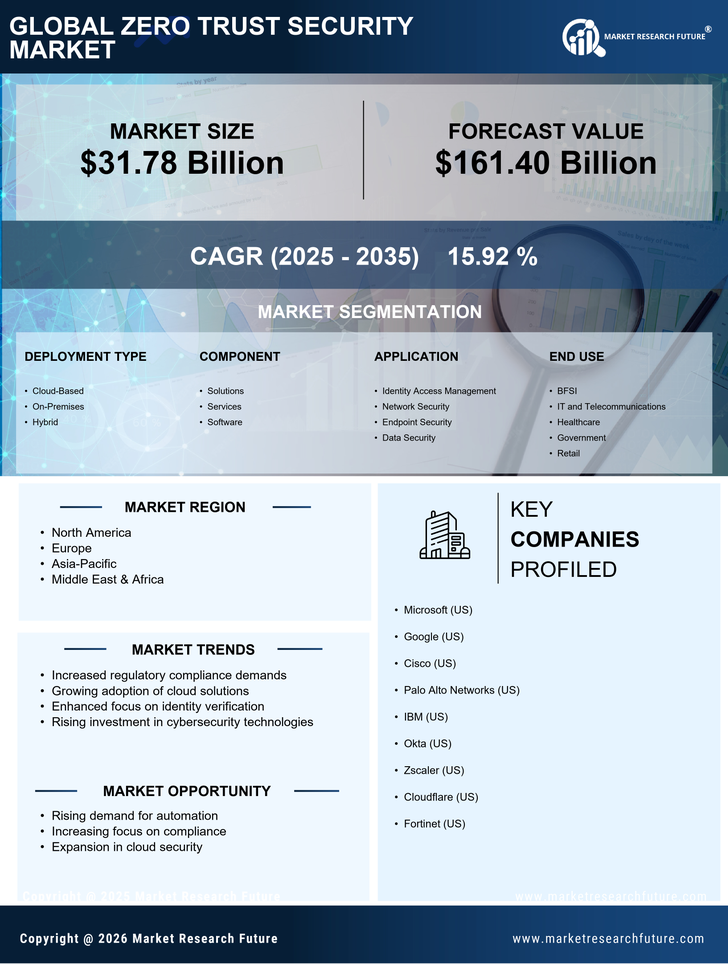

The Zero Trust Security Market is currently experiencing a notable evolution, driven by the increasing need for robust cybersecurity measures. Organizations are increasingly recognizing that traditional perimeter-based security models are insufficient in addressing modern threats. As a result, the Zero Trust framework, which operates on the principle of 'never trust, always verify,' is gaining traction. This paradigm shift emphasizes continuous authentication and strict access controls, ensuring that only authorized users can access sensitive data and systems. Furthermore, the rise of remote work and cloud computing has further accelerated the adoption of Zero Trust strategies, as organizations seek to secure their digital environments against potential breaches. In addition to the growing awareness of cybersecurity risks, regulatory compliance is becoming a significant factor influencing the Zero Trust Security Market.

Organizations are compelled to adhere to various data protection regulations, which often necessitate the implementation of Zero Trust principles. This compliance-driven approach not only enhances security but also fosters trust among customers and stakeholders. As the market continues to mature, it appears that the integration of advanced technologies, such as artificial intelligence and machine learning, will play a crucial role in enhancing Zero Trust frameworks. These technologies may provide organizations with the ability to analyze user behavior and detect anomalies, further strengthening their security posture.

Zero trust solution providers are increasingly integrating real-time behavioral analytics and microsegmentation technologies to strengthen threat detection and access governance frameworks. Software-driven zero trust security companies are focusing on expanding microsegmentation capabilities to enhance workload isolation and lateral movement prevention. Microsegmentation is becoming a critical capability among top companies offering zero trust microsegmentation solutions, particularly in protecting distributed enterprise networks. The Zero Trust Security Market is moderately fragmented, with several established zero trust security companies competing to secure market share through innovation, partnerships, and acquisitions. Microsoft Zero Trust solution capabilities are deeply integrated within its Azure ecosystem, enabling identity-based access control, continuous authentication, and conditional access enforcement.

Increased Adoption of Cloud Services

The shift towards cloud computing is prompting organizations to adopt Zero Trust Security Market principles. As businesses migrate their operations to the cloud, they face new security challenges that necessitate a more stringent approach to access control and data protection. Zero Trust frameworks are being implemented to ensure that all users, regardless of their location, are continuously authenticated and authorized.

Focus on Regulatory Compliance

Regulatory requirements are driving the adoption of Zero Trust Security Market strategies. Organizations are increasingly required to comply with data protection laws, which often mandate strict access controls and data security measures. This compliance focus is pushing businesses to implement Zero Trust principles to safeguard sensitive information and maintain regulatory adherence.

Integration of Advanced Technologies

The incorporation of advanced technologies, such as artificial intelligence and machine learning, is enhancing the effectiveness of Zero Trust Security Market frameworks. These technologies enable organizations to analyze user behavior, detect anomalies, and respond to potential threats in real-time. As a result, the Zero Trust Security Market is likely to see a rise in solutions that leverage these innovations to bolster security measures.