Consumer Preferences

Shifting consumer preferences towards high-quality, durable, and environmentally friendly products are reshaping the Global Waterborne Acrylic Coatings Market Industry. As consumers become more informed about the environmental impact of their choices, there is a growing inclination towards waterborne acrylic coatings that offer lower toxicity and better performance. This trend is particularly evident in the DIY segment, where consumers seek products that are safe and easy to use. Manufacturers are responding by developing a wider range of waterborne acrylic products that cater to these preferences, thereby enhancing market competitiveness. The anticipated growth of the market, with a CAGR of 7.25% from 2025 to 2035, indicates that consumer preferences will continue to drive innovation and expansion.

Regulatory Compliance

Regulatory compliance is a significant driver in the Global Waterborne Acrylic Coatings Market Industry, as governments worldwide impose stricter environmental standards. These regulations often mandate the reduction of harmful emissions from coatings, prompting manufacturers to shift towards waterborne solutions. The ability of waterborne acrylic coatings to meet these regulations positions them favorably in the market. As industries strive to comply with these standards, the demand for compliant products is expected to surge. This shift not only supports environmental sustainability but also enhances the market's growth potential, as companies seek to avoid penalties and maintain their reputations in an increasingly eco-conscious landscape.

Sustainability Trends

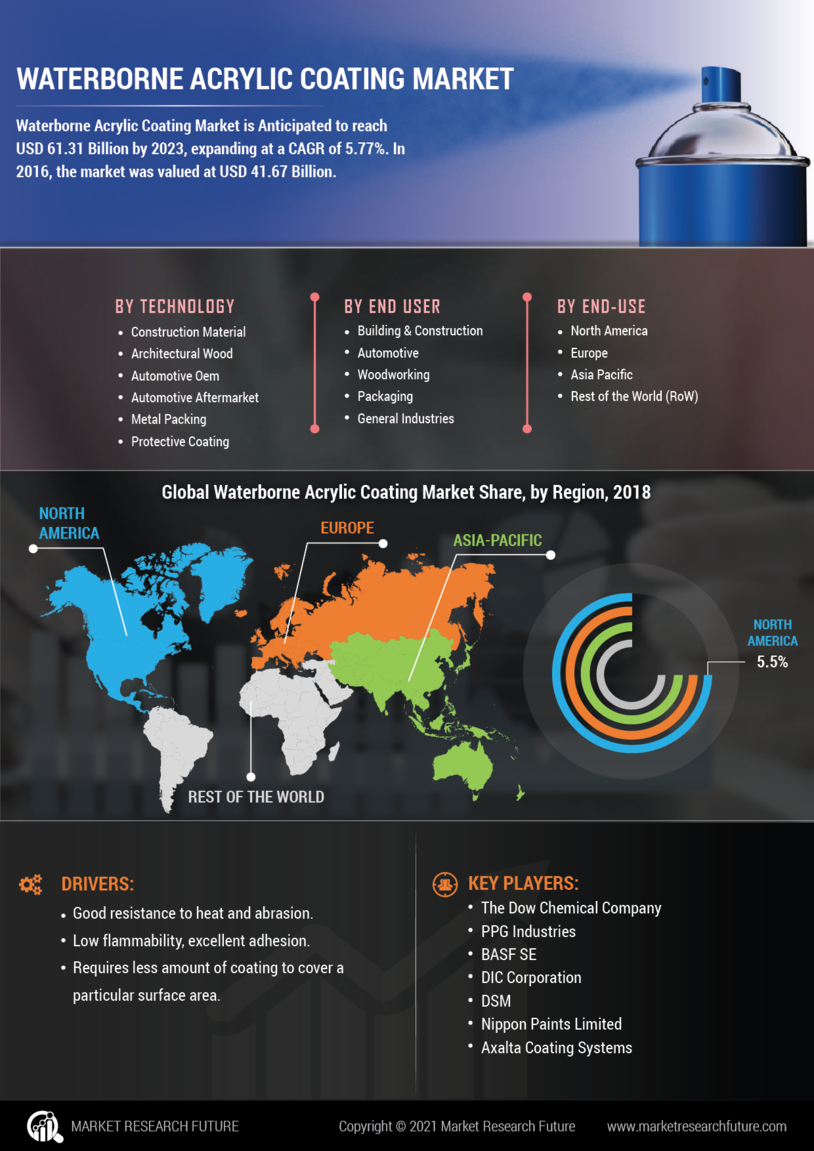

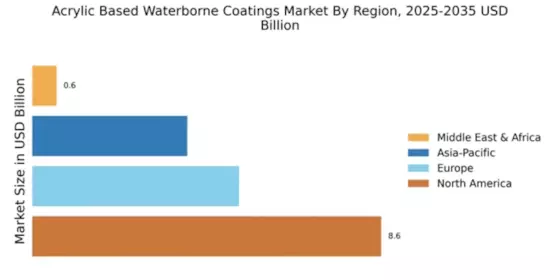

The Global Waterborne Acrylic Coatings Market Industry is experiencing a notable shift towards sustainability, driven by increasing environmental regulations and consumer preferences for eco-friendly products. Waterborne acrylic coatings, known for their low volatile organic compound emissions, align with these sustainability goals. As industries adopt greener practices, the demand for these coatings is expected to rise. This trend is particularly evident in the construction and automotive sectors, where sustainable materials are prioritized. The market's projected growth from 37.6 USD Billion in 2024 to 81.2 USD Billion by 2035, with a CAGR of 7.25% from 2025 to 2035, underscores the importance of sustainability in shaping industry dynamics.

Market Growth Projections

The Global Waterborne Acrylic Coatings Market Industry is poised for substantial growth, with projections indicating an increase from 37.6 USD Billion in 2024 to 81.2 USD Billion by 2035. This growth reflects a compound annual growth rate (CAGR) of 7.25% from 2025 to 2035, driven by various factors including sustainability trends, technological advancements, and rising consumer demand for eco-friendly products. The market's expansion is expected to be supported by the increasing adoption of waterborne coatings across diverse applications, including construction, automotive, and industrial sectors. As industries continue to prioritize environmentally responsible solutions, the waterborne acrylic coatings market is likely to thrive in the coming years.

Technological Advancements

Technological innovations play a crucial role in the Global Waterborne Acrylic Coatings Market Industry, enhancing product performance and application methods. Advances in formulation chemistry have led to the development of coatings with superior durability, adhesion, and weather resistance. These improvements not only meet the stringent requirements of various applications but also cater to the evolving needs of consumers. For instance, the introduction of self-cleaning and anti-microbial coatings has expanded the functionality of waterborne acrylics. As manufacturers continue to invest in research and development, the market is likely to witness an influx of innovative products, further driving growth and adoption across multiple sectors.

Growing Construction Sector

The expansion of the construction sector significantly influences the Global Waterborne Acrylic Coatings Market Industry. As urbanization accelerates globally, the demand for residential and commercial buildings increases, leading to a higher requirement for protective and decorative coatings. Waterborne acrylic coatings are favored in this sector due to their excellent performance characteristics and environmental benefits. The construction industry's growth trajectory is reflected in the increasing investments in infrastructure projects, which further propels the demand for these coatings. With the market projected to grow from 37.6 USD Billion in 2024 to 81.2 USD Billion by 2035, the construction sector remains a vital driver of this upward trend.