Market Analysis

Content Delivery Network Market (Global, 2023)

Introduction

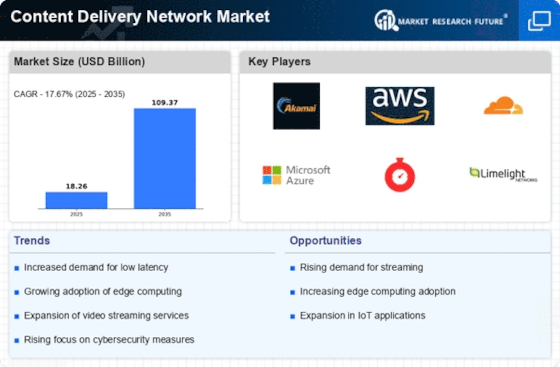

Content delivery networks (CDNs) have become an integral part of the digital landscape, with the increasing demand for fast content delivery and enhanced experiences on all platforms. In the era of digitalisation, the need for a quick and reliable distribution of data has never been greater. A CDN plays a vital role in optimising the delivery of web content, reducing latency, improving performance and ensuring reliability, all of which are essential to retaining the attention and satisfaction of users. A proliferation of mobile devices and the Internet of Things (IoT) has accelerated the adoption of CDNs, as companies strive to deliver a seamless experience to users, regardless of location or device. This report examines the trends, technological developments and competitive landscape in the content delivery market, shedding light on the factors driving the market and the strategic opportunities available for key players.

PESTLE Analysis

- Political

- The market for content delivery networks will be influenced by a number of political factors in 2023, including government regulations on data privacy and cybersecurity. The European Union's General Data Protection Regulation, for example, imposes strict rules on the processing of personal data, which will affect the content delivery networks of European companies or European clients. In 2024, the compliance costs of European companies are expected to rise to around $1.5 million per year per company, as a result of the GDPR. Meanwhile, geopolitical tensions between the United States and China are putting pressure on technology companies, which will also affect the operations and relationships of content delivery network operators in those regions.

- Economic

- In 2023 the economic situation of the C.D.N. market is influenced by varying conditions in the world economy and by the fluctuating rate of inflation. The International Monetary Fund (IMF) predicts that world inflation will remain around 3.5% in 2024, which may have an effect on the operating costs of C.D.N. suppliers. The average revenue per user (ARPU) for C.D.N. services is estimated at about ten dollars per month, indicating a highly competitive market. In the business world, companies are increasingly looking for cost-effective solutions. This is likely to lead to a demand for C.D.N. services that are offered at budget prices, which may change the market’s pricing strategies.

- Social

- Social factors play a crucial role in the Content Distribution Network market, especially the growing demand for high-quality streaming services and the consumption of online content. In 2023, it is estimated that over 70% of the Internet's traffic will be from streaming video, and the average Internet user will watch a daily average of 3.5 hours of streaming content. This trend has prompted CDNs to develop new services to meet the higher bandwidth and lower latency demands of consumers. Also, the popularity of remote work and distance learning has increased the demand for digital content distribution, which has also driven the development of content distribution networks.

- Technological

- The CDN market is driven by technological innovations such as edge computing and artificial intelligence. In 2024, it is estimated that more than 60% of CDNs will use AI to optimize content delivery and improve the user experience. Also, the use of 5G technology is expected to increase the speed of data transmission by up to 100 times compared to 4G, and the demand for CDNs will increase accordingly. The CDN industry has been investing heavily in the construction of the platform, and the cost per node is expected to exceed $500,000 in 2024.

- Legal

- Legal factors affecting the content delivery network market include the need to comply with various international laws and regulations on data privacy and intellectual property. In 2022, the United States passed the Digital Service Act, which imposes stricter regulations on Internet platforms, including content delivery networks, in order to protect the safety and privacy of Internet users. It can fine companies up to 10 million dollars for non-compliance. Content delivery networks are also under increasing legal pressure from copyright infringement cases. In order to avoid legal problems and protect the intellectual property rights of their customers, content delivery networks have to adopt strict content management measures.

- Environmental

- Considering the environment is becoming increasingly important in the CDN market, especially in the context of companies striving to reduce their carbon footprint. In 2023, it was reported that data centers, which are a key part of the CDN business, accounted for about 2% of global greenhouse gas emissions. Many CDN companies are now investing in renewable energy, with more than a third pledging to go completely green by 2025. Not only does this help reduce the impact on the environment, it also reflects the growing consumer demand for sustainable practices, and this influences buying decisions in the CDN market.

Porter's Five Forces

- Threat of New Entrants

- The content delivery network (CDN) market has a medium barrier to entry, because of the significant capital expenditure required to build up the necessary infrastructure and technology. Besides, the incumbents have economies of scale, brand awareness, and customer relationships, which act as a deterrent to new entrants.

- Bargaining Power of Suppliers

- The bargaining power of the suppliers in the CNY market is relatively low. The market is characterized by a large number of technology suppliers and a variety of network configurations, which makes it easy for CNY companies to change suppliers. Moreover, the increasingly popular cloud services and open-source applications have further reduced the power of suppliers.

- Bargaining Power of Buyers

- The buyer has considerable bargaining power in the CDN market, as a result of the large number of suppliers and the competition between them. Customers are able to easily compare services and switch suppliers, which forces the CDNs to offer lower prices, more features and better service in order to retain customers.

- Threat of Substitutes

- The threat of substitution in the market for CGNs is moderate. The alternatives are mainly the traditional hosting and the P2P distribution of content, but these solutions often lack the performance and reliability of CGNs. However, the development of technology can lead to new substitutes that can affect the market.

- Competitive Rivalry

- Competition in the CDN market is very intense, and there are many players. The competition is very high. The big players are constantly innovating and expanding their services, which leads to price wars and aggressive marketing strategies. The growing consumption of digital content is also driving the competition between CDNs.

SWOT Analysis

Strengths

- High demand for fast and reliable content delivery due to increasing internet usage.

- Ability to enhance user experience through reduced latency and improved load times.

- Strong partnerships with major cloud service providers and tech companies.

Weaknesses

- High operational costs associated with infrastructure maintenance.

- Dependence on third-party networks can lead to service disruptions.

- Limited market penetration in developing regions.

Opportunities

- Growing adoption of streaming services and online gaming.

- Expansion into emerging markets with increasing internet access.

- Integration of advanced technologies like AI and machine learning for optimization.

Threats

- Intense competition from established players and new entrants.

- Cybersecurity threats and data privacy concerns impacting customer trust.

- Regulatory challenges and compliance issues in different regions.

Summary

Content delivery network market in 2023 is characterized by strong demand for content delivery, owing to the need for quick and reliable content delivery, which is supported by strategic alliances. High operating costs and the reliance on third-party networks are the challenges. Opportunities are found in the gaming and streaming industries, especially in emerging economies. Competition is fierce and the market has to overcome regulatory barriers and cyber threats.

Leave a Comment