Water Treatment Equipment Repair and Overhaul Market Summary

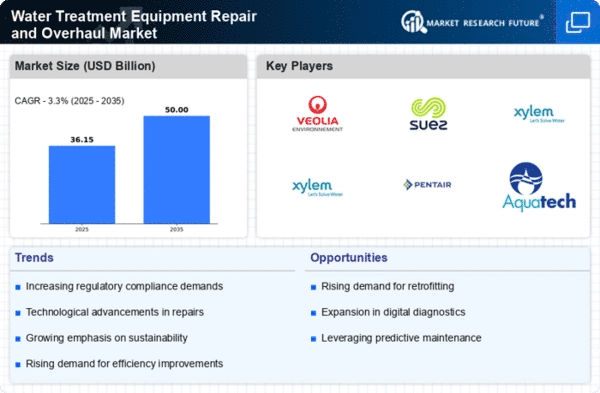

As per MRFR analysis, the Water Treatment Equipment Repair and Overhaul Market was estimated at 35.0 USD Billion in 2024. The market is projected to grow from 36.15 USD Billion in 2025 to 50.0 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 3.3 during the forecast period 2025 - 2035.

Key Market Trends & Highlights

The Water Treatment Equipment Repair and Overhaul Market is experiencing a dynamic shift driven by technological advancements and sustainability efforts.

- Technological advancements in repair techniques are enhancing efficiency and reducing downtime in the water treatment sector.

- There is an increased focus on sustainability, prompting companies to adopt eco-friendly practices in water treatment operations.

- North America remains the largest market, while Asia-Pacific is emerging as the fastest-growing region in water treatment equipment repair.

- Rising demand for clean water and aging infrastructure are key drivers propelling growth in the municipal water treatment and filtration systems segments.

Market Size & Forecast

| 2024 Market Size | 35.0 (USD Billion) |

| 2035 Market Size | 50.0 (USD Billion) |

| CAGR (2025 - 2035) | 3.3% |

Major Players

Veolia Environnement (FR), SUEZ (FR), Xylem Inc. (US), Evoqua Water Technologies (US), Pentair plc (US), Aquatech International LLC (US), Aqua-Aerobic Systems, Inc. (US), Kurita Water Industries Ltd. (JP), Thermo Fisher Scientific Inc. (US)