Increasing Data Traffic

The Dense Wave Digital Multiplexing DWDM System Market is experiencing a surge in demand due to the exponential growth of data traffic. With the proliferation of cloud computing, streaming services, and IoT devices, the need for high-capacity data transmission has intensified. Reports indicate that global internet traffic is expected to reach 4.8 zettabytes per year by 2025, necessitating advanced solutions like DWDM systems. These systems enable multiple data streams to be transmitted simultaneously over a single optical fiber, significantly enhancing bandwidth efficiency. As organizations seek to accommodate this rising data demand, the DWDM market is poised for substantial growth, driven by the need for robust and scalable network infrastructure.

Advancements in Optical Networking

Technological advancements in optical networking are propelling the Dense Wave Digital Multiplexing DWDM System Market forward. Innovations such as coherent optical technology and advanced modulation formats are enhancing the performance and capacity of DWDM systems. For instance, the introduction of 400G and 800G DWDM solutions is enabling service providers to offer higher bandwidth at lower costs. These advancements not only improve data transmission rates but also reduce latency, making DWDM systems more attractive for telecommunications and data center operators. As the demand for faster and more reliable networks continues to grow, the DWDM market is likely to benefit from these technological improvements, positioning itself as a critical component in modern communication infrastructure.

Rising Need for Network Scalability

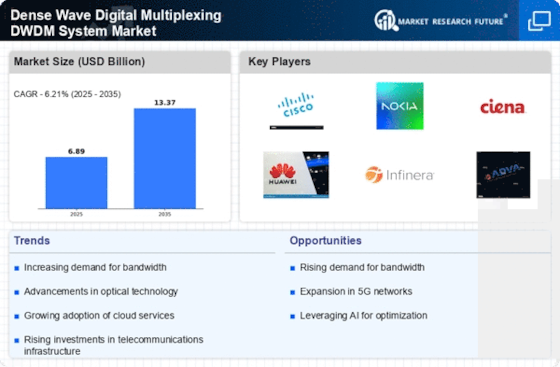

The need for network scalability is becoming increasingly critical in the Dense Wave Digital Multiplexing DWDM System Market. As organizations expand their operations and user bases, the ability to scale network capacity without significant infrastructure changes is essential. DWDM systems provide a flexible solution, allowing operators to increase bandwidth by adding more channels without the need for additional fiber. This scalability is particularly important for data centers and telecommunications providers, who must adapt to fluctuating demands. Market analysis suggests that the scalability offered by DWDM systems could lead to a market growth rate of approximately 12% annually, as businesses seek to future-proof their networks against evolving data requirements.

Growing Adoption of Fiber Optic Networks

The transition from copper to fiber optic networks is a significant driver for the Dense Wave Digital Multiplexing DWDM System Market. Fiber optics offer superior bandwidth and lower attenuation compared to traditional copper cables, making them ideal for high-speed data transmission. As businesses and service providers increasingly adopt fiber optic technology, the demand for DWDM systems is expected to rise. According to industry estimates, the fiber optic market is projected to grow at a compound annual growth rate of over 10% through 2025. This shift towards fiber optics not only enhances network performance but also supports the deployment of next-generation applications, further fueling the growth of the DWDM market.

Regulatory Support for Broadband Expansion

Regulatory initiatives aimed at expanding broadband access are influencing the Dense Wave Digital Multiplexing DWDM System Market. Governments worldwide are implementing policies to promote high-speed internet connectivity, particularly in underserved areas. These initiatives often include funding for infrastructure development, which can facilitate the deployment of DWDM systems. For example, various countries have allocated billions in funding to enhance broadband infrastructure, thereby creating opportunities for DWDM technology adoption. As regulatory support continues to grow, it is likely that the DWDM market will see increased investment and expansion, driven by the need to meet national connectivity goals and improve overall network performance.