Rising Energy Costs

The increasing cost of energy is a primary driver for the Zero Energy Buildings Market. As energy prices continue to rise, both residential and commercial property owners are seeking ways to mitigate these expenses. Zero energy buildings, which produce as much energy as they consume, present a viable solution. According to recent data, energy costs have escalated by approximately 20% over the past five years, prompting a shift towards energy-efficient designs. This trend is likely to accelerate as energy prices remain volatile, making zero energy buildings an attractive investment. The Zero Energy Buildings Market is thus positioned to benefit from this economic pressure, as more stakeholders recognize the long-term savings associated with energy self-sufficiency.

Technological Innovations

Technological innovations are transforming the Zero Energy Buildings Market by enhancing energy efficiency and sustainability. Advancements in renewable energy technologies, such as solar panels and energy storage systems, have made it more feasible for buildings to achieve zero energy status. The integration of smart building technologies, including energy management systems, allows for real-time monitoring and optimization of energy use. Recent studies indicate that the adoption of these technologies can reduce energy consumption by up to 30%. As these innovations become more accessible and affordable, the Zero Energy Buildings Market is expected to expand, attracting a broader range of stakeholders interested in sustainable building practices.

Increased Environmental Awareness

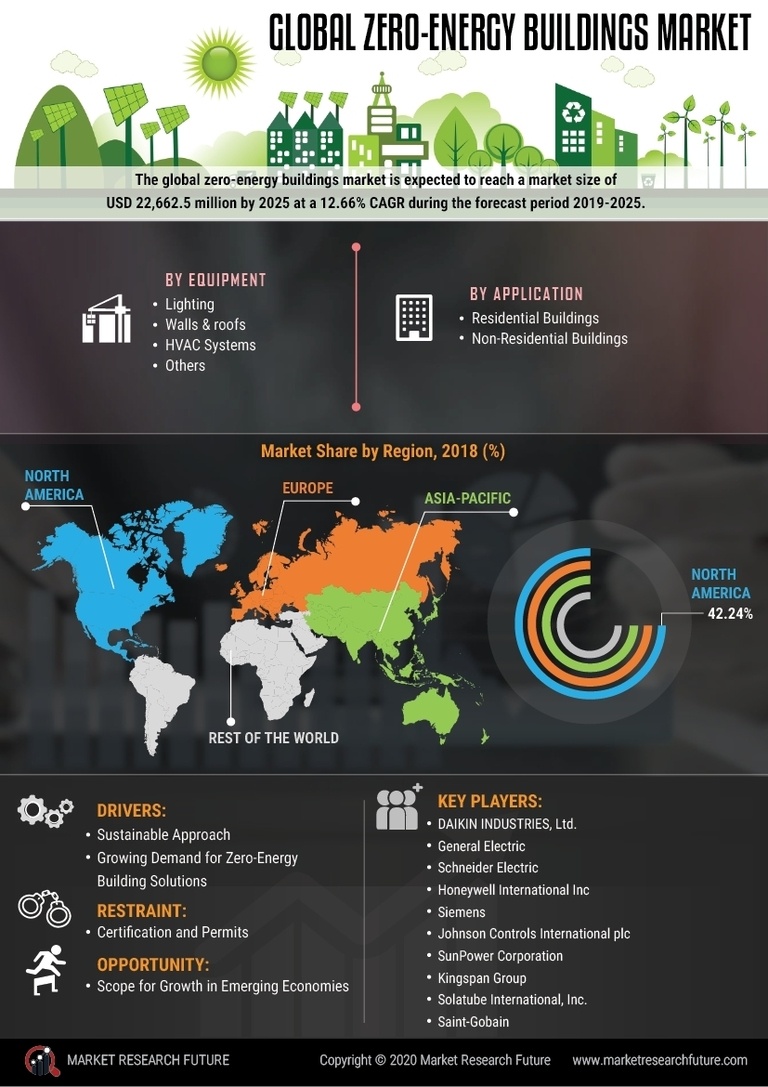

The growing awareness of environmental issues is significantly influencing the Zero Energy Buildings Market. As climate change concerns escalate, consumers and businesses alike are prioritizing sustainability in their building choices. Zero energy buildings, which minimize carbon footprints and promote renewable energy use, align with these values. Market Research Future indicates that a substantial percentage of consumers are willing to pay a premium for environmentally friendly buildings. This shift in consumer preferences is likely to drive demand for zero energy buildings, as stakeholders seek to align their investments with sustainable practices. The Zero Energy Buildings Market stands to gain from this heightened environmental consciousness, as more entities recognize the importance of reducing their ecological impact.

Government Incentives and Policies

Government incentives and policies play a crucial role in promoting the Zero Energy Buildings Market. Various governments have implemented tax credits, rebates, and grants to encourage the construction of energy-efficient buildings. For instance, certain regions have established mandates requiring new buildings to meet zero energy standards by specific deadlines. These initiatives not only stimulate market growth but also enhance public awareness of energy efficiency. The Zero Energy Buildings Market is likely to see increased participation from developers and builders who are motivated by these financial incentives. As policies evolve, the market may experience a surge in zero energy projects, further solidifying its position in the construction sector.

Urbanization and Population Growth

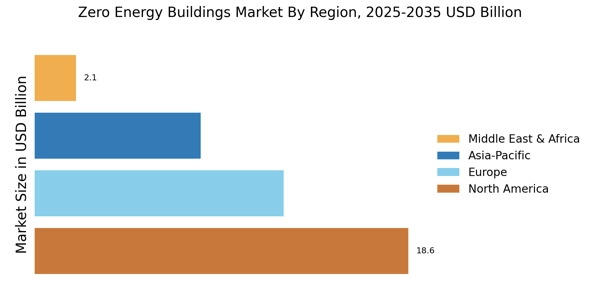

Urbanization and population growth are key factors propelling the Zero Energy Buildings Market. As urban areas expand and populations increase, the demand for housing and commercial spaces intensifies. This surge in demand necessitates innovative building solutions that can accommodate growth while minimizing environmental impact. Zero energy buildings offer a sustainable alternative, as they can be designed to meet the energy needs of densely populated areas without straining local resources. Projections suggest that urban populations will continue to rise, further driving the need for energy-efficient construction. Consequently, the Zero Energy Buildings Market is likely to experience robust growth as urban planners and developers seek to implement sustainable building practices in response to these demographic trends.