Corporate Sustainability Goals

The Zero Emission Truck Market is increasingly shaped by corporate sustainability goals that prioritize environmental responsibility. Many corporations are setting ambitious targets to achieve net-zero emissions by 2050, which necessitates a transition to zero-emission transportation solutions. This strategic shift is prompting companies to reevaluate their logistics and supply chain operations, leading to a heightened interest in zero-emission trucks. Recent surveys indicate that over 60% of logistics companies are planning to incorporate electric trucks into their fleets within the next five years. This commitment to sustainability not only enhances brand reputation but also aligns with evolving regulatory frameworks and consumer expectations.

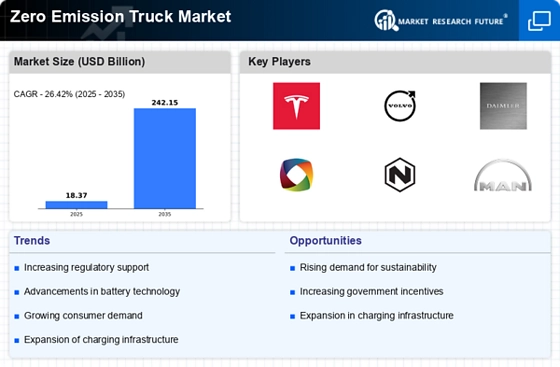

Advancements in Battery Technology

The Zero Emission Truck Market is significantly influenced by advancements in battery technology. Innovations in battery efficiency and energy density are enabling longer ranges and shorter charging times for electric trucks. Recent developments indicate that battery costs have decreased by approximately 80% over the past decade, making electric trucks more economically viable. This technological progress is likely to enhance the appeal of zero-emission trucks to fleet operators, as they can now achieve operational efficiency without compromising on performance. As battery technology continues to evolve, it is expected that the market will witness an influx of new models, further driving the adoption of zero-emission trucks.

Government Incentives and Subsidies

The Zero Emission Truck Market is bolstered by various government incentives and subsidies aimed at promoting the adoption of clean transportation technologies. Many governments are implementing financial incentives, such as tax credits and grants, to encourage businesses to invest in zero-emission trucks. For instance, recent policies in several regions have allocated billions in funding to support the transition to electric and hydrogen-powered vehicles. This financial backing not only reduces the initial investment burden for companies but also accelerates the overall growth of the zero-emission truck market. As these initiatives gain traction, they are likely to play a pivotal role in shaping the future landscape of the industry.

Increasing Demand for Sustainable Logistics

The Zero Emission Truck Market is experiencing a notable surge in demand for sustainable logistics solutions. Companies are increasingly recognizing the importance of reducing their carbon footprints and aligning with environmental goals. This shift is driven by consumer preferences for eco-friendly products and services, which has led to a growing number of businesses adopting zero-emission trucks as part of their fleets. According to recent data, the logistics sector is projected to see a 30% increase in the adoption of zero-emission vehicles by 2030. This trend not only enhances corporate social responsibility but also positions companies favorably in a competitive market that values sustainability.

Technological Integration and Smart Logistics

The Zero Emission Truck Market is witnessing a trend towards technological integration and smart logistics solutions. The rise of digital technologies, such as telematics and fleet management software, is enabling companies to optimize their operations and improve efficiency. By integrating zero-emission trucks into smart logistics systems, businesses can monitor performance, track emissions, and enhance route planning. This integration is expected to lead to a reduction in operational costs and an increase in overall productivity. As the industry embraces these technological advancements, the adoption of zero-emission trucks is likely to accelerate, further transforming the logistics landscape.

.png)