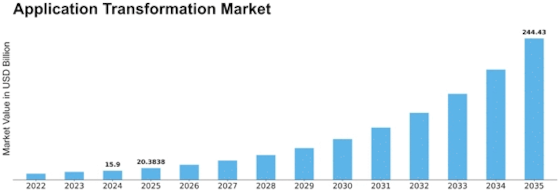

Application Transformation Size

Application Transformation Market Growth Projections and Opportunities

A complex interaction of elements shapes the Application Transformation market, reflecting changing technology, corporate objectives, and the desire for digital innovation. Application Transformation uses cloud computing, microservices, and containerization to modernize and optimize software programs for the digital age. Several forces make this market dynamic, affecting corporate strategies and goals across sectors. The requirement for agility and flexibility in software development drives Application Transformation market dynamics. Application development is being rethought as companies respond quickly to changing market circumstances, consumer expectations, and competitive challenges. Application Transformation helps enterprises adopt agile approaches and accelerate software delivery by breaking down monolithic programs into modular, scalable components. Finance, healthcare, and retail, which are experiencing fast digital transformation, need agility to adapt quickly to market developments. Cloud computing's widespread use also affects Application Transformation market dynamics. Cloud technologies enable scalable and cost-effective hosting and deployment of contemporary applications. For its accessibility, scalability, and lower infrastructure costs, organizations are moving their applications to the cloud. Application Transformation optimises applications for the cloud, ensures interoperability with cloud services, and integrates on-premises and cloud components. Demand for better user experiences and increased digital-savvy customer expectations drive Application Transformation market dynamics. Businesses must develop intuitive, responsive, and feature-rich apps to compete online. Application Transformation improves user experience by redesigning and optimizing user interfaces, adding sophisticated functionality, and using new frameworks. User involvement strongly affects company performance in e-commerce, therefore this need is high. Rapid technical innovation, notably in microservices architecture and containerization, affects Application Transformation market dynamics. Applications may be divided into microservices that can be created, deployed, and scaled separately. Containerization tools like Docker standardize and port programs, making them easy to deploy across computer environments. Application Transformation uses these breakthroughs to construct modular, scalable, and manageable software architectures, allowing enterprises to use new technology. Application Transformation market dynamics depend on competition and digital distinction. Businesses want to stand out with new digital solutions, and Application Transformation helps. Strategic advantage comes from modernizing existing programs, adopting new technologies, and releasing new features quicker than rivals. To compete in the digital age and fulfill consumer expectations, companies are investing in Application Transformation. Application Transformation market trends depend on security, particularly as enterprises modernize and shift to cloud environments. New architectures and technologies provide new security concerns that must be handled to secure sensitive data and comply with regulations. To reduce risks and construct durable, secure systems, Application Transformation projects use encryption, identity and access management, and threat detection. Modernizing apps without sacrificing security drives Application Transformation solution adoption. In strict compliance areas like healthcare and finance, the changing regulatory environment affects Application Transformation market dynamics. Modernized apps must comply with industry and data protection rules. Application Transformation involves data encryption, audit trails, and secure access controls for compliance. Application Transformation efforts need enterprises to traverse difficult regulatory frameworks and comply. Globalization and scaleability in a dispersed context affect Application Transformation market dynamics. Scaling apps smoothly is essential for multinational organizations serving varied markets. Application Transformation assures that software designs can handle varied workloads, geographies, and audiences. Scalability is crucial in fluctuating-demand businesses like online shopping and streaming. Application Transformation market dynamics depend on interoperability with old systems and applications. Legacy applications and contemporary systems must operate together in organizations. Integration with infrastructure, data sources, and third-party systems is essential for application transformation solutions. Interoperability lets companies modernize and optimize their application portfolios while preserving their investments.

Leave a Comment