房地产贷款市场 摘要

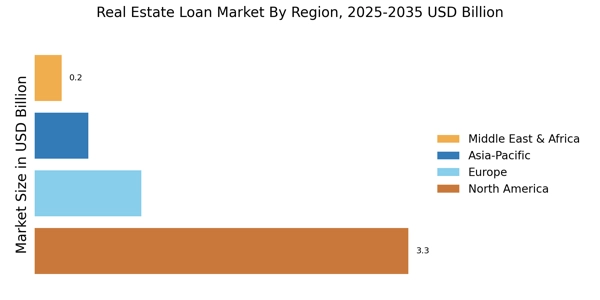

根据MRFR分析,房地产贷款市场规模在2024年估计为47.59亿美元。房地产贷款行业预计将从2025年的49.42亿美元增长到2035年的72.05亿美元,预计在2025年至2035年的预测期内,年均增长率(CAGR)为3.84。

主要市场趋势和亮点

房地产贷款市场正朝着更灵活和可持续的融资选项转变。

- "灵活贷款选项的需求正在增加,特别是在北美,借款人寻求量身定制的解决方案。

- 可持续融资正在获得关注,反映出亚太地区对环保投资的更广泛趋势。

- 贷款处理中的技术整合正在提高效率,尤其是在固定利率贷款领域,该领域仍然是最大的。

- 不断上涨的房产价值和低利率正在推动住宅物业领域的增长,而城市化趋势则支持商业物业的扩展。"

市场规模与预测

| 2024 Market Size | 4.759(美元十亿) |

| 2035 Market Size | 72.05(十亿美元) |

| CAGR (2025 - 2035) | 3.84% |

主要参与者

富国银行(美国)、摩根大通(美国)、美国银行(美国)、Quicken Loans(美国)、美国银行(美国)、PNC金融服务(美国)、花旗集团(美国)、LoanDepot(美国)、Caliber Home Loans(美国)