EMI RFI Shielding Materials Market Summary

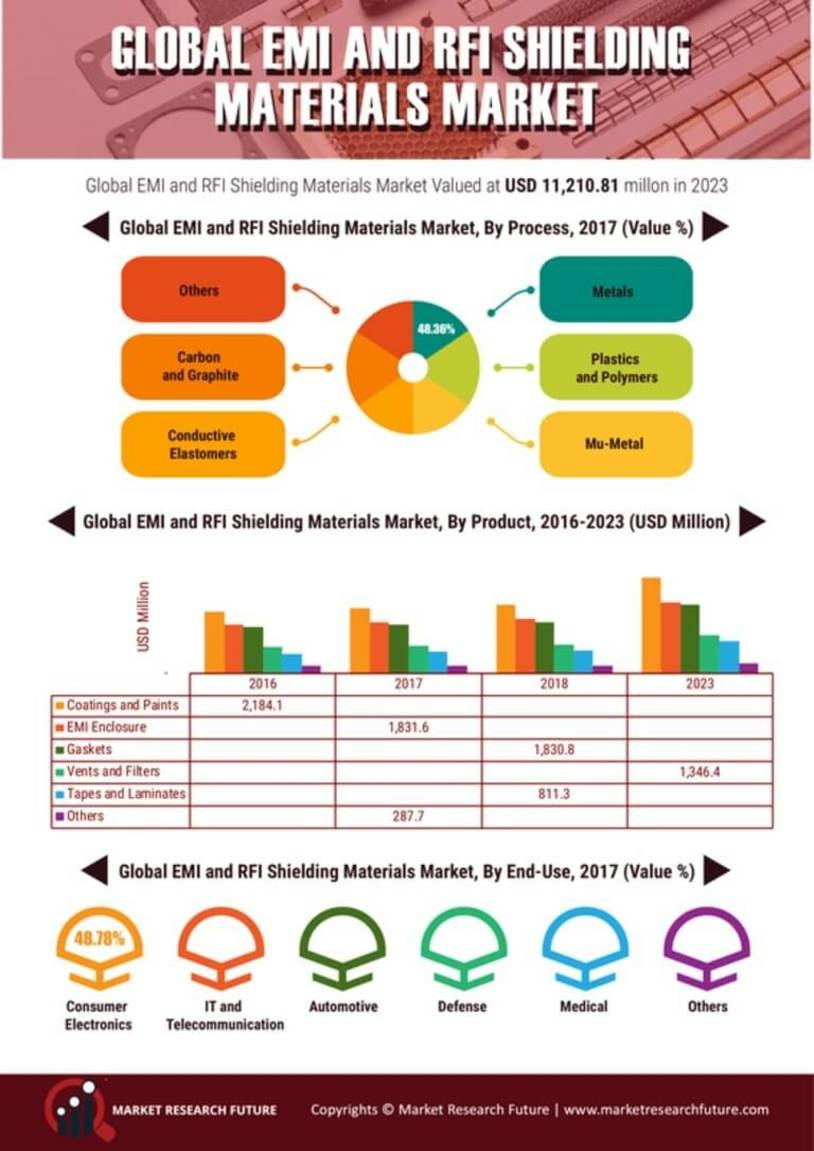

As per Market Research Future analysis, the EMI & RFI Shielding Materials Market was estimated at 7.74 USD Billion in 2024. The EMI & RFI shielding materials industry is projected to grow from 8.138 USD Billion in 2025 to 13.44 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 5.14% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The EMI and RFI Shielding Materials Market is poised for substantial growth driven by technological advancements and increasing demand for electronic devices.

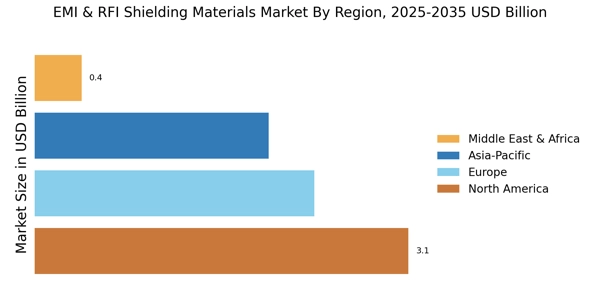

- Sustainability in material development is becoming a prominent trend, particularly in North America, which is the largest market.

- The integration of advanced technologies is reshaping the landscape of EMI and RFI shielding materials, especially in the rapidly growing Asia-Pacific region.

- Customization and tailored solutions are gaining traction, particularly within the metal segment, which remains the largest in the market.

- Rising demand for electronic devices and advancements in material science are key drivers propelling growth in the gasket segment, which is currently the fastest-growing.

Market Size & Forecast

| 2024 Market Size | 7.74 (USD Billion) |

| 2035 Market Size | 13.44 (USD Billion) |

| CAGR (2025 - 2035) | 5.14% |

Major Players

3M (US), Laird (GB), Parker Hannifin (US), Chomerics (US), Henkel (DE), EMI Shielding (US), Schaffner (CH), Leader Tech (US), Tech-Etch (US)