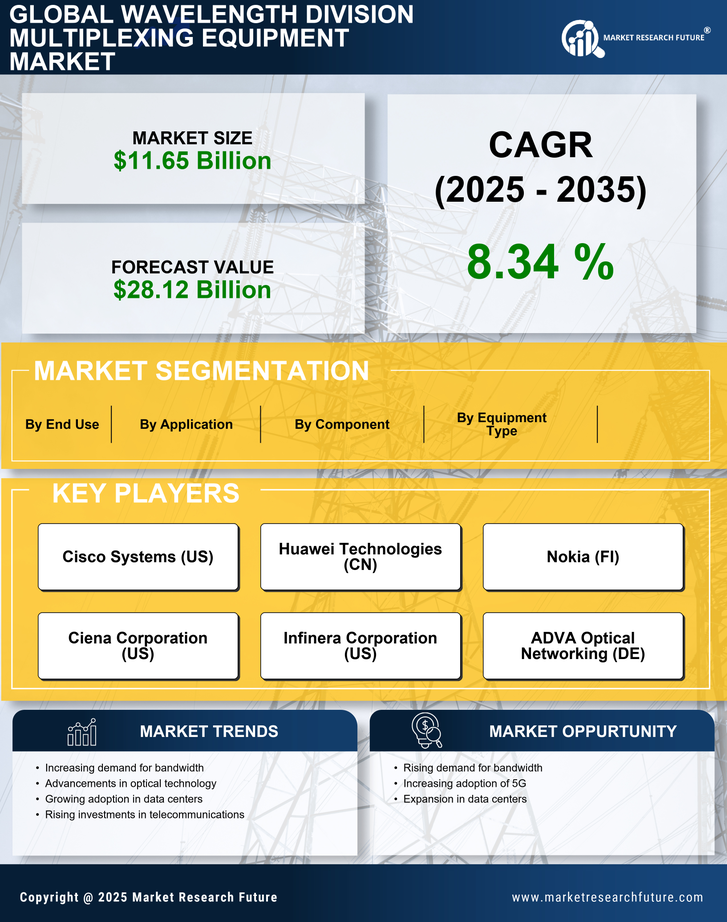

The Wavelength Division Multiplexing (WDM) Equipment Market is currently characterized by a dynamic competitive landscape, driven by the increasing demand for high-capacity data transmission and the proliferation of broadband services globally. Major players such as Cisco Systems (US), Huawei Technologies (CN), and Ciena Corporation (US) are strategically positioned to leverage their technological advancements and extensive portfolios. Cisco Systems (US) focuses on innovation in optical networking solutions, while Huawei Technologies (CN) emphasizes regional expansion and partnerships to enhance its market presence. Ciena Corporation (US) is known for its commitment to digital transformation, particularly in software-defined networking, which collectively shapes a competitive environment that is increasingly reliant on technological differentiation and strategic collaborations.

In terms of business tactics, companies are localizing manufacturing and optimizing supply chains to enhance operational efficiency and reduce costs. The market structure appears moderately fragmented, with a mix of established players and emerging companies vying for market share. The collective influence of key players is significant, as they engage in strategic partnerships and collaborations to bolster their competitive positions and address the evolving needs of customers.

In August 2025, Huawei Technologies (CN) announced a strategic partnership with a leading telecommunications provider to deploy its latest WDM technology across multiple regions. This collaboration is expected to enhance network capacity and reliability, positioning Huawei as a key player in the rapidly evolving telecommunications landscape. The strategic importance of this partnership lies in its potential to expand Huawei's footprint in emerging markets, thereby increasing its competitive edge.

In September 2025, Ciena Corporation (US) launched a new suite of optical networking solutions designed to optimize data center interconnectivity. This initiative reflects Ciena's focus on innovation and its commitment to meeting the growing demand for high-speed data transmission. The launch is strategically significant as it not only reinforces Ciena's market position but also addresses the increasing need for efficient data management solutions in a digital-first world.

In October 2025, Cisco Systems (US) unveiled a new AI-driven analytics platform aimed at enhancing the performance of WDM networks. This development underscores Cisco's commitment to integrating advanced technologies into its offerings, thereby improving operational efficiency and customer experience. The introduction of this platform is likely to set a new standard in the industry, emphasizing the importance of AI in optimizing network performance and reliability.

As of October 2025, current competitive trends in the WDM Equipment Market are heavily influenced by digitalization, sustainability, and the integration of artificial intelligence. Strategic alliances are increasingly shaping the landscape, as companies recognize the need for collaboration to drive innovation and address complex market demands. Looking ahead, competitive differentiation is expected to evolve, with a notable shift from price-based competition to a focus on technological innovation, supply chain reliability, and sustainable practices. This transition may redefine how companies position themselves in the market, emphasizing the importance of adaptability and forward-thinking strategies.