY DIETARY SUPPLEMENTS MARKET ANALYSIS BY INGREDIENTS GERMANY DIETARY SUPPLEMENTS MARKET ANALYSIS BY DISTRIBUTION CHANNEL

-

GERMANY DIETARY SUPPLEMENTS MARKET ANALYSIS BY REGIONAL UK DIETARY SUPPLEMENTS MARKET ANALYSIS BY FORM UK DIETARY SUPPLEMENTS MARKET ANALYSIS BY INGREDIENTS UK DIETARY SUPPLEMENTS MARKET ANALYSIS BY DISTRIBUTION CHANNEL

-

UK DIETARY SUPPLEMENTS MARKET ANALYSIS BY REGIONAL FRANCE DIETARY SUPPLEMENTS MARKET ANALYSIS BY FORM FRANCE DIETARY SUPPLEMENTS MARKET ANALYSIS BY INGREDIENTS FRANCE DIETARY SUPPLEMENTS MARKET ANALYSIS BY DISTRIBUTION CHANNEL

-

FRANCE DIETARY SUPPLEMENTS MARKET ANALYSIS BY REGIONAL RUSSIA DIETARY SUPPLEMENTS MARKET ANALYSIS BY FORM RUSSIA DIETARY SUPPLEMENTS MARKET ANALYSIS BY INGREDIENTS RUSSIA DIETARY SUPPLEMENTS MARKET ANALYSIS BY DISTRIBUTION CHANNEL

-

RUSSIA DIETARY SUPPLEMENTS MARKET ANALYSIS BY REGIONAL ITALY DIETARY SUPPLEMENTS MARKET ANALYSIS BY FORM ITALY DIETARY SUPPLEMENTS MARKET ANALYSIS BY INGREDIENTS ITALY DIETARY SUPPLEMENTS MARKET ANALYSIS BY DISTRIBUTION CHANNEL

-

ITALY DIETARY SUPPLEMENTS MARKET ANALYSIS BY REGIONAL SPAIN DIETARY SUPPLEMENTS MARKET ANALYSIS BY FORM SPAIN DIETARY SUPPLEMENTS MARKET ANALYSIS BY INGREDIENTS SPAIN DIETARY SUPPLEMENTS MARKET ANALYSIS BY DISTRIBUTION CHANNEL

-

SPAIN DIETARY SUPPLEMENTS MARKET ANALYSIS BY REGIONAL REST OF EUROPE DIETARY SUPPLEMENTS MARKET ANALYSIS BY FORM REST OF EUROPE DIETARY SUPPLEMENTS MARKET ANALYSIS BY INGREDIENTS

-

CHINA DIETARY SUPPLEMENTS MARKET ANALYSIS BY FORM CHINA DIETARY SUPPLEMENTS MARKET ANALYSIS BY INGREDIENTS CHINA DIETARY SUPPLEMENTS MARKET ANALYSIS BY DISTRIBUTION CHANNEL

-

CHINA DIETARY SUPPLEMENTS MARKET ANALYSIS BY REGIONAL INDIA DIETARY SUPPLEMENTS MARKET ANALYSIS BY FORM INDIA DIETARY SUPPLEMENTS MARKET ANALYSIS BY INGREDIENTS INDIA DIETARY SUPPLEMENTS MARKET ANALYSIS BY DISTRIBUTION CHANNEL

-

INDIA DIETARY SUPPLEMENTS MARKET ANALYSIS BY REGIONAL JAPAN DIETARY SUPPLEMENTS MARKET ANALYSIS BY FORM JAPAN DIETARY SUPPLEMENTS MARKET ANALYSIS BY INGREDIENTS JAPAN DIETARY SUPPLEMENTS MARKET ANALYSIS BY DISTRIBUTION CHANNEL

-

JAPAN DIETARY SUPPLEMENTS MARKET ANALYSIS BY REGIONAL SOUTH KOREA DIETARY SUPPLEMENTS MARKET ANALYSIS BY FORM SOUTH KOREA DIETARY SUPPLEMENTS MARKET ANALYSIS BY INGREDIENTS

-

MALAYSIA DIETARY SUPPLEMENTS MARKET ANALYSIS BY INGREDIENTS MALAYSIA DIETARY SUPPLEMENTS MARKET ANALYSIS BY DISTRIBUTION CHANNEL

-

MALAYSIA DIETARY SUPPLEMENTS MARKET ANALYSIS BY REGIONAL THAILAND DIETARY SUPPLEMENTS MARKET ANALYSIS BY FORM THAILAND DIETARY SUPPLEMENTS MARKET ANALYSIS BY INGREDIENTS THAILAND DIETARY SUPPLEMENTS MARKET ANALYSIS BY DISTRIBUTION CHANNEL

-

THAILAND DIETARY SUPPLEMENTS MARKET ANALYSIS BY REGIONAL INDONESIA DIETARY SUPPLEMENTS MARKET ANALYSIS BY FORM INDONESIA DIETARY SUPPLEMENTS MARKET ANALYSIS BY INGREDIENTS INDONESIA DIETARY SUPPLEMENTS MARKET ANALYSIS BY DISTRIBUTION CHANNEL

-

REST OF APAC DIETARY SUPPLEMENTS MARKET ANALYSIS BY INGREDIENTS

-

BRAZIL DIETARY SUPPLEMENTS MARKET ANALYSIS BY FORM BRAZIL DIETARY SUPPLEMENTS MARKET ANALYSIS BY INGREDIENTS BRAZIL DIETARY SUPPLEMENTS MARKET ANALYSIS BY DISTRIBUTION CHANNEL

-

BRAZIL DIETARY SUPPLEMENTS MARKET ANALYSIS BY REGIONAL MEXICO DIETARY SUPPLEMENTS MARKET ANALYSIS BY FORM MEXICO DIETARY SUPPLEMENTS MARKET ANALYSIS BY INGREDIENTS MEXICO DIETARY SUPPLEMENTS MARKET ANALYSIS BY DISTRIBUTION CHANNEL

-

MEXICO DIETARY SUPPLEMENTS MARKET ANALYSIS BY REGIONAL ARGENTINA DIETARY SUPPLEMENTS MARKET ANALYSIS BY FORM ARGENTINA DIETARY SUPPLEMENTS MARKET ANALYSIS BY INGREDIENTS ARGENTINA DIETARY SUPPLEMENTS MARKET ANALYSIS BY DISTRIBUTION CHANNEL

-

ANALYSIS BY END USER MARKET ANALYSIS BY REGIONAL MARKET ANALYSIS ANALYSIS BY FORM ANALYSIS BY INGREDIENTS ANALYSIS BY DISTRIBUTION CHANNEL SUPPLEMENTS MARKET ANALYSIS BY END USER SUPPLEMENTS MARKET ANALYSIS BY REGIONAL SUPPLEMENTS MARKET ANALYSIS BY FORM SUPPLEMENTS MARKET ANALYSIS BY INGREDIENTS SOUTH AFRICA DIETARY SUPPLEMENTS MARKET ANALYSIS BY DISTRIBUTION CHANNEL

-

REST OF MEA DIETARY SUPPLEMENTS MARKET ANALYSIS BY INGREDIENTS

-

RESEARCH PROCESS OF MRFR DIETARY SUPPLEMENTS MARKET ANALYSIS: DIETARY SUPPLEMENTS MARKET ANALYSIS: DIETARY SUPPLEMENTS MARKET CHAIN: DIETARY SUPPLEMENTS MARKET MARKET, BY FORM, 2025 (% SHARE) MARKET, BY FORM, 2019 TO 2035 (USD Billions) DIETARY SUPPLEMENTS MARKET, BY INGREDIENTS, 2025 (% SHARE) DIETARY SUPPLEMENTS MARKET, BY INGREDIENTS, 2019 TO 2035 (USD Billions)

-

2019 TO 2035 (USD Billions)

-

MARKET, BY REGIONAL, 2025 (% SHARE) MARKET, BY REGIONAL, 2019 TO 2035 (USD Billions) BENCHMARKING OF MAJOR COMPETITORS

Dietary Supplements Market Segmentation

Dietary Supplements Market By Form (USD Billion, 2019-2035)

- Tablets

- Capsules

- Powders

- Liquids

- Soft gels

Dietary Supplements Market By Ingredients (USD Billion, 2019-2035)

- Vitamins

- Minerals

- Herbs

- Amino Acids

- Enzymes

Dietary Supplements Market By Distribution Channel (USD Billion, 2019-2035)

- Online

- Supermarkets

- Health Food Stores

- Pharmacies

- Direct Sales

Dietary Supplements Market By End User (USD Billion, 2019-2035)

- Adults

- Children

- Pregnant Women

- Elderly

Dietary Supplements Market By Regional (USD Billion, 2019-2035)

- North America

- Europe

- South America

- Asia Pacific

- Middle East and Africa

Dietary Supplements Market Regional Outlook (USD Billion, 2019-2035)

North America Outlook (USD Billion, 2019-2035)

North America Dietary Supplements Market by Form Type

- Tablets

- Capsules

- Powders

- Liquids

- Soft gels

North America Dietary Supplements Market by Ingredients Type

- Vitamins

- Minerals

- Herbs

- Amino Acids

- Enzymes

North America Dietary Supplements Market by Distribution Channel Type

- Online

- Supermarkets

- Health Food Stores

- Pharmacies

- Direct Sales

North America Dietary Supplements Market by End User Type

- Adults

- Children

- Pregnant Women

- Elderly

North America Dietary Supplements Market by Regional Type

- US

- Canada

- US Outlook (USD Billion, 2019-2035)

US Dietary Supplements Market by Form Type

- Tablets

- Capsules

- Powders

- Liquids

- Soft gels

US Dietary Supplements Market by Ingredients Type

- Vitamins

- Minerals

- Herbs

- Amino Acids

- Enzymes

US Dietary Supplements Market by Distribution Channel Type

- Online

- Supermarkets

- Health Food Stores

- Pharmacies

- Direct Sales

US Dietary Supplements Market by End User Type

- Adults

- Children

- Pregnant Women

- Elderly

- CANADA Outlook (USD Billion, 2019-2035)

CANADA Dietary Supplements Market by Form Type

- Tablets

- Capsules

- Powders

- Liquids

- Soft gels

CANADA Dietary Supplements Market by Ingredients Type

- Vitamins

- Minerals

- Herbs

- Amino Acids

- Enzymes

CANADA Dietary Supplements Market by Distribution Channel Type

- Online

- Supermarkets

- Health Food Stores

- Pharmacies

- Direct Sales

CANADA Dietary Supplements Market by End User Type

- Adults

- Children

- Pregnant Women

- Elderly

Europe Outlook (USD Billion, 2019-2035)

Europe Dietary Supplements Market by Form Type

- Tablets

- Capsules

- Powders

- Liquids

- Soft gels

Europe Dietary Supplements Market by Ingredients Type

- Vitamins

- Minerals

- Herbs

- Amino Acids

- Enzymes

Europe Dietary Supplements Market by Distribution Channel Type

- Online

- Supermarkets

- Health Food Stores

- Pharmacies

- Direct Sales

Europe Dietary Supplements Market by End User Type

- Adults

- Children

- Pregnant Women

- Elderly

Europe Dietary Supplements Market by Regional Type

- Germany

- UK

- France

- Russia

- Italy

- Spain

- Rest of Europe

- GERMANY Outlook (USD Billion, 2019-2035)

GERMANY Dietary Supplements Market by Form Type

- Tablets

- Capsules

- Powders

- Liquids

- Soft gels

GERMANY Dietary Supplements Market by Ingredients Type

- Vitamins

- Minerals

- Herbs

- Amino Acids

- Enzymes

GERMANY Dietary Supplements Market by Distribution Channel Type

- Online

- Supermarkets

- Health Food Stores

- Pharmacies

- Direct Sales

GERMANY Dietary Supplements Market by End User Type

- Adults

- Children

- Pregnant Women

- Elderly

- UK Outlook (USD Billion, 2019-2035)

UK Dietary Supplements Market by Form Type

- Tablets

- Capsules

- Powders

- Liquids

- Soft gels

UK Dietary Supplements Market by Ingredients Type

- Vitamins

- Minerals

- Herbs

- Amino Acids

- Enzymes

UK Dietary Supplements Market by Distribution Channel Type

- Online

- Supermarkets

- Health Food Stores

- Pharmacies

- Direct Sales

UK Dietary Supplements Market by End User Type

- Adults

- Children

- Pregnant Women

- Elderly

- FRANCE Outlook (USD Billion, 2019-2035)

FRANCE Dietary Supplements Market by Form Type

- Tablets

- Capsules

- Powders

- Liquids

- Soft gels

FRANCE Dietary Supplements Market by Ingredients Type

- Vitamins

- Minerals

- Herbs

- Amino Acids

- Enzymes

FRANCE Dietary Supplements Market by Distribution Channel Type

- Online

- Supermarkets

- Health Food Stores

- Pharmacies

- Direct Sales

FRANCE Dietary Supplements Market by End User Type

- Adults

- Children

- Pregnant Women

- Elderly

- RUSSIA Outlook (USD Billion, 2019-2035)

RUSSIA Dietary Supplements Market by Form Type

- Tablets

- Capsules

- Powders

- Liquids

- Soft gels

RUSSIA Dietary Supplements Market by Ingredients Type

- Vitamins

- Minerals

- Herbs

- Amino Acids

- Enzymes

RUSSIA Dietary Supplements Market by Distribution Channel Type

- Online

- Supermarkets

- Health Food Stores

- Pharmacies

- Direct Sales

RUSSIA Dietary Supplements Market by End User Type

- Adults

- Children

- Pregnant Women

- Elderly

- ITALY Outlook (USD Billion, 2019-2035)

ITALY Dietary Supplements Market by Form Type

- Tablets

- Capsules

- Powders

- Liquids

- Soft gels

ITALY Dietary Supplements Market by Ingredients Type

- Vitamins

- Minerals

- Herbs

- Amino Acids

- Enzymes

ITALY Dietary Supplements Market by Distribution Channel Type

- Online

- Supermarkets

- Health Food Stores

- Pharmacies

- Direct Sales

ITALY Dietary Supplements Market by End User Type

- Adults

- Children

- Pregnant Women

- Elderly

- SPAIN Outlook (USD Billion, 2019-2035)

SPAIN Dietary Supplements Market by Form Type

- Tablets

- Capsules

- Powders

- Liquids

- Soft gels

SPAIN Dietary Supplements Market by Ingredients Type

- Vitamins

- Minerals

- Herbs

- Amino Acids

- Enzymes

SPAIN Dietary Supplements Market by Distribution Channel Type

- Online

- Supermarkets

- Health Food Stores

- Pharmacies

- Direct Sales

SPAIN Dietary Supplements Market by End User Type

- Adults

- Children

- Pregnant Women

- Elderly

- REST OF EUROPE Outlook (USD Billion, 2019-2035)

REST OF EUROPE Dietary Supplements Market by Form Type

- Tablets

- Capsules

- Powders

- Liquids

- Soft gels

REST OF EUROPE Dietary Supplements Market by Ingredients Type

- Vitamins

- Minerals

- Herbs

- Amino Acids

- Enzymes

REST OF EUROPE Dietary Supplements Market by Distribution Channel Type

- Online

- Supermarkets

- Health Food Stores

- Pharmacies

- Direct Sales

REST OF EUROPE Dietary Supplements Market by End User Type

- Adults

- Children

- Pregnant Women

- Elderly

APAC Outlook (USD Billion, 2019-2035)

APAC Dietary Supplements Market by Form Type

- Tablets

- Capsules

- Powders

- Liquids

- Soft gels

APAC Dietary Supplements Market by Ingredients Type

- Vitamins

- Minerals

- Herbs

- Amino Acids

- Enzymes

APAC Dietary Supplements Market by Distribution Channel Type

- Online

- Supermarkets

- Health Food Stores

- Pharmacies

- Direct Sales

APAC Dietary Supplements Market by End User Type

- Adults

- Children

- Pregnant Women

- Elderly

APAC Dietary Supplements Market by Regional Type

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Indonesia

- Rest of APAC

- CHINA Outlook (USD Billion, 2019-2035)

CHINA Dietary Supplements Market by Form Type

- Tablets

- Capsules

- Powders

- Liquids

- Soft gels

CHINA Dietary Supplements Market by Ingredients Type

- Vitamins

- Minerals

- Herbs

- Amino Acids

- Enzymes

CHINA Dietary Supplements Market by Distribution Channel Type

- Online

- Supermarkets

- Health Food Stores

- Pharmacies

- Direct Sales

CHINA Dietary Supplements Market by End User Type

- Adults

- Children

- Pregnant Women

- Elderly

- INDIA Outlook (USD Billion, 2019-2035)

INDIA Dietary Supplements Market by Form Type

- Tablets

- Capsules

- Powders

- Liquids

- Soft gels

INDIA Dietary Supplements Market by Ingredients Type

- Vitamins

- Minerals

- Herbs

- Amino Acids

- Enzymes

INDIA Dietary Supplements Market by Distribution Channel Type

- Online

- Supermarkets

- Health Food Stores

- Pharmacies

- Direct Sales

INDIA Dietary Supplements Market by End User Type

- Adults

- Children

- Pregnant Women

- Elderly

- JAPAN Outlook (USD Billion, 2019-2035)

JAPAN Dietary Supplements Market by Form Type

- Tablets

- Capsules

- Powders

- Liquids

- Soft gels

JAPAN Dietary Supplements Market by Ingredients Type

- Vitamins

- Minerals

- Herbs

- Amino Acids

- Enzymes

JAPAN Dietary Supplements Market by Distribution Channel Type

- Online

- Supermarkets

- Health Food Stores

- Pharmacies

- Direct Sales

JAPAN Dietary Supplements Market by End User Type

- Adults

- Children

- Pregnant Women

- Elderly

- SOUTH KOREA Outlook (USD Billion, 2019-2035)

SOUTH KOREA Dietary Supplements Market by Form Type

- Tablets

- Capsules

- Powders

- Liquids

- Soft gels

SOUTH KOREA Dietary Supplements Market by Ingredients Type

- Vitamins

- Minerals

- Herbs

- Amino Acids

- Enzymes

SOUTH KOREA Dietary Supplements Market by Distribution Channel Type

- Online

- Supermarkets

- Health Food Stores

- Pharmacies

- Direct Sales

SOUTH KOREA Dietary Supplements Market by End User Type

- Adults

- Children

- Pregnant Women

- Elderly

- MALAYSIA Outlook (USD Billion, 2019-2035)

MALAYSIA Dietary Supplements Market by Form Type

- Tablets

- Capsules

- Powders

- Liquids

- Soft gels

MALAYSIA Dietary Supplements Market by Ingredients Type

- Vitamins

- Minerals

- Herbs

- Amino Acids

- Enzymes

MALAYSIA Dietary Supplements Market by Distribution Channel Type

- Online

- Supermarkets

- Health Food Stores

- Pharmacies

- Direct Sales

MALAYSIA Dietary Supplements Market by End User Type

- Adults

- Children

- Pregnant Women

- Elderly

- THAILAND Outlook (USD Billion, 2019-2035)

THAILAND Dietary Supplements Market by Form Type

- Tablets

- Capsules

- Powders

- Liquids

- Soft gels

THAILAND Dietary Supplements Market by Ingredients Type

- Vitamins

- Minerals

- Herbs

- Amino Acids

- Enzymes

THAILAND Dietary Supplements Market by Distribution Channel Type

- Online

- Supermarkets

- Health Food Stores

- Pharmacies

- Direct Sales

THAILAND Dietary Supplements Market by End User Type

- Adults

- Children

- Pregnant Women

- Elderly

- INDONESIA Outlook (USD Billion, 2019-2035)

INDONESIA Dietary Supplements Market by Form Type

- Tablets

- Capsules

- Powders

- Liquids

- Soft gels

INDONESIA Dietary Supplements Market by Ingredients Type

- Vitamins

- Minerals

- Herbs

- Amino Acids

- Enzymes

INDONESIA Dietary Supplements Market by Distribution Channel Type

- Online

- Supermarkets

- Health Food Stores

- Pharmacies

- Direct Sales

INDONESIA Dietary Supplements Market by End User Type

- Adults

- Children

- Pregnant Women

- Elderly

- REST OF APAC Outlook (USD Billion, 2019-2035)

REST OF APAC Dietary Supplements Market by Form Type

- Tablets

- Capsules

- Powders

- Liquids

- Soft gels

REST OF APAC Dietary Supplements Market by Ingredients Type

- Vitamins

- Minerals

- Herbs

- Amino Acids

- Enzymes

REST OF APAC Dietary Supplements Market by Distribution Channel Type

- Online

- Supermarkets

- Health Food Stores

- Pharmacies

- Direct Sales

REST OF APAC Dietary Supplements Market by End User Type

- Adults

- Children

- Pregnant Women

- Elderly

South America Outlook (USD Billion, 2019-2035)

South America Dietary Supplements Market by Form Type

- Tablets

- Capsules

- Powders

- Liquids

- Soft gels

South America Dietary Supplements Market by Ingredients Type

- Vitamins

- Minerals

- Herbs

- Amino Acids

- Enzymes

South America Dietary Supplements Market by Distribution Channel Type

- Online

- Supermarkets

- Health Food Stores

- Pharmacies

- Direct Sales

South America Dietary Supplements Market by End User Type

- Adults

- Children

- Pregnant Women

- Elderly

South America Dietary Supplements Market by Regional Type

- Brazil

- Mexico

- Argentina

- Rest of South America

- BRAZIL Outlook (USD Billion, 2019-2035)

BRAZIL Dietary Supplements Market by Form Type

- Tablets

- Capsules

- Powders

- Liquids

- Soft gels

BRAZIL Dietary Supplements Market by Ingredients Type

- Vitamins

- Minerals

- Herbs

- Amino Acids

- Enzymes

BRAZIL Dietary Supplements Market by Distribution Channel Type

- Online

- Supermarkets

- Health Food Stores

- Pharmacies

- Direct Sales

BRAZIL Dietary Supplements Market by End User Type

- Adults

- Children

- Pregnant Women

- Elderly

- MEXICO Outlook (USD Billion, 2019-2035)

MEXICO Dietary Supplements Market by Form Type

- Tablets

- Capsules

- Powders

- Liquids

- Soft gels

MEXICO Dietary Supplements Market by Ingredients Type

- Vitamins

- Minerals

- Herbs

- Amino Acids

- Enzymes

MEXICO Dietary Supplements Market by Distribution Channel Type

- Online

- Supermarkets

- Health Food Stores

- Pharmacies

- Direct Sales

MEXICO Dietary Supplements Market by End User Type

- Adults

- Children

- Pregnant Women

- Elderly

- ARGENTINA Outlook (USD Billion, 2019-2035)

ARGENTINA Dietary Supplements Market by Form Type

- Tablets

- Capsules

- Powders

- Liquids

- Soft gels

ARGENTINA Dietary Supplements Market by Ingredients Type

- Vitamins

- Minerals

- Herbs

- Amino Acids

- Enzymes

ARGENTINA Dietary Supplements Market by Distribution Channel Type

- Online

- Supermarkets

- Health Food Stores

- Pharmacies

- Direct Sales

ARGENTINA Dietary Supplements Market by End User Type

- Adults

- Children

- Pregnant Women

- Elderly

- REST OF SOUTH AMERICA Outlook (USD Billion, 2019-2035)

REST OF SOUTH AMERICA Dietary Supplements Market by Form Type

- Tablets

- Capsules

- Powders

- Liquids

- Soft gels

REST OF SOUTH AMERICA Dietary Supplements Market by Ingredients Type

- Vitamins

- Minerals

- Herbs

- Amino Acids

- Enzymes

REST OF SOUTH AMERICA Dietary Supplements Market by Distribution Channel Type

- Online

- Supermarkets

- Health Food Stores

- Pharmacies

- Direct Sales

REST OF SOUTH AMERICA Dietary Supplements Market by End User Type

- Adults

- Children

- Pregnant Women

- Elderly

MEA Outlook (USD Billion, 2019-2035)

MEA Dietary Supplements Market by Form Type

- Tablets

- Capsules

- Powders

- Liquids

- Soft gels

MEA Dietary Supplements Market by Ingredients Type

- Vitamins

- Minerals

- Herbs

- Amino Acids

- Enzymes

MEA Dietary Supplements Market by Distribution Channel Type

- Online

- Supermarkets

- Health Food Stores

- Pharmacies

- Direct Sales

MEA Dietary Supplements Market by End User Type

- Adults

- Children

- Pregnant Women

- Elderly

MEA Dietary Supplements Market by Regional Type

- GCC Countries

- South Africa

- Rest of MEA

- GCC COUNTRIES Outlook (USD Billion, 2019-2035)

GCC COUNTRIES Dietary Supplements Market by Form Type

- Tablets

- Capsules

- Powders

- Liquids

- Soft gels

GCC COUNTRIES Dietary Supplements Market by Ingredients Type

- Vitamins

- Minerals

- Herbs

- Amino Acids

- Enzymes

GCC COUNTRIES Dietary Supplements Market by Distribution Channel Type

- Online

- Supermarkets

- Health Food Stores

- Pharmacies

- Direct Sales

GCC COUNTRIES Dietary Supplements Market by End User Type

- Adults

- Children

- Pregnant Women

- Elderly

- SOUTH AFRICA Outlook (USD Billion, 2019-2035)

SOUTH AFRICA Dietary Supplements Market by Form Type

- Tablets

- Capsules

- Powders

- Liquids

- Soft gels

SOUTH AFRICA Dietary Supplements Market by Ingredients Type

- Vitamins

- Minerals

- Herbs

- Amino Acids

- Enzymes

SOUTH AFRICA Dietary Supplements Market by Distribution Channel Type

- Online

- Supermarkets

- Health Food Stores

- Pharmacies

- Direct Sales

SOUTH AFRICA Dietary Supplements Market by End User Type

- Adults

- Children

- Pregnant Women

- Elderly

- REST OF MEA Outlook (USD Billion, 2019-2035)

REST OF MEA Dietary Supplements Market by Form Type

- Tablets

- Capsules

- Powders

- Liquids

- Soft gels

REST OF MEA Dietary Supplements Market by Ingredients Type

- Vitamins

- Minerals

- Herbs

- Amino Acids

- Enzymes

REST OF MEA Dietary Supplements Market by Distribution Channel Type

- Online

- Supermarkets

- Health Food Stores

- Pharmacies

- Direct Sales

REST OF MEA Dietary Supplements Market by End User Type

- Adults

- Children

- Pregnant Women

- Elderly

Free Sample Request

Kindly complete the form below to receive a free sample of this Report

Customer Strories

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

Leave a Comment