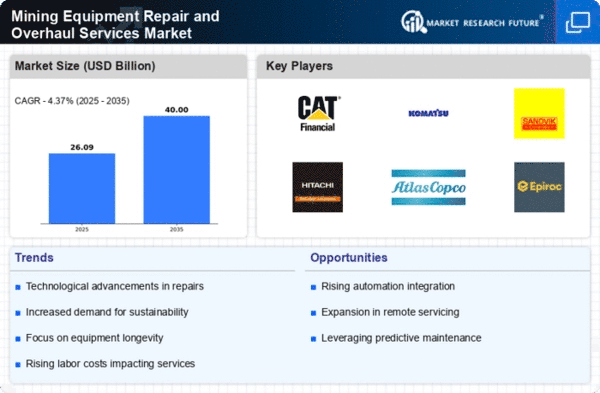

The Mining Equipment Repair and Overhaul Services Market is characterized by a competitive landscape that is increasingly shaped by technological advancements and strategic partnerships. Key players such as Caterpillar (US), Komatsu (JP), and Sandvik (SE) are actively pursuing innovation and digital transformation to enhance service delivery and operational efficiency. Caterpillar (US) has focused on integrating advanced analytics into its service offerings, which allows for predictive maintenance and reduced downtime for clients. Meanwhile, Komatsu (JP) has been expanding its global footprint through strategic acquisitions, thereby enhancing its service capabilities in emerging markets. Sandvik (SE) emphasizes sustainability in its operations, aligning its repair services with environmentally friendly practices, which resonates well with the growing demand for sustainable mining solutions.The business tactics employed by these companies reflect a concerted effort to optimize supply chains and localize manufacturing processes. The market structure appears moderately fragmented, with a mix of large multinational corporations and regional players. This fragmentation allows for a diverse range of service offerings, yet the collective influence of major players like Caterpillar (US) and Komatsu (JP) tends to dominate market trends and pricing strategies. Their ability to leverage economies of scale and advanced technologies positions them favorably against smaller competitors.

In November Caterpillar (US) announced a partnership with a leading AI firm to develop predictive maintenance solutions tailored for mining equipment. This strategic move is likely to enhance Caterpillar's service portfolio, enabling clients to minimize operational disruptions and optimize equipment performance. The integration of AI into repair services not only positions Caterpillar as a technology leader but also aligns with the industry's shift towards data-driven decision-making.

In October Komatsu (JP) completed the acquisition of a regional repair service provider in South America, significantly expanding its service network in that region. This acquisition is strategically important as it allows Komatsu to tap into the growing mining sector in South America, where demand for repair and overhaul services is on the rise. By enhancing its local presence, Komatsu can offer more responsive and tailored services to its clients, thereby strengthening customer loyalty and market share.

In September Sandvik (SE) launched a new line of eco-friendly repair solutions aimed at reducing the environmental impact of mining operations. This initiative underscores Sandvik's commitment to sustainability and positions the company favorably among environmentally conscious clients. The introduction of these solutions is expected to not only meet regulatory requirements but also attract new customers who prioritize sustainable practices in their operations.

As of December the competitive trends in the Mining Equipment Repair and Overhaul Services Market are increasingly defined by digitalization, sustainability, and the integration of AI technologies. Strategic alliances are becoming more prevalent, as companies recognize the need to collaborate to enhance service offerings and operational efficiencies. Looking ahead, competitive differentiation is likely to evolve from traditional price-based competition to a focus on innovation, technological advancements, and supply chain reliability. This shift suggests that companies that can effectively leverage technology and sustainability will be better positioned to thrive in this dynamic market.