Rising Demand for Craft Spirits

The White Spirits Market is experiencing a notable surge in demand for craft spirits, which are often perceived as higher quality and more authentic than mass-produced alternatives. This trend is driven by consumers' increasing preference for unique flavors and artisanal production methods. According to recent data, craft spirits account for a significant portion of the overall spirits market, with a growth rate that outpaces traditional brands. This shift towards craft offerings is reshaping the competitive landscape, compelling established brands to innovate and diversify their portfolios. As consumers seek out distinctive experiences, the White Spirits Market is likely to benefit from this trend, as craft distilleries often focus on white spirits such as gin and vodka, further enhancing their market presence.

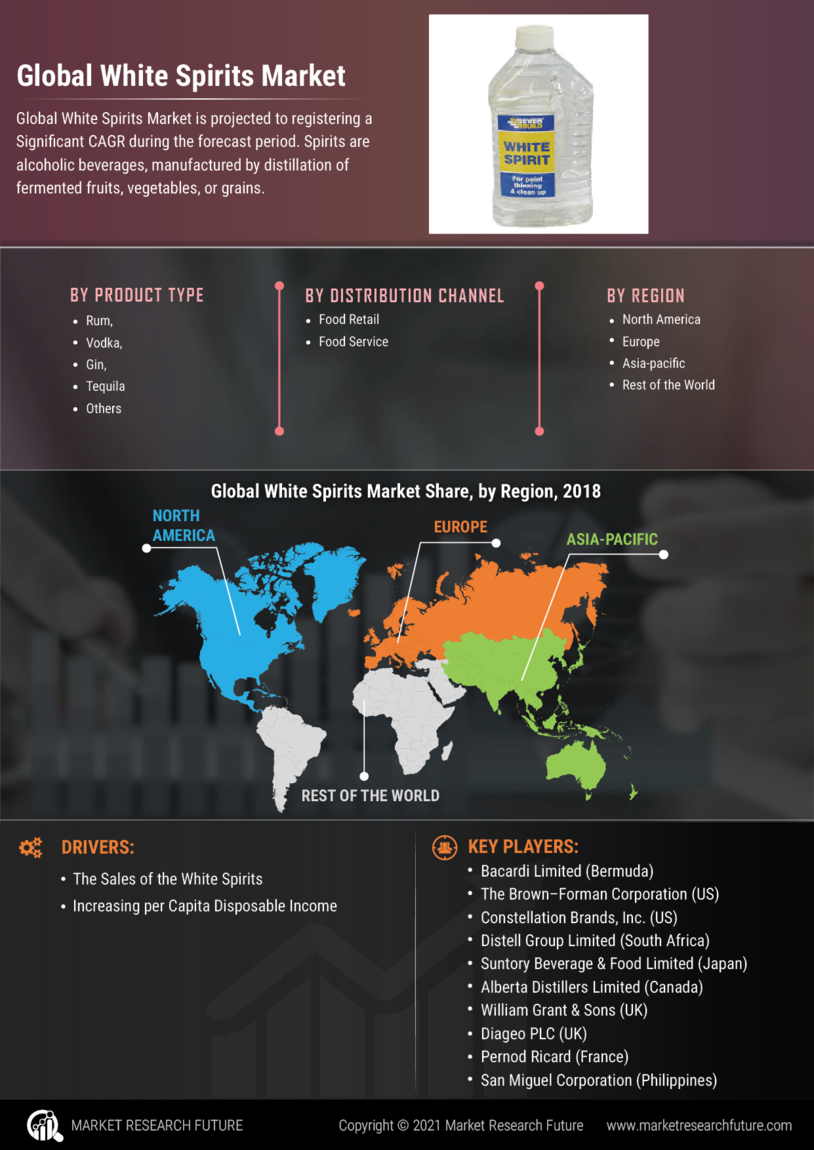

Expansion of Distribution Channels

The White Spirits Market is benefiting from the expansion of distribution channels, which enhances accessibility for consumers. Retailers are increasingly diversifying their offerings, with supermarkets, specialty liquor stores, and online platforms providing a wider range of white spirits. This trend is particularly relevant as e-commerce continues to grow, allowing consumers to purchase their favorite spirits from the comfort of their homes. Data indicates that online sales of alcoholic beverages have seen a remarkable increase, reflecting changing consumer preferences. As distribution channels expand, the White Spirits Market is poised for growth, as more consumers gain access to a variety of products, including premium and craft options that may have previously been difficult to find.

Cultural Influences and Globalization

Cultural influences and globalization are playing a pivotal role in shaping the White Spirits Market. As cultures intermingle, there is a growing appreciation for diverse drinking traditions and flavors, leading to an increased interest in white spirits from various regions. This phenomenon is evident in the rising popularity of international brands and unique local spirits, which are gaining traction in new markets. Market data suggests that consumers are more willing to explore and experiment with spirits from different cultures, contributing to the overall growth of the industry. As globalization continues to break down barriers, the White Spirits Market is likely to thrive, driven by the curiosity and adventurous spirit of consumers seeking new experiences.

Innovative Mixology and Cocktail Culture

The White Spirits Market is significantly influenced by the rise of innovative mixology and cocktail culture, which has become a prominent aspect of social gatherings and dining experiences. Bartenders and consumers alike are experimenting with new recipes and flavor combinations, leading to an increased use of white spirits in cocktails. This trend is supported by the proliferation of cocktail bars and mixology classes, which educate consumers on the versatility of spirits like vodka and gin. Market Research Future suggests that the cocktail segment is expanding rapidly, with white spirits being a preferred choice for many mixologists. As this culture continues to evolve, the White Spirits Market is likely to see sustained growth, driven by the creativity and experimentation that characterize modern drinking habits.

Health Consciousness and Low-Calorie Options

In the White Spirits Market, there is a growing trend towards health consciousness among consumers, leading to an increased demand for low-calorie and lower-alcohol options. This shift is particularly evident as individuals become more aware of the health implications associated with alcohol consumption. Brands are responding by developing lighter versions of traditional spirits, which appeal to a demographic that seeks to enjoy social drinking without compromising their health goals. Market data indicates that low-calorie spirits are gaining traction, with sales figures reflecting a steady increase. This trend not only caters to health-conscious consumers but also aligns with the broader movement towards wellness, positioning the White Spirits Market favorably in a competitive landscape.