Welding Shielding Gas Size

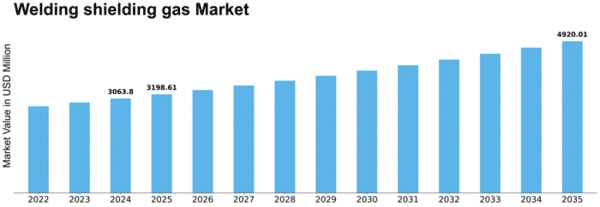

Welding shielding gas Market Growth Projections and Opportunities

The welding gas/shielding gas market is a dynamic sector that plays a crucial role in the welding industry. Market dynamics in this space are influenced by various factors, including technological advancements, end-user industries, and global economic trends. One of the key drivers of market growth is the increasing demand for welding processes across diverse applications such as construction, automotive, aerospace, and manufacturing.

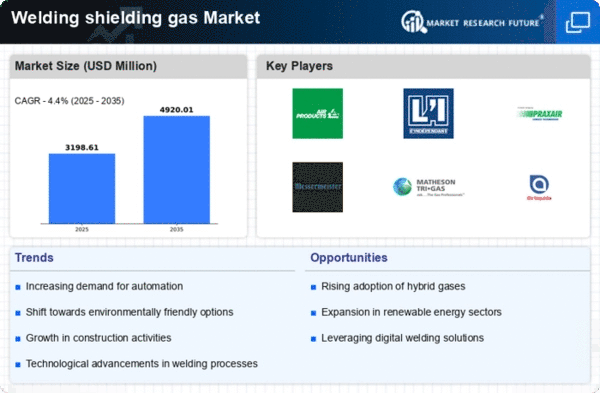

Technological advancements have significantly impacted the welding gas/shielding gas market. Innovations in welding processes, such as the adoption of advanced welding techniques like laser welding and electron beam welding, have led to the development of new gas mixtures and formulations. This has created a demand for specialized shielding gases that enhance the efficiency and quality of welding operations. As a result, market players continuously invest in research and development to introduce cutting-edge gas solutions that cater to evolving industry needs.

The market dynamics are also shaped by the expansion and growth of end-user industries. The construction and automotive sectors, in particular, are major consumers of welding gases. The rise in infrastructure projects worldwide and the increasing demand for automobiles contribute significantly to the consumption of welding gases. Additionally, the aerospace industry, with its stringent quality and safety standards, relies heavily on shielding gases for precise and high-quality welding applications. Therefore, the performance of these end-user industries directly influences the demand for welding gases, creating a dynamic and interconnected market ecosystem.

Global economic trends and geopolitical factors also play a pivotal role in shaping the welding gas/shielding gas market dynamics. Economic growth or downturns in key regions can impact industrial activities and, subsequently, the demand for welding gases. Moreover, geopolitical uncertainties, trade policies, and environmental regulations can influence the availability and pricing of raw materials required for manufacturing welding gases. Market players must navigate these external factors to maintain stability and capitalize on emerging opportunities.

Environmental considerations are increasingly becoming a significant factor in the welding gas/shielding gas market dynamics. With a growing emphasis on sustainability, there is a rising demand for eco-friendly and low-emission welding gases. Market players are responding to this trend by developing and promoting gas mixtures that minimize environmental impact while maintaining high welding performance. This shift in consumer preferences and regulatory pressures is reshaping the competitive landscape and encouraging innovation within the industry.

Competitive dynamics within the market are characterized by the presence of key players who continually strive to expand their market share through strategies such as mergers and acquisitions, partnerships, and product development. The pursuit of a diverse product portfolio and a global presence is common among industry leaders, allowing them to cater to a wide range of applications and geographies. This competitive environment fosters innovation and ensures that market players remain responsive to changing customer needs and industry trends.

In conclusion, the welding gas/shielding gas market is a dynamic and evolving sector driven by technological advancements, end-user industry growth, global economic trends, environmental considerations, and competitive dynamics. The ability of market players to adapt to these dynamics will determine their success in this rapidly changing landscape. As the welding industry continues to advance, the market for welding gases is expected to witness further transformations, offering both challenges and opportunities for industry participants.

Leave a Comment