North America : Market Leader in Services

North America is poised to maintain its leadership in the Earth Moving Equipment Repair and Overhaul Services Market, holding a market size of $4.25B in 2025. Key growth drivers include robust infrastructure investments, a surge in construction activities, and stringent regulatory standards promoting equipment maintenance. The region's demand is further fueled by technological advancements and a growing emphasis on sustainability in construction practices.

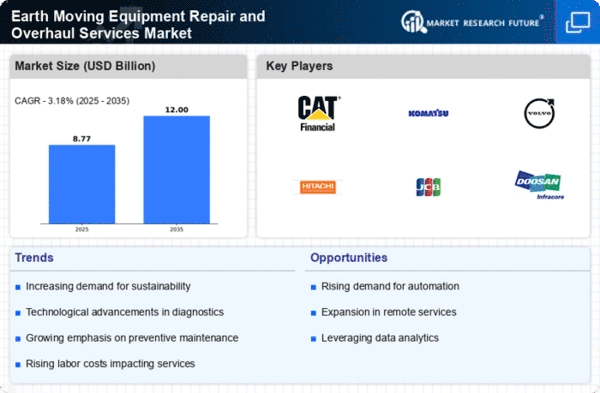

The competitive landscape is dominated by major players such as Caterpillar Inc., Terex Corporation, and CASE Construction Equipment. The U.S. leads the market, supported by a strong network of service providers and a high concentration of construction projects. The presence of established companies ensures a steady supply of innovative repair solutions, enhancing operational efficiency and reducing downtime for equipment users.

Europe : Emerging Market Dynamics

Europe's Earth Moving Equipment Repair and Overhaul Services Market is projected to reach $2.5B by 2025, driven by increasing urbanization and infrastructure development. Regulatory frameworks emphasizing safety and environmental standards are pivotal in shaping market dynamics. The demand for efficient repair services is also rising due to the aging equipment fleet across the region, necessitating regular maintenance and overhaul services to ensure compliance with regulations.

Leading countries such as Germany, France, and the UK are at the forefront of this market, with a competitive landscape featuring key players like Volvo Construction Equipment and Liebherr Group. The presence of advanced technology and skilled labor enhances service quality, while government initiatives to boost construction activities further stimulate market growth. The European market is characterized by a mix of established firms and emerging players, fostering innovation and competition.

Asia-Pacific : Rapid Growth Potential

The Asia-Pacific region is witnessing rapid growth in the Earth Moving Equipment Repair and Overhaul Services Market, projected to reach $1.75B by 2025. Key drivers include increasing investments in infrastructure, urbanization, and a growing construction sector. Countries like China and India are leading this growth, supported by government initiatives aimed at enhancing infrastructure development and modernization of equipment, which in turn drives demand for repair services.

China stands out as a major player, with significant contributions from local manufacturers and service providers. The competitive landscape is evolving, with both international and domestic companies vying for market share. Key players such as Komatsu Ltd. and Hitachi Construction Machinery are expanding their service offerings to cater to the growing demand, ensuring that they remain competitive in this dynamic market.

Middle East and Africa : Untapped Market Opportunities

The Middle East and Africa region is emerging as a significant player in the Earth Moving Equipment Repair and Overhaul Services Market, with a projected size of $0.9B by 2025. The growth is driven by increasing investments in infrastructure projects, particularly in the Gulf Cooperation Council (GCC) countries. Regulatory frameworks are evolving to support construction activities, which in turn boosts the demand for repair and maintenance services for heavy equipment.

Countries like the UAE and South Africa are leading the market, with a growing number of construction projects requiring efficient repair services. The competitive landscape is characterized by a mix of local and international players, including JCB and Doosan Infracore. As the region continues to develop, the demand for high-quality repair services is expected to rise, presenting significant opportunities for service providers.