Market Trends

Introduction

Into 2024, the aftermarket for cars is in the process of a major transformation, driven by a confluence of macroeconomic factors. Technological developments, particularly in electric and driverless cars, are reshaping customer expectations and the service requirements. Regulations, aimed at reducing emissions and the impact on the environment, are forcing manufacturers and the service industry to change. Also, the changing buying behaviour of customers, with the increasing importance of e-commerce and of enhanced service experiences, is redefining the market. Those who wish to understand the trends and to seize the opportunities must be aware of these trends.

Top Trends

-

Electrification of Aftermarket Services

ELECTRIC CARS AND THEIR AFTERMARKETS. As electric cars become more popular, the aftermarket industry is adapting to meet the needs of EV owners. Training programmes are being introduced for technicians, as around 70 per cent of service centres need to be upskilled in EV repair. Governments are encouraging the purchase of EVs, which is expected to increase the number of EVs on the road. This shift to EVs is driving the need for new parts and services, which will impact on aftermarket inventory management and service offerings. -

Integration of Advanced Driver-Assistance Systems (ADAS)

A new trend is forming: forty percent of new cars are now fitted with a level of assistance. The industry is focusing on the calibration and repair of these systems, because a lack of calibration can have safety consequences. Regulators are making it compulsory to repair the level of assistance, which is why the aftermarket is investing in special tools and training. This trend is expected to drive innovation in services and customer relations. -

Sustainability and Eco-Friendly Products

The automobile after-market is increasingly focusing on sustainability, with more than 60% of consumers preferring green products. Companies are responding by developing biodegradable and recyclate-friendly products, as well as by promoting remanufactured components. The trend is being accelerated by the government, which is increasingly demanding that the industry embraces a greener approach. Brand loyalty is set to be boosted as new market segments are created around the concept of being ‘green’. -

Digital Transformation and E-commerce Growth

The shift towards digital platforms is gaining momentum, with the aftermarket sector expected to grow considerably. Companies are investing in e-commerce, with around half of consumers now preferring to buy spare parts for their cars over the Internet. This is mainly due to the greater convenience and the increasing availability of spare parts via mobile applications. Artificial intelligence-based recommendations and virtual reality may help to further enhance the customer experience. -

Data-Driven Decision Making

Data analysis is transforming the way the aftermarket industry operates, with over 65 percent of aftermarket businesses using it to improve their inventory management. This trend is leading to better forecasting and more targeted marketing strategies. Leading companies are already using telematics data to understand consumer behavior and vehicle performance. Data collection will become more sophisticated, leading to more targeted services and improved operational efficiency. -

Increased Focus on Vehicle Customization

The desire for individualization is growing, with 55 percent of car owners interested in aftermarket modifications. This is causing companies to broaden their product lines with more accessories and parts that can be modified. Social media and influencer marketing are playing a significant role in promoting this trend. And the future may bring more collaborations with technology companies to offer smart personalization and enhance customer engagement. -

Expansion of Mobility Services

The mobility services are growing, e.g. ride-hailing, car sharing, car subscriptions. This has an effect on the aftermarket. Companies are adapting their service concepts to the new mobility trends. The new mobility models are also putting pressure on the traditional service concepts and the inventory strategies. Future developments could include tailor-made packages in cooperation with mobility service providers. -

Enhanced Supply Chain Resilience

Recent supply disruptions have highlighted the need for a robust supply chain in the aftermarket. The industry has reacted by investing in local sourcing and diversifying its supplier network. Around 45 per cent of the companies have changed their supply chain management. This trend is driven by the need to be agile and respond quickly to changes in the market. The future may well see an increased level of collaboration between companies to ensure stability and efficiency in the supply chain. -

Growth of Autonomous Vehicle Technologies

The new technology of the driverless vehicle is reshaping the aftermarket, and a quarter of industry leaders are investing in related services. These vehicles are more likely to be used in the future, and there will be a need for specialized maintenance and repair services. Regulations have also changed to accommodate the driverless technology. This has affected the service standards. This trend will eventually lead to the emergence of new business models centered on the aftermarket of driverless vehicles. -

Rise of Subscription-Based Services

Subscription services are gaining in popularity in the after-market, with around 20 per cent of consumers expressing an interest in such a service. Companies are already offering subscriptions for maintenance packages and spare-parts delivery. This trend is being driven by the desire for convenience and predictability of costs. Subscription services will develop further, with different packages tailored to different needs, which should enhance customer retention.

Conclusion: Navigating the Automotive Aftermarket Landscape

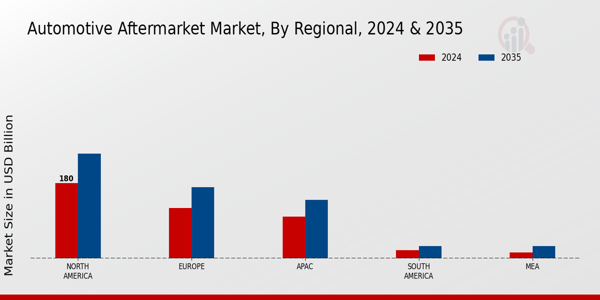

The after-market for automobiles in 2024 is characterized by a highly competitive and fragmented field, where both the established and the new players compete. Regional developments point towards a shift towards sustainability and digital transformation, which requires the players to adapt their strategies accordingly. The established players are able to use their brand and distribution networks, whereas the new players focus on the development of new technology, such as artificial intelligence and automation, to improve customer experience and operational efficiency. It is important to be able to combine the integration of sustainable practices with the flexibility of the supply chain to lead in this new landscape. The ability to prioritize investments in advanced capabilities will be essential for market share and long-term success.

Leave a Comment