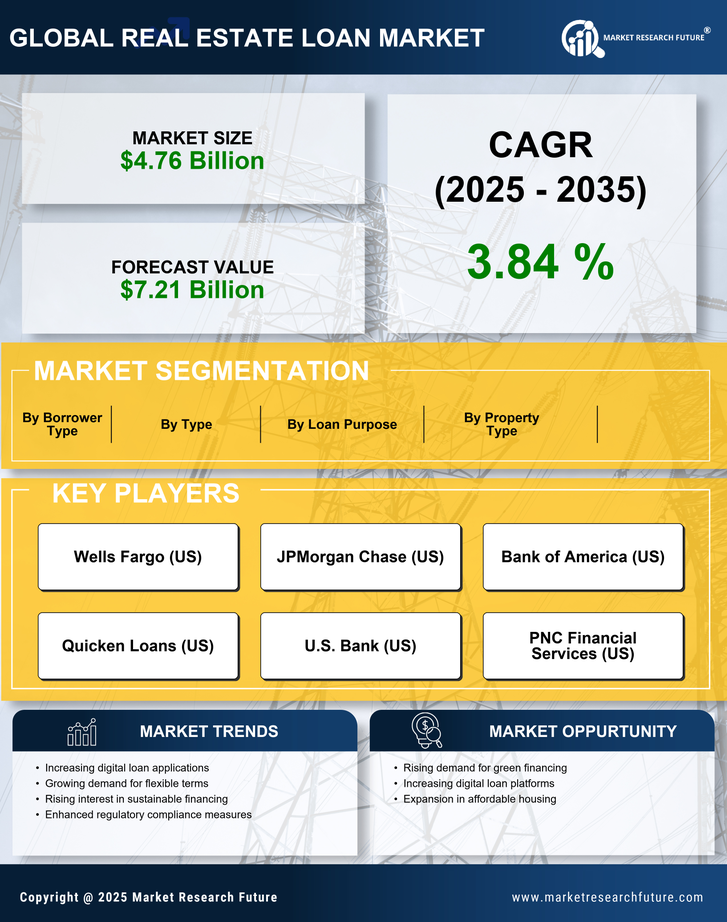

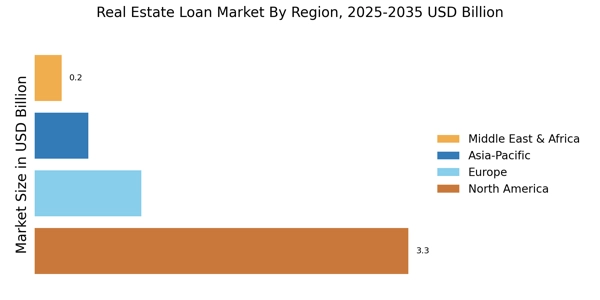

North America : Market Leader in Real Estate Loans

North America remains the largest market for real estate loans, driven by a robust economy, low-interest rates, and increasing consumer confidence. The U.S. holds approximately 70% of the market share, with Canada following at around 15%. Regulatory support, such as favorable lending policies and government-backed mortgage programs, further fuels demand. The region's growth is also supported by a rising trend in homeownership and real estate investments. The competitive landscape is dominated by major players like Wells Fargo, JPMorgan Chase, and Bank of America, which collectively account for a significant portion of the market. These institutions offer a variety of loan products tailored to meet diverse consumer needs. The presence of innovative fintech companies, such as Quicken Loans and LoanDepot, is reshaping the market by providing streamlined digital solutions, enhancing customer experience, and increasing accessibility to real estate financing.

Europe : Emerging Market with Growth Potential

Europe's real estate loan market is witnessing a resurgence, driven by economic recovery and increasing property values. The region's market share is approximately 20%, with Germany and the UK being the largest contributors, holding around 30% and 25% of the market, respectively. Regulatory frameworks, such as the EU Mortgage Credit Directive, are enhancing consumer protection and promoting responsible lending practices, which are crucial for market stability and growth. Leading countries like Germany, France, and the UK are characterized by a competitive landscape with both traditional banks and emerging fintech firms. Major players include Deutsche Bank and Barclays, which are adapting to changing consumer preferences by offering innovative loan products. The presence of digital platforms is also increasing, providing consumers with more options and improving the overall efficiency of the lending process.

Asia-Pacific : Rapid Growth in Real Estate Loans

The Asia-Pacific region is rapidly emerging as a significant player in the real estate loan market, driven by urbanization, rising incomes, and a growing middle class. The market share is estimated at around 10%, with China and India leading the charge, holding approximately 40% and 25% of the market, respectively. Regulatory initiatives aimed at improving transparency and consumer protection are fostering a more stable lending environment, encouraging investment in real estate. Countries like China, India, and Australia are witnessing intense competition among both traditional banks and new fintech entrants. Key players such as ICICI Bank and Commonwealth Bank are innovating their offerings to cater to the evolving needs of consumers. The increasing adoption of digital platforms is enhancing accessibility and efficiency in the loan application process, making it easier for consumers to secure financing for real estate purchases.

Middle East and Africa : Emerging Market with Unique Challenges

The Middle East and Africa region presents a unique landscape for real estate loans, characterized by diverse economic conditions and regulatory environments. The market share is approximately 5%, with South Africa and the UAE being the largest markets, holding around 30% and 25% respectively. Economic diversification efforts and regulatory reforms are driving growth, although challenges such as political instability and currency fluctuations remain significant hurdles for investors and lenders alike. Leading countries like South Africa, Nigeria, and the UAE are experiencing a mix of traditional banking and innovative fintech solutions. Major players include Standard Bank and First National Bank, which are adapting to local market needs. The presence of digital lending platforms is gradually increasing, providing consumers with more options and improving access to real estate financing, despite the region's unique challenges.