Increasing Demand For Propylene Glycol In Food And Beverage Applications

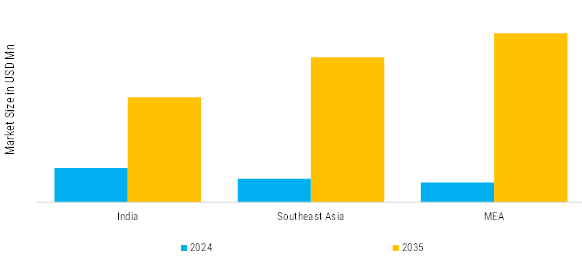

The increasing demand for propylene glycol (PG) in food and beverage applications is emerging as a strong growth driver for the propylene glycol market across India, Southeast Asia, the Middle East, and Africa. Propylene glycol is widely used in the food industry as a humectant, solvent, carrier, and emulsifier due to its generally recognized as safe (GRAS) status by international regulatory bodies. It serves critical functional roles such as maintaining moisture content, enhancing texture, stabilizing flavourings, and extending shelf life in a wide range of food and beverage products—including baked goods, frostings, dressings, beverages, processed meats, dairy products, and confectioneries. As urbanization intensifies across the ISMEA region, coupled with rising disposable incomes and changing consumer preferences, there has been a marked increase in the consumption of packaged, ready-to-eat, and processed food and beverage products. This, in turn, has significantly boosted demand for food-grade additives like propylene glycol. In India, the packaged food sector is witnessing exponential growth, driven by rapid urbanization, a growing middle class, increasing dual-income households, and greater exposure to global food trends. In Southeast Asia, countries such as Indonesia, Vietnam, Thailand, and the Philippines are experiencing a similar boom in processed and convenience food consumption.

Rising urban populations, westernization of diets, and increased participation of women in the workforce have contributed to a growing demand for packaged and ready-to-consume foods. In the Middle East, the rising trend of health-conscious snacking, ready-to-eat meals, and premium bakery products has created new opportunities for PG in food applications. The Gulf Cooperation Council (GCC) countries, in particular, have witnessed rapid expansion in food processing capacity to reduce import dependency and support food security initiatives. In Africa, the growth in urban populations and improving cold-chain infrastructure are enabling the expansion of food processing industries, particularly in nations such as South Africa, Nigeria, Kenya, and Egypt.

Growing Use Of Propylene Glycol In Pharmaceuticals And Personal Care Products

The increasing utilization of propylene glycol (PG) in pharmaceuticals and personal care products is emerging as a key driver propelling the growth of the PG market across India, Southeast Asia, the Middle East, and Africa. Propylene glycol is a versatile and safe chemical compound widely used as a solvent, humectant, stabilizer, and carrier in both pharmaceutical formulations and personal care items. Its chemical properties, such as low toxicity, hygroscopic nature, and compatibility with a wide range of active ingredients, make it an indispensable component in products like oral medications, topical creams, injectable drugs, ointments, lotions, shampoos, deodorants, and serums. As the demand for modern healthcare, wellness, and hygiene solutions continues to expand rapidly across the ISMEA region, the downstream consumption of PG has seen a corresponding surge. The compound’s non-irritating and moisture-retaining characteristics, combined with its ability to improve the delivery of active ingredients, make it especially valuable in tropical and arid climates prevalent across much of these regions.

In India, the pharmaceutical industry is one of the largest in the world by volume, and the country has become a global hub for generic drug production and export. The domestic demand for over-the-counter (OTC) medications, dermatological products, and personal care items has risen steadily, driven by increasing awareness of hygiene, skin care, and preventive health. In Southeast Asia, rapid economic development, rising disposable incomes, and increased healthcare access are fueling the growth of the pharmaceutical and personal care sectors. Countries such as Indonesia, Thailand, Vietnam, and the Philippines have experienced significant expansions in domestic drug manufacturing and cosmetic production, spurred by rising local demand and regional exports. In the Middle East, particularly in the Gulf countries, the pharmaceutical and personal care markets have grown substantially due to government-backed healthcare reforms, increasing medical tourism, and high per capita spending on luxury and personal wellness products. In Africa, while the pharmaceutical and personal care industries are still developing, rapid urbanization, rising middle-class populations, and increasing focus on hygiene and healthcare access are fueling new demand.

Rising Production Of Bio-Based Propylene Glycol Due To Environmental Concerns

The growing focus on sustainability and environmental responsibility is significantly driving the adoption and production of bio-based propylene glycol (bio-PG) across India, Southeast Asia, the Middle East, and Africa. Traditionally derived from petroleum-based feedstocks such as propylene oxide, conventional propylene glycol production has long been associated with the environmental drawbacks of fossil fuel consumption, greenhouse gas emissions, and non-renewable resource depletion. However, rising awareness about climate change, resource scarcity, and the environmental impacts of petrochemical-based manufacturing has accelerated the shift toward greener alternatives. Bio-based PG, which is produced from renewable resources like glycerol (a byproduct of biodiesel production), sorbitol, or sugars, presents a lower carbon footprint and improved biodegradability. As a result, governments, manufacturers, and end-user industries in these region are increasingly recognizing bio-PG as a strategic solution that aligns with broader environmental sustainability goals.

In India, this shift is supported by both policy direction and market demand. The Indian government’s strong push for bio-based industrial development—through initiatives like the National Bio-Energy Mission and the Ethanol Blending Program—has fostered an environment conducive to bio-PG production. In Southeast Asia, the trend toward bio-based PG is being driven by both economic and environmental imperatives. The region has a strong foundation in agricultural production—particularly palm oil and sugarcane—which can serve as feedstock sources for bio-PG. In the Middle East, despite the region’s deep-rooted dependency on hydrocarbon resources, there is a notable shift toward diversification and sustainability, especially among Gulf countries like Saudi Arabia and the UAE. Driven by Vision 2030 strategies and a growing recognition of climate challenges, regional governments are encouraging the development of bio-based and circular economy solutions. In Africa, the rising emphasis on industrial sustainability and green technology adoption is opening up new opportunities for bio-based PG.