Regulatory Compliance and Standards

The Wood Preservation Chemical Market is significantly shaped by the evolving regulatory landscape surrounding chemical usage in wood treatment. Governments and environmental agencies are increasingly implementing stringent regulations to ensure the safety and sustainability of wood preservation chemicals. Compliance with these regulations is essential for manufacturers, as non-compliance can lead to severe penalties and market access issues. The market is adapting to these changes by developing eco-friendly and compliant products that meet regulatory standards. This shift not only enhances the credibility of the Wood Preservation Chemical Market but also aligns with the growing consumer demand for safer and more sustainable products. As regulations continue to evolve, companies that proactively adapt to these changes are likely to gain a competitive edge.

Increasing Demand for Sustainable Construction

The Wood Preservation Chemical Market is experiencing a notable surge in demand driven by the increasing emphasis on sustainable construction practices. As consumers and builders alike prioritize environmentally friendly materials, the need for effective wood preservation solutions has intensified. This trend is reflected in the rising adoption of treated wood in residential and commercial projects, with the market for treated wood projected to reach approximately USD 10 billion by 2026. The Wood Preservation Chemical Market plays a crucial role in ensuring that wood products maintain their integrity and longevity, thereby supporting sustainable building initiatives. Furthermore, the growing awareness of the environmental impact of untreated wood has led to a shift towards using chemicals that are less harmful to ecosystems, further propelling market growth.

Rising Awareness of Wood Preservation Benefits

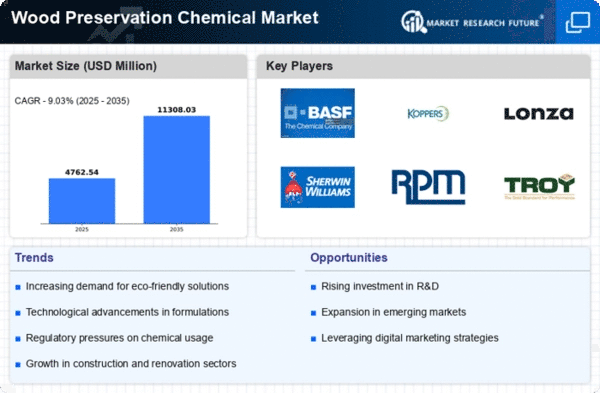

The Wood Preservation Chemical Market is significantly influenced by the rising awareness among consumers and industries regarding the benefits of wood preservation. As wood is a natural resource, its longevity and durability are paramount for various applications, including construction, furniture, and flooring. The market is projected to grow at a compound annual growth rate of 5.2% through 2027, indicating a robust interest in preservation chemicals that enhance wood's resistance to pests, moisture, and decay. This awareness is not only limited to consumers but extends to manufacturers who are increasingly investing in high-quality preservation solutions to meet market demands. The emphasis on maintaining the aesthetic and functional qualities of wood products is likely to drive further innovation within the Wood Preservation Chemical Market.

Growth in the Furniture and Construction Sectors

The Wood Preservation Chemical Market is poised for growth, largely driven by the expansion of the furniture and construction sectors. As urbanization accelerates and disposable incomes rise, the demand for wooden furniture and construction materials is increasing. The construction industry alone is expected to grow at a rate of 4% annually, leading to a higher requirement for treated wood products. This trend is further supported by the increasing preference for wooden structures due to their aesthetic appeal and sustainability. Consequently, the Wood Preservation Chemical Market is likely to benefit from this growth, as manufacturers seek to provide effective preservation solutions that meet the needs of these expanding sectors. The interplay between construction growth and wood preservation is expected to create a robust market environment.

Technological Innovations in Preservation Techniques

Technological advancements are reshaping the Wood Preservation Chemical Market, introducing innovative preservation techniques that enhance the efficacy and safety of wood treatment processes. Recent developments include the use of nanotechnology and bio-based preservatives, which offer improved performance while minimizing environmental impact. The market is witnessing a shift towards these advanced solutions, as they provide longer-lasting protection against biological threats. For instance, the introduction of water-based preservatives has gained traction, as they are less toxic and more user-friendly. This trend is expected to contribute to a projected market growth of 4.5% annually over the next five years. As manufacturers continue to invest in research and development, the Wood Preservation Chemical Market is likely to see a proliferation of new products that cater to evolving consumer preferences.