Growing Automotive Sector

The Global Plating on Plastics Market (POP) Market Industry is significantly influenced by the growth of the automotive sector. As automotive manufacturers increasingly incorporate plastic components for aesthetic and functional purposes, the demand for plating on these materials rises. This trend is particularly evident in the production of interior and exterior parts, where plated plastics enhance visual appeal and performance. The automotive industry is expected to be a key contributor to the market's expansion, with a projected compound annual growth rate of 5.3% from 2025 to 2035. This growth trajectory underscores the importance of plating technologies in meeting the evolving needs of automotive design and manufacturing.

Market Growth Projections

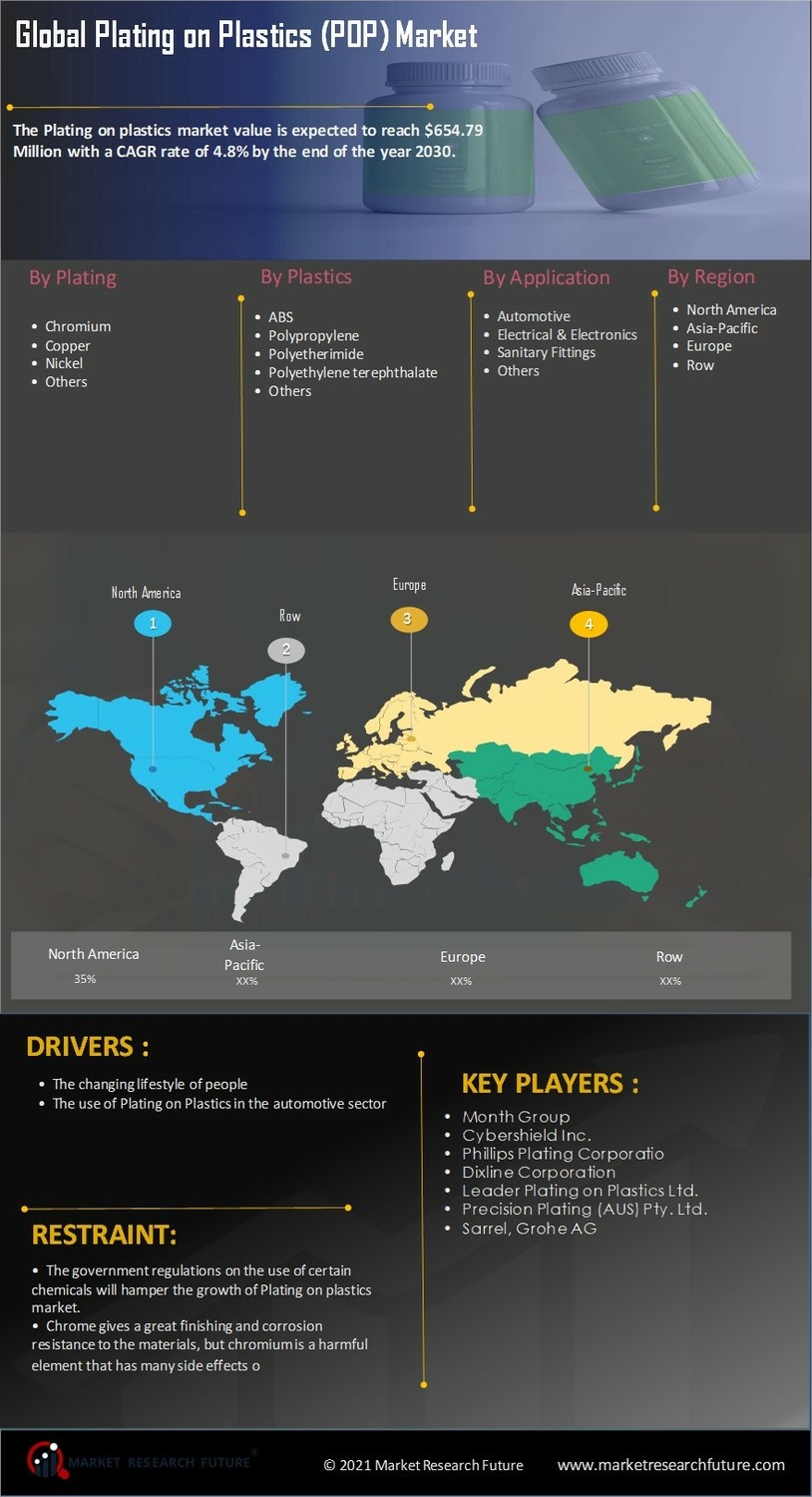

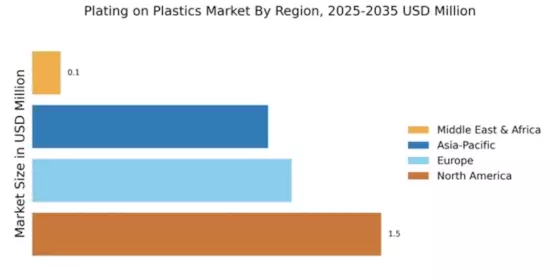

The Global Plating on Plastics Market (POP) Market Industry is poised for substantial growth, with projections indicating a market size of 469.2 USD Million in 2024 and an anticipated increase to 827.8 USD Million by 2035. This growth trajectory suggests a compound annual growth rate of 5.3% from 2025 to 2035, reflecting the industry's resilience and adaptability to emerging trends. Factors such as technological advancements, rising demand for lightweight materials, and increasing focus on aesthetics contribute to this positive outlook. The market's expansion underscores the importance of plating technologies in various applications, from automotive to consumer electronics, highlighting its integral role in modern manufacturing.

Rising Demand for Lightweight Materials

The Global Plating on Plastics Market (POP) Market Industry experiences a notable surge in demand for lightweight materials across various sectors, particularly in automotive and aerospace. As manufacturers strive to enhance fuel efficiency and reduce emissions, the adoption of lightweight components becomes increasingly critical. For instance, the automotive sector is projected to witness a significant shift towards plastic substrates that can be effectively plated, thereby reducing overall vehicle weight. This trend is expected to contribute to the market's growth, with the industry valued at 469.2 USD Million in 2024, indicating a robust trajectory as companies seek innovative solutions to meet regulatory standards.

Increasing Focus on Aesthetics and Customization

A growing emphasis on aesthetics and customization within various industries is driving the Global Plating on Plastics Market (POP) Market Industry. Consumers increasingly seek personalized products that reflect their individual styles, prompting manufacturers to explore innovative plating options. This trend is particularly pronounced in consumer electronics, where plated plastics are used to enhance the visual appeal of devices. As companies strive to differentiate their offerings in a competitive market, the demand for high-quality plating solutions is likely to rise. This shift towards customization may further propel the market, aligning with the broader trend of personalization across consumer goods.

Technological Advancements in Plating Techniques

Technological advancements play a pivotal role in shaping the Global Plating on Plastics Market (POP) Market Industry. Innovations in electroplating and vacuum metallization techniques are enhancing the efficiency and quality of plating processes. These advancements not only improve adhesion and durability but also expand the range of applications for plated plastics. For example, the introduction of environmentally friendly plating methods aligns with global sustainability goals, appealing to eco-conscious consumers. As these technologies evolve, they are likely to drive market growth, with projections indicating a market size of 827.8 USD Million by 2035, reflecting the industry's adaptability to changing consumer preferences.

Environmental Regulations and Sustainability Initiatives

The Global Plating on Plastics Market (POP) Market Industry is increasingly shaped by stringent environmental regulations and sustainability initiatives. Governments worldwide are implementing policies aimed at reducing the environmental impact of manufacturing processes, which includes the use of eco-friendly plating techniques. Companies are compelled to adopt sustainable practices, such as utilizing non-toxic materials and minimizing waste during production. This shift not only aligns with regulatory requirements but also resonates with environmentally conscious consumers. As a result, the market is expected to witness growth driven by the demand for sustainable plating solutions, reflecting a broader commitment to environmental stewardship.