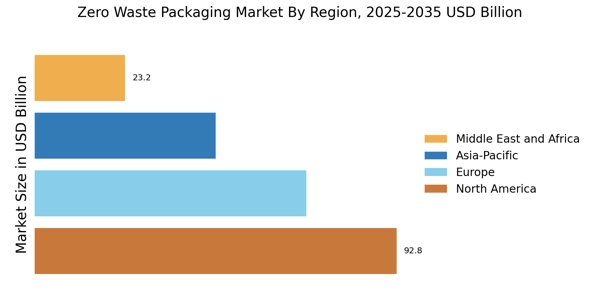

North America : Sustainability Leader

North America is witnessing a significant shift towards zero waste packaging, driven by increasing consumer awareness and stringent regulations aimed at reducing plastic waste. The region holds the largest Zero Waste Packaging Market share at approximately 40%, with the United States being the primary contributor. Regulatory initiatives, such as the U.S. Environmental Protection Agency's focus on sustainable materials, are catalyzing this growth, pushing companies to innovate in packaging solutions.

The competitive landscape is dominated by major players like Procter & Gamble, Coca-Cola, and PepsiCo, who are investing heavily in sustainable practices. The U.S. market is characterized by a robust demand for eco-friendly packaging solutions, with companies increasingly adopting circular economy principles. Canada is also emerging as a significant player, contributing to the region's overall Zero Waste Packaging Market growth with its own set of regulations promoting sustainability.

Europe : Regulatory Pioneer

Europe is at the forefront of the zero waste packaging market, driven by stringent regulations and a strong consumer preference for sustainable products. The region holds the second-largest Zero Waste Packaging Market share at around 30%. The European Union's Circular Economy Action Plan is a key regulatory catalyst, promoting the use of recyclable and reusable packaging materials, which is significantly influencing Zero Waste Packaging Market dynamics and consumer behavior.

Leading countries such as Germany, France, and the Netherlands are spearheading innovations in sustainable packaging. Companies like Unilever and Danone are actively participating in initiatives to reduce waste and enhance recyclability. The competitive landscape is robust, with numerous startups emerging alongside established players, all focused on developing innovative solutions that align with the region's sustainability goals.

Asia-Pacific : Emerging Market Potential

The Asia-Pacific region is rapidly emerging as a significant player in the zero waste packaging market, driven by increasing environmental awareness and government initiatives promoting sustainability. The Zero Waste Packaging Market share is estimated to be around 20%. Countries like China and Japan are leading the charge, implementing regulations that encourage the reduction of plastic waste and the adoption of eco-friendly packaging solutions, thus fostering a favorable environment for market growth.

China's commitment to reducing plastic waste has led to a surge in demand for sustainable packaging options. Key players such as Tetra Pak and Amcor are expanding their operations in the region, focusing on innovative packaging solutions that cater to local consumer preferences. The competitive landscape is evolving, with both multinational corporations and local startups vying for Zero Waste Packaging Market share, indicating a vibrant and dynamic market environment.

Middle East and Africa : Resource-Rich Opportunities

The Middle East and Africa region is gradually recognizing the importance of zero waste packaging, driven by increasing environmental concerns and a growing consumer base that values sustainability. The Zero Waste Packaging Market share is currently around 10%. Countries like South Africa and the UAE are taking steps to implement regulations that promote sustainable packaging practices, creating a conducive environment for Zero Waste Packaging Market growth and innovation in packaging solutions.

In South Africa, initiatives aimed at reducing plastic waste are gaining traction, with local companies beginning to adopt eco-friendly packaging alternatives. The competitive landscape is still developing, with a mix of established players and new entrants focusing on sustainable practices. As awareness grows, the region is expected to see a significant increase in demand for zero waste packaging solutions, aligning with global sustainability trends.