Urbanization Trends

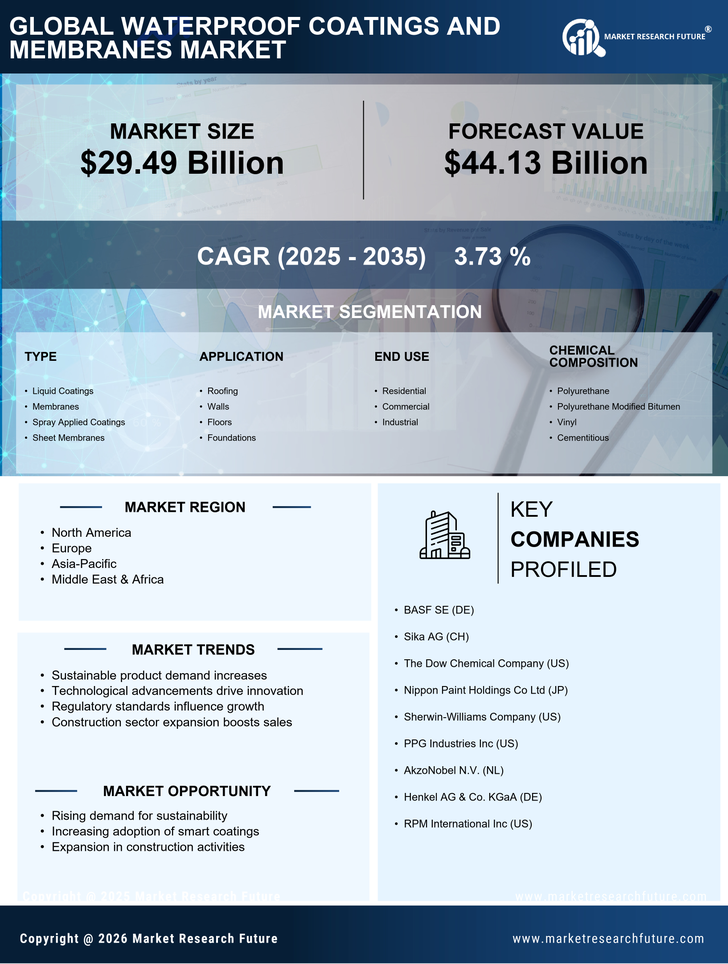

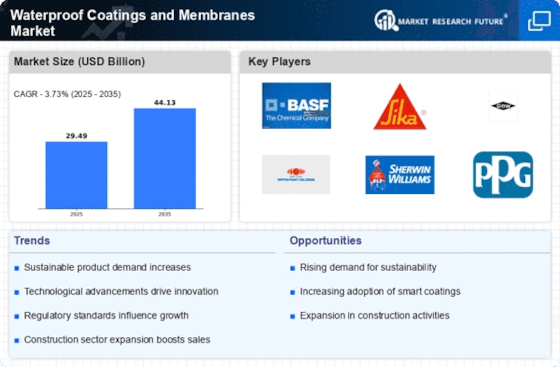

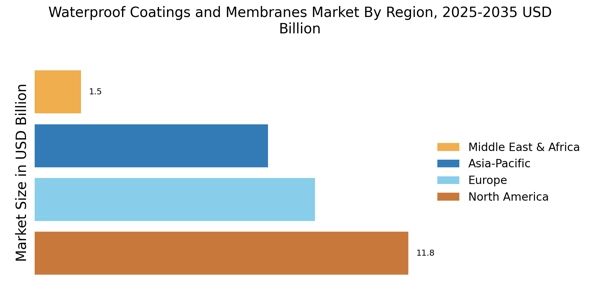

Rapid urbanization is a significant driver of the Waterproof Coatings and Membranes Market, as the demand for infrastructure development escalates. With more people migrating to urban areas, the need for residential and commercial buildings is surging, leading to increased construction activities. This trend necessitates the use of waterproof coatings and membranes to protect structures from water damage, thereby enhancing their longevity and safety. Market analysis suggests that the construction sector's growth could lead to a substantial increase in the demand for waterproofing solutions, with projections indicating a potential market expansion of over 5 billion USD by 2027. As urban areas continue to expand, the waterproof coatings and membranes will play a crucial role in ensuring the resilience of buildings against environmental challenges.

Regulatory Compliance

The Waterproof Coatings and Membranes Market is significantly influenced by regulatory compliance requirements that mandate the use of specific materials and practices in construction. Governments and regulatory bodies are increasingly enforcing standards aimed at improving building safety and environmental sustainability. These regulations often require the use of high-performance waterproofing solutions that meet stringent criteria for durability and environmental impact. As a result, manufacturers are compelled to innovate and adapt their product lines to comply with these regulations, which can drive market growth. The market is expected to see a rise in demand for certified waterproof coatings, as compliance becomes a critical factor for contractors and builders. This trend not only enhances product credibility but also fosters consumer trust in waterproofing solutions.

Technological Innovations

Technological advancements are reshaping the Waterproof Coatings and Membranes Market, introducing new materials and application techniques that enhance performance and durability. Innovations such as nanotechnology and smart coatings are gaining traction, offering superior waterproofing capabilities and self-healing properties. These advancements not only improve the longevity of coatings but also reduce maintenance costs for end-users. The integration of digital technologies in the application process, such as automated spraying systems, is streamlining operations and increasing efficiency. Market data indicates that the adoption of these technologies could lead to a reduction in application time by up to 30%, thereby appealing to contractors and builders. As these technologies continue to evolve, they are likely to create new opportunities for growth within the industry, attracting investments and fostering competition.

Sustainability Initiatives

The increasing emphasis on sustainability appears to drive the Waterproof Coatings and Membranes Market. As environmental concerns gain traction, manufacturers are compelled to develop eco-friendly products that minimize environmental impact. This shift is evident in the rising demand for water-based coatings and membranes, which are perceived as less harmful compared to solvent-based alternatives. Furthermore, regulatory frameworks are evolving to support sustainable practices, encouraging companies to innovate in their product offerings. The market for sustainable waterproof coatings is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 6% in the coming years. This trend not only aligns with consumer preferences but also positions companies favorably in a competitive landscape, as they adapt to the growing demand for environmentally responsible solutions.

Rising Awareness of Water Damage

The growing awareness of the detrimental effects of water damage is propelling the Waterproof Coatings and Membranes Market forward. Homeowners and businesses are increasingly recognizing the importance of protecting their properties from moisture-related issues, such as mold growth and structural deterioration. This heightened awareness is leading to a surge in demand for effective waterproofing solutions, as consumers seek to safeguard their investments. Market Research Future indicates that the cost of water damage can reach billions annually, prompting property owners to prioritize waterproofing measures. As educational campaigns and information dissemination continue to rise, the market for waterproof coatings and membranes is likely to expand, driven by informed consumers who understand the long-term benefits of investing in quality waterproofing solutions.