Market Share

Introduction: Navigating the Competitive Landscape of Content Delivery Networks

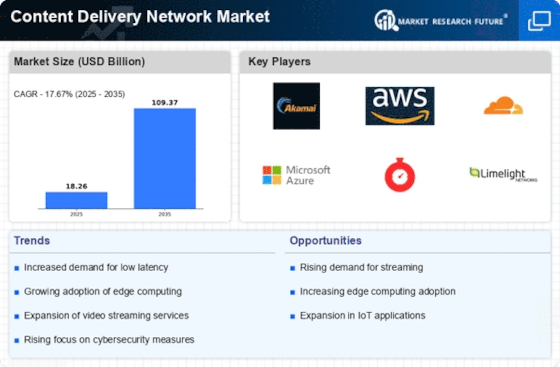

The Content Distribution Network (CDN) market is experiencing unprecedented competition, resulting from the speed of technology, regulatory changes, and consumers’ growing expectations for a seamless digital experience. The major players in this market, including hardware and software manufacturers, system integrators, and the most advanced AI startups, are all vying for leadership by introducing advanced capabilities such as artificial intelligence-based data analysis, automation, and green data center solutions. These capabilities are not only improving the quality of services, but also reshaping market positioning, as businesses are increasingly focused on efficiency and the environment. Meanwhile, new growth opportunities are emerging, particularly in the Asia-Pacific and North American regions, where strategic deployment trends are focusing on edge computing and enhanced security. As we look ahead to 2024 and 2025, a clear understanding of these trends will be crucial for C-level executives and strategic planners who wish to benefit from the evolving landscape of Content Distribution Networks.

Competitive Positioning

Full-Suite Integrators

These vendors offer comprehensive solutions that integrate various aspects of content delivery and cloud services.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Akamai Technologies | Extensive global network presence | Content delivery and security solutions | Global |

| Amazon Web Services | Scalable cloud infrastructure | Cloud services and CDN | Global |

| International Business Machines Corp. | Strong enterprise integration capabilities | Cloud and CDN services | Global |

Specialized Technology Vendors

These vendors focus on niche solutions within the CDN space, often emphasizing performance and specific use cases.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Limelight Networks | High-performance video delivery | Media and content delivery | North America, Europe |

Infrastructure & Equipment Providers

These vendors provide the underlying infrastructure and technology necessary for effective content delivery.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Verizon | Robust telecommunications backbone | CDN and network services | North America |

| AT&T Intellectual Property | Integrated network solutions | CDN and connectivity services | North America |

| Google LLC | Innovative cloud technology | Cloud and CDN services | Global |

Emerging Players & Regional Champions

- Cloudflare (US): Offers a wide range of content delivery network services, specializing in security and performance, and recently signed a contract with a major e-commerce platform to provide a global presence, and competes with Akamai with its competitive price and innovation.

- Fastly (US): a specialist in real-time content delivery and edge computing, recently implementing a solution for a major media company to improve its streaming quality, complements traditional content delivery networks with a faster, more flexible service tailored to dynamic content.

- StackPath (USA): Focuses on edge computing and security, recently partnered with a gaming company to reduce latency in online gaming, challenges established players by emphasizing low-latency solutions and integrated security features.

- CDN77 (Europe): Provides a cost-effective CDN solution with a focus on video streaming, recently expanded its services in Eastern Europe, complements larger vendors by targeting niche markets with competitive pricing.

- BunnyCDN (Europe): Offers a user-friendly CDN service with a focus on simplicity and affordability, recently gained traction among small to medium-sized businesses, challenges larger vendors by providing straightforward pricing and easy integration.

Regional Trends: By 2023, there will be a notable increase in the use of content delivery networks in emerging Asian and Eastern European countries, mainly due to the growth in demand for video streaming and gaming. The trend towards specializing in edge computing and security features will continue to meet the requirements of dynamic content delivery. In addition, the development of cost-effective solutions that can be used by SMEs to compete with the big players will continue.

Collaborations & M&A Movements

- This is the reason why Akamai and Microsoft have formed a partnership to develop cloud security solutions. Akamai is a leading content delivery network (CDN), while Microsoft is a leading cloud platform. By combining the two, they are hoping to strengthen their respective positions in the cloud services market.

- Cloudflare acquired Area 1 Security in 2023 to bolster its cybersecurity offerings, integrating advanced phishing protection into its CDN services, which is expected to significantly enhance its market share in the security-focused CDN segment.

- Amazon Web Services (AWS) and Fastly have entered into an agreement to optimize content delivery for streaming services. AWS customers will be able to take advantage of Fastly's edge cloud platform, thereby gaining a new edge in the media and entertainment industry.

Competitive Summary Table

| Capability | Leading Players | Remarks |

|---|---|---|

| Global Reach | Akamai, Cloudflare, Amazon CloudFront | With a network of more than 300,000 servers in the world, Akamai ensures low latency and high availability. Cloudflare's extensive data center network makes it easy to deliver content in different regions. Amazon Cloudfront integrates with AWS to make its content distribution network even more global. |

| Security Features | Cloudflare, Akamai, Fastly | Cloudflare is the first choice for security-conscious customers. Its DDoS protection and web application firewall are among the best in the industry. The Akamai security platform is integrated with its content delivery network, and provides real-time threat intelligence. Fastly puts its emphasis on security at the edge, for faster reaction to attacks. |

| Performance Optimization | Fastly, Akamai, StackPath | Fastly's real-time caching and instant purging capabilities allow for dynamic content delivery, enhancing performance. Akamai's intelligent routing optimizes content delivery paths, while StackPath focuses on edge computing to reduce latency. |

| Analytics and Reporting | Akamai, Cloudflare, Amazon CloudFront | The Akamai toolset gives you detailed information on traffic patterns and the behavior of your users. Cloudflare’s analytics dashboard is very friendly to use and gives you real-time data. Amazon Cloudfront is integrated with the AWS analytics toolset to give you detailed reports. |

| Integration with Other Services | Amazon CloudFront, Akamai, Microsoft Azure CDN | Amazon CloudFront is a web content delivery service. CloudFront has a good relationship with other cloud vendors, and it is very convenient for users to use Amazon services. Azure CDN is integrated with other Azure services, and it is easy for users to use. |

| Customer Support | Akamai, Cloudflare, Fastly | Akamai is known for its dedicated account management and 24/7 support, which is crucial for enterprise clients. Cloudflare offers extensive documentation and community support, while Fastly provides personalized support options for its customers. |

Conclusion: Navigating the CDN Competitive Landscape

The market for content delivery networks in 2023 is characterized by a high degree of fragmentation and fierce competition between both the incumbents and the new entrants. The regional trends indicate an increasing demand for localized content delivery solutions, which is why the suppliers have adapted their strategies accordingly. The established companies are relying on their well-developed infrastructures, while the newcomers are relying on new features such as AI, automation, and sustainable development to set themselves apart. In the future, the ability to offer flexible solutions that meet the diverse customer needs will be decisive for leadership. Suppliers must therefore put these features at the forefront, not only to optimize the service but also to meet the increased requirements for sustainability and efficiency in the digital environment.

Leave a Comment