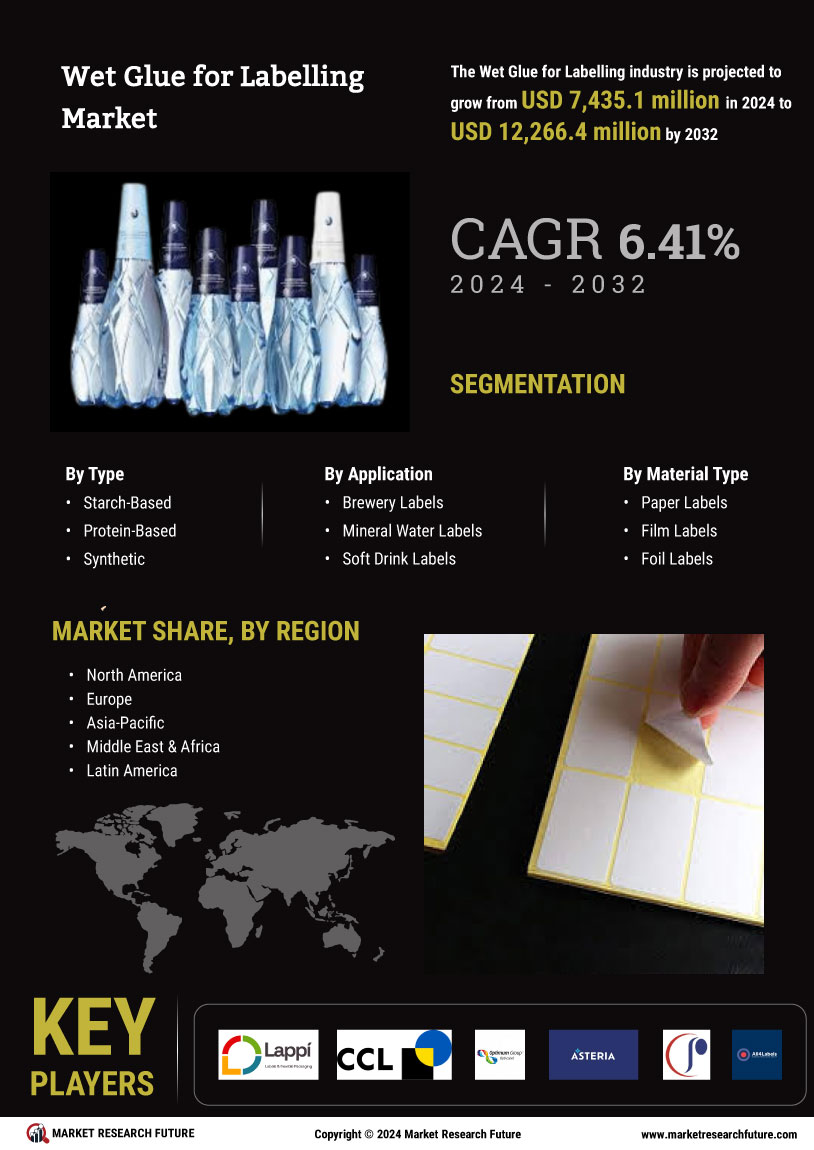

Market Trends and Projections

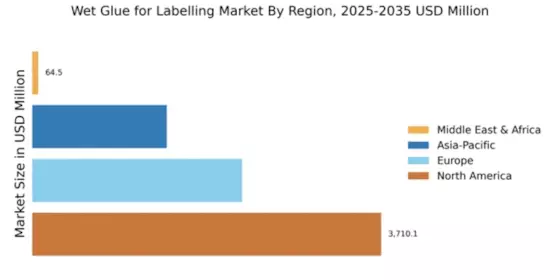

The Global Wet Glue for Labelling Market Industry is poised for substantial growth, with projections indicating a market value of 7.44 USD Billion in 2024 and an anticipated increase to 14.8 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate of 6.44% from 2025 to 2035. Various factors, including technological advancements, regulatory compliance, and the rise of e-commerce, are contributing to this upward trend. The market's expansion reflects the increasing importance of effective labelling solutions across diverse sectors, highlighting the dynamic nature of the Global Wet Glue for Labelling Market Industry.

Diverse Applications Across Industries

The versatility of wet glues across various industries is a significant factor driving the Global Wet Glue for Labelling Market Industry. From food and beverage to pharmaceuticals and consumer goods, wet glues are utilized for a myriad of labelling applications. This diversity allows manufacturers to cater to a broad customer base, enhancing market opportunities. For instance, the food industry relies heavily on wet glues for product labelling that withstands moisture and temperature fluctuations. As industries continue to evolve and diversify, the demand for specialized wet glues tailored to specific applications is expected to rise, further solidifying the Global Wet Glue for Labelling Market Industry's growth trajectory.

Growth of E-commerce and Online Retail

The surge in e-commerce and online retail is driving demand for effective labelling solutions, thereby benefiting the Global Wet Glue for Labelling Market Industry. As online shopping continues to grow, the need for reliable and efficient labelling systems becomes paramount to ensure product identification and branding during shipping. Wet glues are favored for their ability to adhere to various packaging materials, providing a seamless solution for e-commerce businesses. This trend is expected to contribute to the market's expansion, with projections indicating a potential market value of 14.8 USD Billion by 2035. The increasing reliance on online retail channels underscores the importance of wet glues in the Global Wet Glue for Labelling Market Industry.

Rising Demand for Sustainable Packaging

The Global Wet Glue for Labelling Market Industry is experiencing a notable shift towards sustainable packaging solutions. As consumers increasingly prefer eco-friendly products, manufacturers are compelled to adopt adhesives that align with environmental standards. This trend is evident in the growing use of water-based and biodegradable wet glues, which not only reduce environmental impact but also enhance brand image. The market's value is projected to reach 7.44 USD Billion in 2024, indicating a robust response to sustainability initiatives. Companies that prioritize sustainable practices may gain a competitive edge, potentially driving further growth in the Global Wet Glue for Labelling Market Industry.

Regulatory Compliance and Safety Standards

Compliance with stringent regulatory requirements is a critical driver for the Global Wet Glue for Labelling Market Industry. Manufacturers are increasingly required to adhere to safety and quality standards, particularly in sectors such as food and pharmaceuticals. This has led to the development of wet glues that meet specific regulatory criteria, ensuring consumer safety and product integrity. Companies that prioritize compliance not only mitigate risks but also enhance their market reputation. As regulations evolve, the demand for compliant adhesive solutions is likely to grow, further propelling the Global Wet Glue for Labelling Market Industry. This trend highlights the intersection of safety, quality, and market dynamics.

Technological Advancements in Adhesive Formulations

Innovations in adhesive technology are significantly influencing the Global Wet Glue for Labelling Market Industry. The development of advanced formulations that enhance adhesion properties and drying times is becoming increasingly prevalent. For instance, the introduction of high-performance wet glues that can withstand extreme temperatures and humidity levels is attracting attention from various sectors, including food and beverage. These advancements not only improve operational efficiency but also expand the application scope of wet glues. As a result, the market is likely to witness a compound annual growth rate of 6.44% from 2025 to 2035, reflecting the positive impact of technological progress on the Global Wet Glue for Labelling Market Industry.