Weapons And Ammunition Market Summary

As per Market Research Future analysis, the Weapons and Ammunition Market Size was estimated at 62.08 USD Billion in 2024. The Weapons and Ammunition industry is projected to grow from 66.18 USD Billion in 2025 to 125.4 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 6.6% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Weapons and Ammunition Market is currently experiencing a dynamic evolution driven by technological advancements and geopolitical factors.

- Technological advancements are reshaping the design and functionality of small arms, enhancing their effectiveness and user experience.

- Sustainability initiatives are gaining traction, prompting manufacturers to explore eco-friendly materials and production processes in the weapons sector.

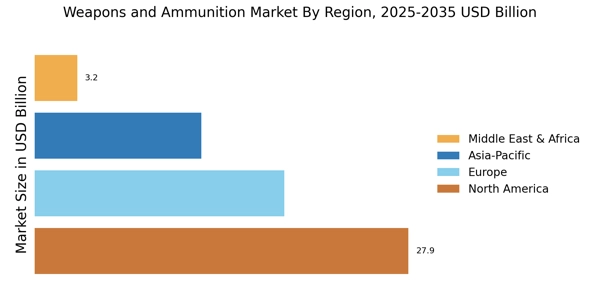

- Geopolitical influences are significantly impacting defense strategies, particularly in North America, which remains the largest market for weapons and ammunition.

- Increased defense budgets and rising civilian demand for firearms are key drivers propelling growth in the small arms and bullets segments.

Market Size & Forecast

| 2024 Market Size | 62.08 (USD Billion) |

| 2035 Market Size | 125.4 (USD Billion) |

| CAGR (2025 - 2035) | 6.6% |

Major Players

Lockheed Martin (US), Northrop Grumman (US), General Dynamics (US), BAE Systems (GB), Raytheon Technologies (US), Thales Group (FR), Leonardo S.p.A. (IT), Rheinmetall AG (DE), Elbit Systems (IL), Saab AB (SE)