Consumer Preferences

Shifting consumer preferences are a notable driver for the Waterborne Polyurethane Dispersions Market. As consumers become more environmentally conscious, there is a growing demand for products that are safe and sustainable. Waterborne polyurethane dispersions, known for their low toxicity and minimal environmental impact, are increasingly favored in various applications, including coatings and adhesives. In 2025, the market is expected to benefit from this trend, as consumers actively seek out eco-friendly alternatives. Manufacturers are likely to respond by enhancing product formulations to meet these preferences, thereby fostering innovation within the industry. This alignment with consumer values not only drives sales but also strengthens brand loyalty, positioning companies favorably in a competitive market landscape. The focus on consumer preferences is anticipated to shape the future trajectory of the waterborne polyurethane dispersions market.

Regulatory Compliance

Regulatory compliance is an essential driver influencing the Waterborne Polyurethane Dispersions Market. Stricter environmental regulations are compelling manufacturers to transition from solvent-based to waterborne systems. In 2025, compliance with these regulations is expected to drive a significant shift in production practices, as companies seek to avoid penalties and enhance their market reputation. The adoption of waterborne polyurethane dispersions is seen as a proactive approach to meet these regulatory demands while maintaining product performance. This trend is likely to create a favorable environment for market growth, as businesses invest in technologies that align with regulatory standards. Furthermore, the increasing awareness among consumers regarding environmental issues is pushing companies to prioritize sustainable practices, thereby further driving the demand for waterborne solutions.

Technological Innovations

Technological advancements play a crucial role in shaping the Waterborne Polyurethane Dispersions Market. Innovations in formulation and production processes are enhancing the performance characteristics of these dispersions. For instance, the development of new catalysts and additives is improving the curing speed and durability of waterborne polyurethanes. In 2025, the market is anticipated to expand as manufacturers leverage these technologies to create high-performance products that meet diverse application needs. The integration of digital technologies in manufacturing processes is also streamlining operations, reducing costs, and increasing efficiency. As a result, companies are likely to gain a competitive edge by offering superior products that cater to evolving consumer demands. This technological evolution is expected to drive market growth and foster a more dynamic industry landscape.

Sustainability Initiatives

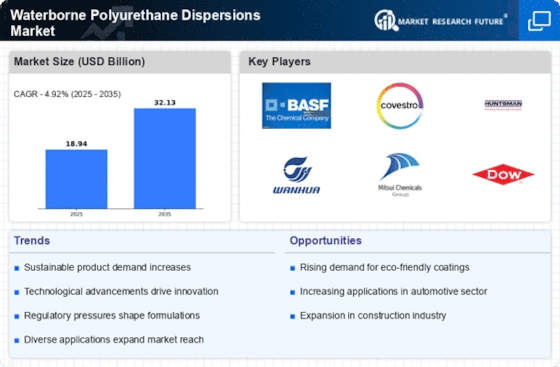

The increasing emphasis on sustainability is a pivotal driver for the Waterborne Polyurethane Dispersions Market. As industries strive to reduce their environmental footprint, waterborne polyurethane dispersions, which are low in volatile organic compounds, are gaining traction. This shift aligns with regulatory frameworks aimed at minimizing harmful emissions. In 2025, the market is projected to witness a growth rate of approximately 6% as manufacturers adopt eco-friendly practices. The demand for sustainable coatings and adhesives is expected to rise, further propelling the market. Companies are likely to invest in research and development to enhance the performance of these dispersions while maintaining their eco-friendly attributes. This trend not only meets consumer expectations but also positions businesses favorably in a competitive landscape.

Expanding End-Use Industries

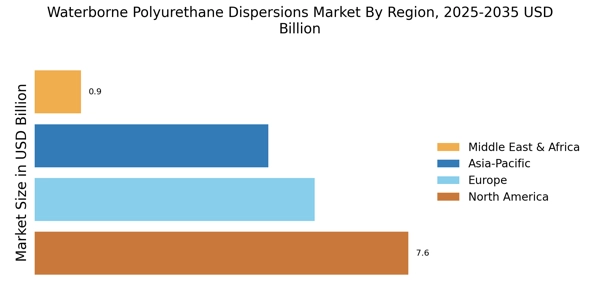

The diversification of end-use industries is a significant driver for the Waterborne Polyurethane Dispersions Market. Sectors such as automotive, construction, and textiles are increasingly adopting waterborne polyurethane dispersions due to their versatility and performance benefits. In 2025, the automotive sector is projected to account for a substantial share of the market, driven by the need for lightweight and durable materials. Additionally, the construction industry is likely to embrace these dispersions for their excellent adhesion and weather resistance properties. This expansion across various sectors indicates a robust demand for waterborne polyurethane dispersions, which are seen as a viable alternative to solvent-based products. As industries continue to evolve, the market is expected to adapt, presenting new opportunities for growth and innovation.