Influence of Social Media

The Luxury Wines and Spirits Market is experiencing a transformative impact due to the influence of social media platforms. These platforms serve as powerful marketing tools, enabling brands to engage directly with consumers and showcase their products in innovative ways. Data suggests that brands leveraging social media effectively can see a significant increase in brand awareness and consumer engagement. Influencers and brand ambassadors play a crucial role in shaping consumer perceptions, often leading to increased sales of luxury wines and spirits. As social media continues to evolve, its role in driving trends and consumer behavior within the Luxury Wines and Spirits Market is likely to expand, creating new opportunities for brands to connect with their target audiences.

Rising Disposable Incomes

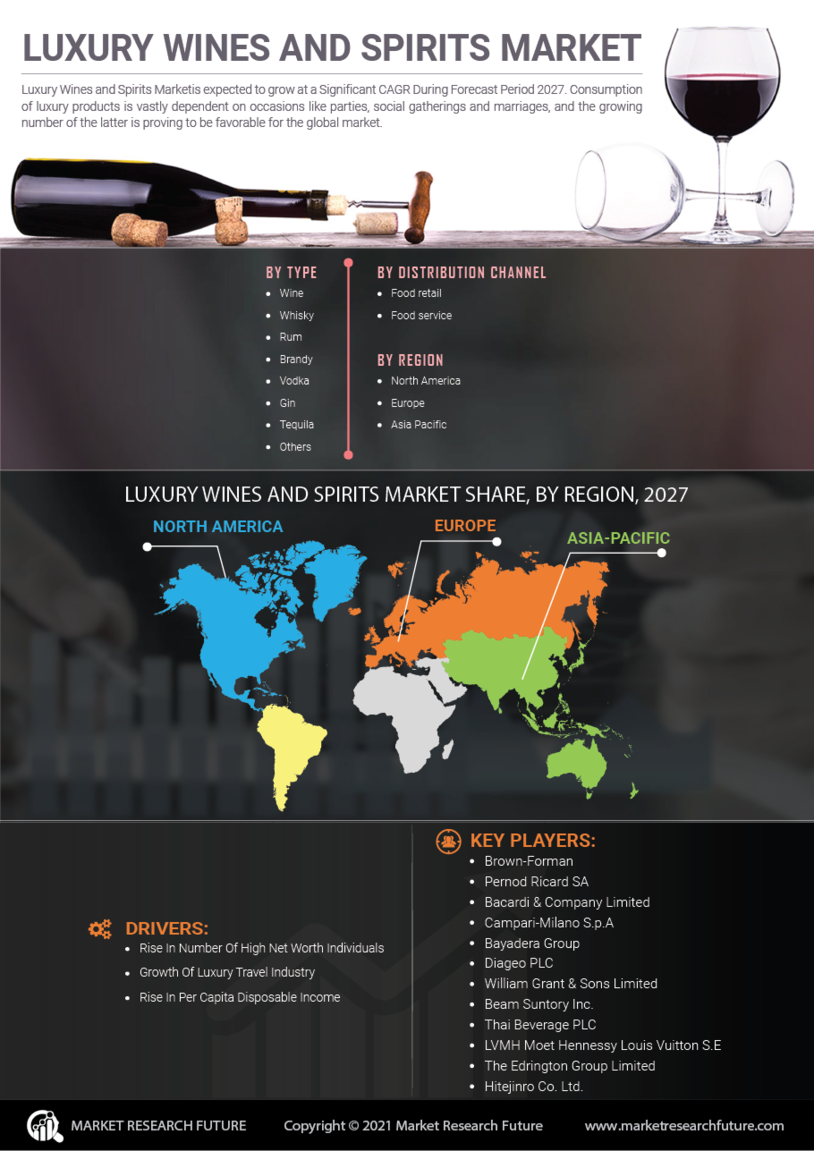

The Luxury Wines and Spirits Market appears to be significantly influenced by the increasing disposable incomes of consumers. As wealth distribution becomes more favorable, particularly in emerging economies, individuals are more inclined to indulge in premium products. Reports indicate that the number of high-net-worth individuals has been on the rise, leading to a greater demand for luxury wines and spirits. This trend is particularly evident in regions where economic growth is robust, allowing consumers to allocate a larger portion of their income towards luxury goods. Consequently, the Luxury Wines and Spirits Market is likely to experience sustained growth as more consumers seek out high-quality, exclusive offerings that reflect their elevated social status.

Evolving Consumer Preferences

Consumer preferences within the Luxury Wines and Spirits Market are evolving, with a noticeable shift towards unique and premium products. Today's consumers are increasingly discerning, seeking out artisanal and craft options that offer distinct flavors and experiences. This trend is supported by data indicating that sales of craft spirits have surged, reflecting a broader desire for authenticity and quality. Additionally, the rise of experiential consumption, where consumers prioritize experiences over mere products, has led to a growing interest in luxury wines and spirits that provide memorable moments. As a result, brands that can effectively communicate their heritage and craftsmanship are likely to thrive in this competitive landscape.

Expansion of E-commerce Channels

The Luxury Wines and Spirits Market is witnessing a notable expansion of e-commerce channels, which is reshaping how consumers access premium products. The convenience and accessibility of online shopping have led to a surge in direct-to-consumer sales, allowing brands to reach a broader audience. Data indicates that online sales of luxury wines and spirits have increased significantly, driven by changing consumer behaviors and preferences. This shift is particularly relevant as younger consumers, who are more comfortable with digital transactions, seek out luxury offerings online. As e-commerce continues to grow, the Luxury Wines and Spirits Market is likely to adapt, with brands investing in digital platforms to enhance their reach and customer engagement.

Growing Interest in Sustainable Practices

Sustainability has emerged as a pivotal driver within the Luxury Wines and Spirits Market, as consumers increasingly prioritize environmentally friendly practices. Brands that adopt sustainable sourcing, production, and packaging methods are likely to resonate with a conscientious consumer base. Reports indicate that a significant percentage of consumers are willing to pay a premium for products that align with their values, particularly in the luxury segment. This trend is prompting many producers to implement eco-friendly practices, from organic farming to reduced carbon footprints. As sustainability becomes a key differentiator, the Luxury Wines and Spirits Market may witness a shift towards brands that not only offer quality products but also demonstrate a commitment to environmental stewardship.