Sustainability Initiatives

Sustainability initiatives are becoming increasingly pivotal within the WLCSP Electroless Plating Market. Manufacturers are under pressure to adopt eco-friendly practices, leading to the development of less toxic and more sustainable plating solutions. The shift towards water-based and biodegradable chemicals is indicative of this trend. Additionally, regulatory frameworks are evolving, compelling companies to minimize waste and emissions associated with plating processes. This transition not only aligns with global environmental goals but also appeals to a growing consumer base that prioritizes sustainability. As a result, companies that embrace these initiatives may gain a competitive edge, potentially increasing their market share in the WLCSP Electroless Plating Market.

Rising Demand for Miniaturization

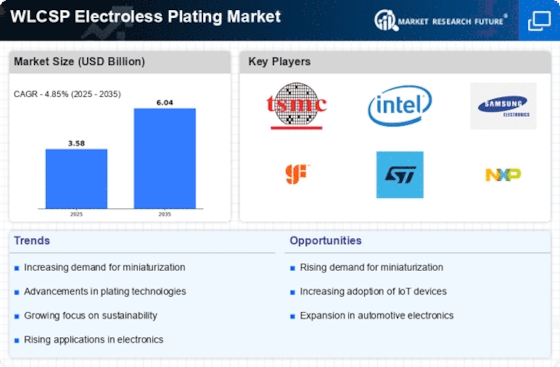

The demand for miniaturization in electronic devices is a significant driver for the WLCSP Electroless Plating Market. As consumer electronics become increasingly compact, the need for smaller and more efficient components is paramount. Electroless plating offers the ability to create fine features and intricate designs that are essential for modern applications, such as smartphones and wearables. This trend is further supported by the growing Internet of Things (IoT) sector, which requires miniaturized sensors and devices. Market analysts estimate that the miniaturization trend could contribute to a market growth of around 5% annually, as manufacturers seek innovative solutions to meet these evolving demands.

Technological Advancements in Electroless Plating

The WLCSP Electroless Plating Market is currently experiencing a surge in technological advancements that enhance the efficiency and effectiveness of plating processes. Innovations in chemical formulations and deposition techniques are leading to improved adhesion and uniformity of metal layers on semiconductor devices. For instance, the introduction of new nickel-phosphorus alloys has shown promise in enhancing the mechanical properties of plated components. Furthermore, automation in plating processes is reducing production times and costs, making it more attractive for manufacturers. As a result, the market is projected to grow at a compound annual growth rate of approximately 6% over the next five years, driven by these technological improvements.

Growing Adoption of Advanced Packaging Technologies

The growing adoption of advanced packaging technologies is a key driver for the WLCSP Electroless Plating Market. As the electronics sector evolves, there is a notable shift towards packaging solutions that enhance performance and reduce size. Techniques such as System-in-Package (SiP) and 3D packaging are gaining traction, necessitating the use of electroless plating for effective interconnects and thermal management. This trend is likely to propel the demand for electroless plating solutions, as manufacturers strive to meet the requirements of these advanced packaging methods. Analysts predict that the market for advanced packaging could expand significantly, thereby positively impacting the WLCSP Electroless Plating Market in the coming years.

Increased Investment in Semiconductor Manufacturing

The WLCSP Electroless Plating Market is benefiting from increased investment in semiconductor manufacturing. Governments and private sectors are channeling funds into the development of advanced semiconductor fabrication facilities, which in turn drives the demand for electroless plating technologies. This investment is crucial for enhancing production capabilities and meeting the rising global demand for semiconductors across various industries, including automotive and telecommunications. Reports indicate that the semiconductor market is expected to reach a valuation of over 500 billion dollars by 2026, creating a favorable environment for the WLCSP Electroless Plating Market to thrive as manufacturers seek reliable and efficient plating solutions.